Ifta Tax Filing Fleetio Use form 56 101, international fuel tax agreement (ifta) fuel tax report (pdf), and form 56 102, ifta fuel tax report supplement (pdf) for paper filing. read our biodiesel fuel and renewable diesel fuel faqs to learn how to report biodiesel fuel on your ifta quarterly return. You can file your international fuel tax agreement (ifta) report using our online webfile system. filing your ifta report is fast, easy and more convenient with webfile. please visit www ptroller.texas.gov taxes file pay for more information.

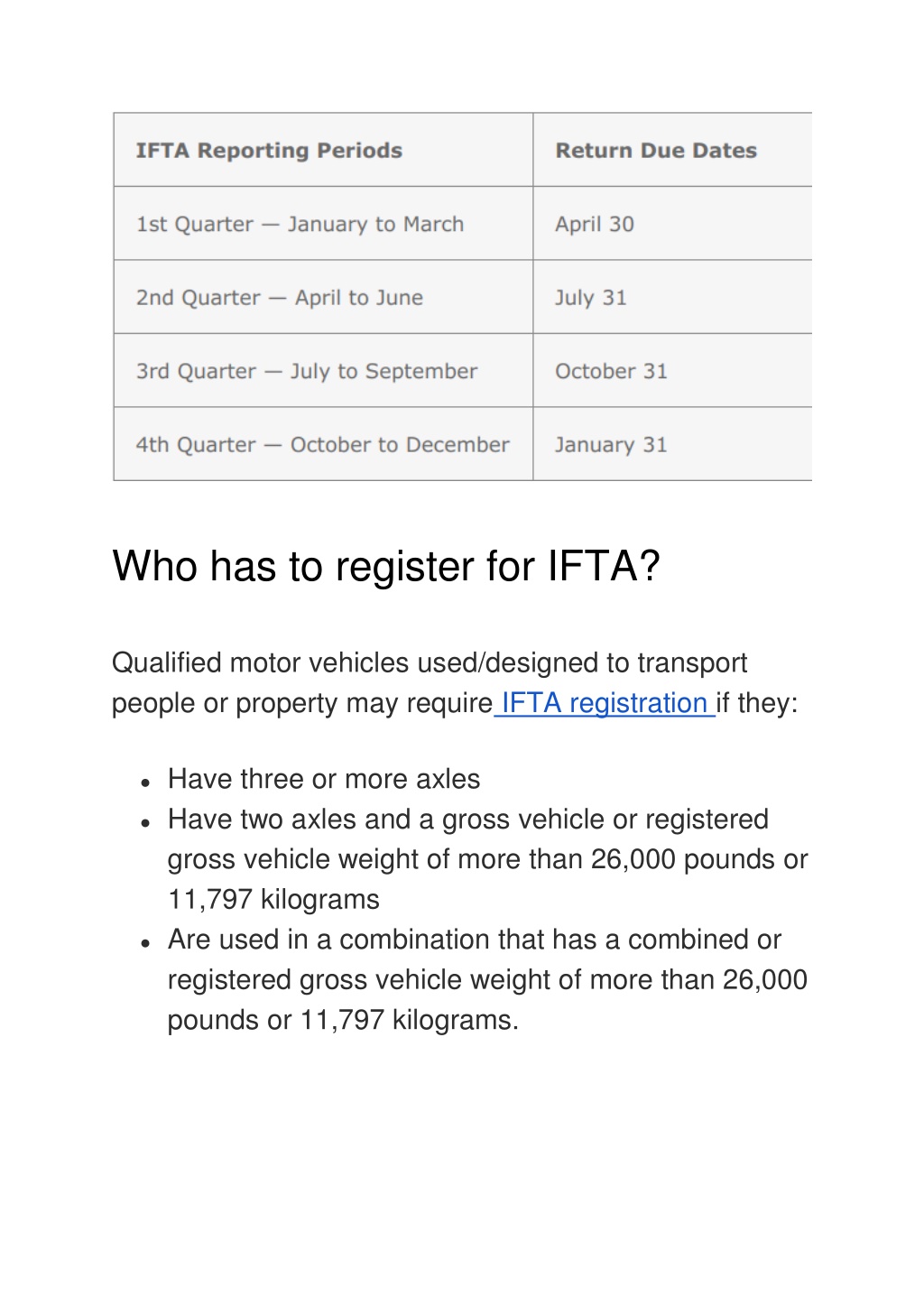

2021 Ifta Report Deadlines The Tcs Fuel Card Makes Filing Easier How do i file an ifta report? some jurisdictions have online filing requirements while others allow for mailed returns. if the return is filed electronically, then it is considered received on the date it was submitted. How do i file an ifta report? filing involves aggregating mileage and fuel purchase data by jurisdiction. submit quarterly reports to your base jurisdiction by the following deadlines: q1: april 30; q2: july 31; q3: october 31; q4: january 31; how do i file ifta online? many jurisdictions offer online portals for ifta reporting. How do you file an ifta report? first, you will need to obtain an ifta license in your base state and a decal for every truck you operate across state lines or the canadian border. every state’s process is slightly different, so you’ll need to learn the application process for your state. Total ifta miles: enter the total ifta miles traveled in ifta jurisdictions by all qualified motor vehicles in your fleet using the fuel indicated. report all miles traveled whether the miles are taxable or nontaxable. round mileage to the nearest whole mile.

