%f0%9f%94%8d What Is Open Interest And Why Is It Important When Trading Options

Open Interest Basics Pdf Option Finance Put Option Open interest is the total number of active contracts in the market that haven't been closed. these contracts are outstanding derivatives, specifically unsettled futures and options. they. What is open interest? the definition of open interest as it applies in options trading is very straightforward; it’s a number that shows the amount of currently open positions of options contracts. the higher the open interest of a contract, the more open positions there are for it.

Open Interest Analysis Definedge Securities Shelf Options traders often use open interest to identify potential trading opportunities. high open interest in certain strike prices can indicate areas where large numbers of traders have positions, which could act as potential support or resistance levels. Open interest measures the total number of options contracts that exist for a particular stock. open interest increases as more options are traded to open a position. Understanding open interest is crucial for participants in financial markets, especially in derivatives trading. it represents the total number of outstanding derivative contracts, such as futures or options, that remain unsettled. Understanding open interest is crucial for traders who want to gain experience in futures or options markets. open interest (oi) is the total number of outstanding derivative contracts (futures or options) that are still active and not yet closed or expired at the end of trading.

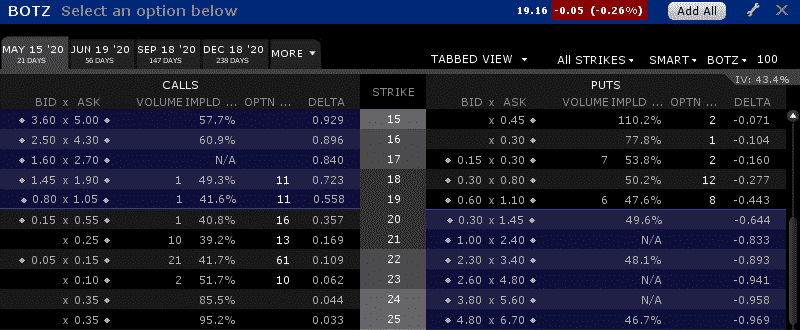

What Is Open Interest In Options Understanding open interest is crucial for participants in financial markets, especially in derivatives trading. it represents the total number of outstanding derivative contracts, such as futures or options, that remain unsettled. Understanding open interest is crucial for traders who want to gain experience in futures or options markets. open interest (oi) is the total number of outstanding derivative contracts (futures or options) that are still active and not yet closed or expired at the end of trading. But what is open interest in options trading? defined as the number of open call or put option contracts for a particular stock, open interest provides investors with a gauge of. Learn what open interest is in options trading, how it works, and why it matters for your trades. Open interest is a crucial concept in derivatives trading that reflects the total number of outstanding derivative contracts, such as options or futures, which have not been settled. it. Open interest is the number of active contracts. it's one of the data fields on most option quote displays, along with bid price, ask price, volume, and implied volatility. yet, many options traders ignore active contracts, which can lead to unforeseen consequence .

Open Interest Analysis Definedge Shelf But what is open interest in options trading? defined as the number of open call or put option contracts for a particular stock, open interest provides investors with a gauge of. Learn what open interest is in options trading, how it works, and why it matters for your trades. Open interest is a crucial concept in derivatives trading that reflects the total number of outstanding derivative contracts, such as options or futures, which have not been settled. it. Open interest is the number of active contracts. it's one of the data fields on most option quote displays, along with bid price, ask price, volume, and implied volatility. yet, many options traders ignore active contracts, which can lead to unforeseen consequence .

Open Interest Analysis Definedge Securities Shelf Open interest is a crucial concept in derivatives trading that reflects the total number of outstanding derivative contracts, such as options or futures, which have not been settled. it. Open interest is the number of active contracts. it's one of the data fields on most option quote displays, along with bid price, ask price, volume, and implied volatility. yet, many options traders ignore active contracts, which can lead to unforeseen consequence .

Open Interest Analysis Definedge Securities Shelf

Comments are closed.