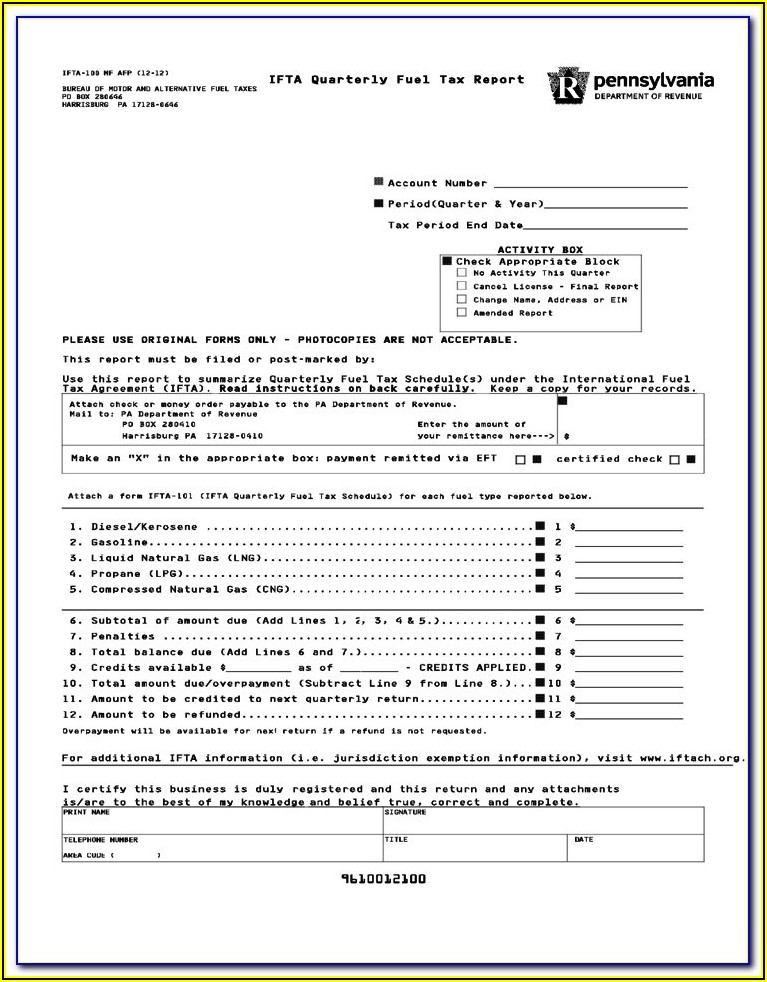

Ifta Tax Report Form Form Resume Examples X42m4l68vk How do you file an ifta report? first, you will need to obtain an ifta license in your base state and a decal for every truck you operate across state lines or the canadian border. every state’s process is slightly different, so you’ll need to learn the application process for your state. Total ifta miles: enter the total ifta miles traveled in ifta jurisdictions by all qualified motor vehicles in your fleet using the fuel indicated. report all miles traveled whether the miles are taxable or nontaxable. round mileage to the nearest whole mile. Don’t forget to file your ifta report! here’s a basic rundown of what they are, how to file, and how to make it easier. 1. to put it simply, the international fuel tax agreement (ifta) is a pact between the lower 48 states and the ten canadian provinces that requires all interstate motor carriers to report fuel taxes. Ifta returns are filed four times per year: 1. gather your records. the first step in preparing your ifta quarterly tax return is gathering all your records. simplex group, simplifies this process by managing your fuel receipts and assisting with ifta compliance. Step by step guide to filing ifta 1. gather data. collect mileage logs and fuel receipts. verify total miles traveled in each jurisdiction. 2. calculate fuel tax. use the ifta formula to compute tax owed per jurisdiction. adjust based on fuel taxes already paid. 3. complete the ifta tax report. enter mileage, fuel purchases, and jurisdictional. Prior to e filing form 2290, you need to know how to generate your ifta quarterly fuel tax report. expressifta helps you to complete this report in four steps: create or login to your free account; enter your business information and base jurisdiction; enter your miles & fuel records; generate your ifta report; e file irs form 2290.

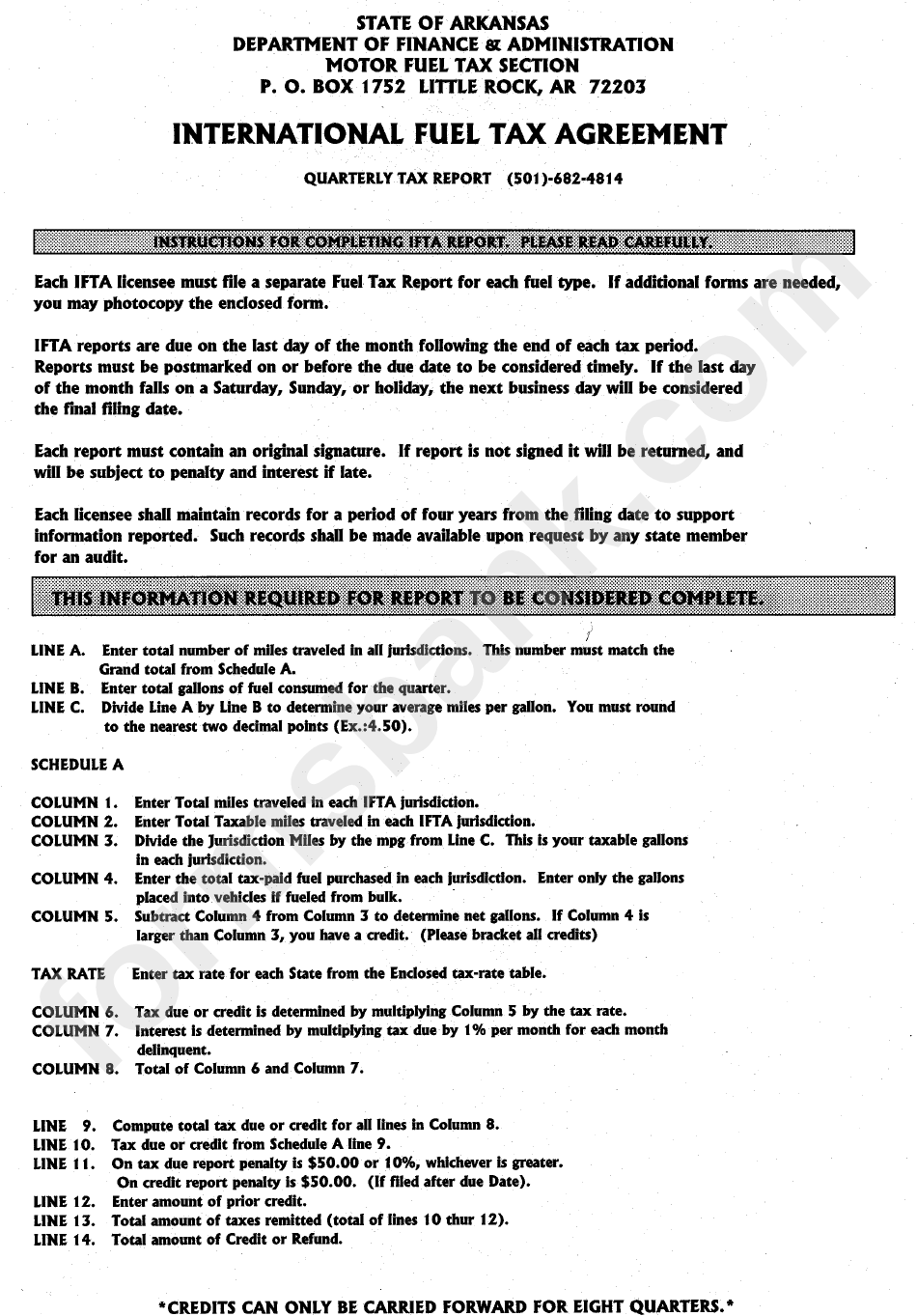

Form Ifta Instructions For Completing Ifta Report Sheet Printable Pdf Don’t forget to file your ifta report! here’s a basic rundown of what they are, how to file, and how to make it easier. 1. to put it simply, the international fuel tax agreement (ifta) is a pact between the lower 48 states and the ten canadian provinces that requires all interstate motor carriers to report fuel taxes. Ifta returns are filed four times per year: 1. gather your records. the first step in preparing your ifta quarterly tax return is gathering all your records. simplex group, simplifies this process by managing your fuel receipts and assisting with ifta compliance. Step by step guide to filing ifta 1. gather data. collect mileage logs and fuel receipts. verify total miles traveled in each jurisdiction. 2. calculate fuel tax. use the ifta formula to compute tax owed per jurisdiction. adjust based on fuel taxes already paid. 3. complete the ifta tax report. enter mileage, fuel purchases, and jurisdictional. Prior to e filing form 2290, you need to know how to generate your ifta quarterly fuel tax report. expressifta helps you to complete this report in four steps: create or login to your free account; enter your business information and base jurisdiction; enter your miles & fuel records; generate your ifta report; e file irs form 2290.

Ppt Simple Ifta Ifta Tax Ifta Retrun Ifta Efiling Ifta Form Step by step guide to filing ifta 1. gather data. collect mileage logs and fuel receipts. verify total miles traveled in each jurisdiction. 2. calculate fuel tax. use the ifta formula to compute tax owed per jurisdiction. adjust based on fuel taxes already paid. 3. complete the ifta tax report. enter mileage, fuel purchases, and jurisdictional. Prior to e filing form 2290, you need to know how to generate your ifta quarterly fuel tax report. expressifta helps you to complete this report in four steps: create or login to your free account; enter your business information and base jurisdiction; enter your miles & fuel records; generate your ifta report; e file irs form 2290.

Step By Step Process On How To File Ifta Max Truckers