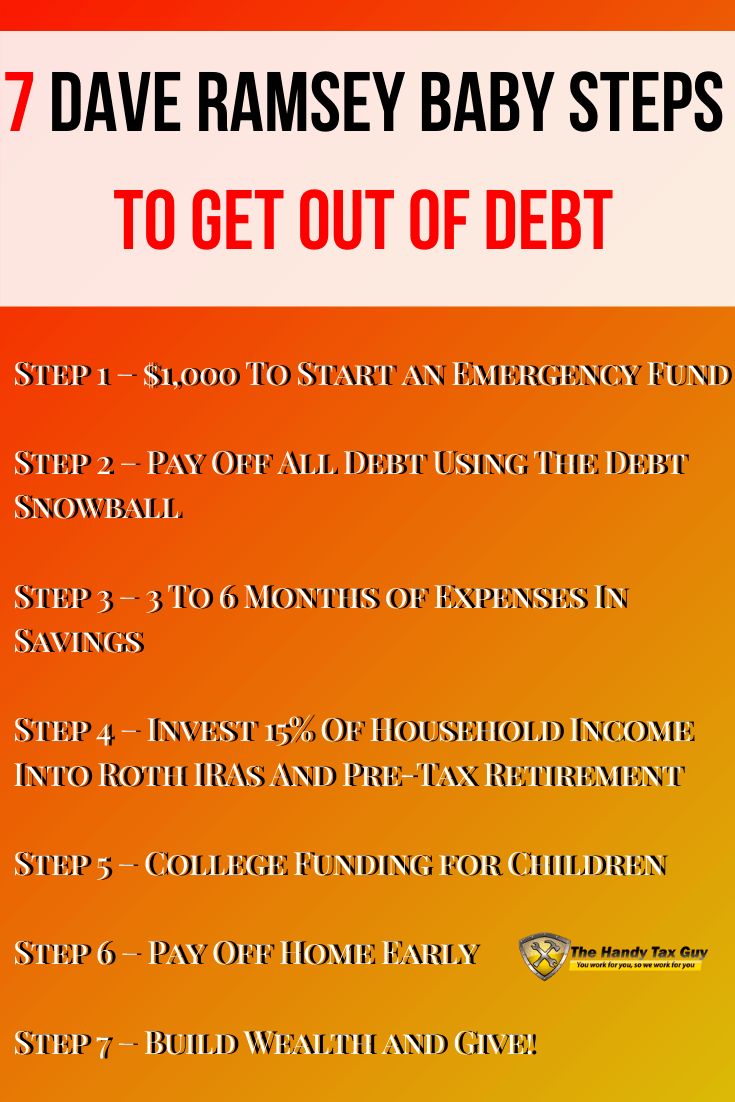

7 Dave Ramsey Baby Steps To Get Out Of Debt The Handy Tax Guy If you’re working to get out of debt or fix your finances, it’s very likely you’ve heard of dave ramsey and his baby steps system. maybe you’re even using it as a framework on your debt free journey like we did, and maybe you even skipped a few dave ramsey steps like we did. We bought a house while in debt . dave suggests not buying a home until you are completely debt free, have saved up 3 6 months of living expenses, and have saved up at least a 20% down payment. your down payment is baby step 3(b) in the baby steps. we didn’t do that.

3 Dave Ramsey Steps We Didn T Follow While Getting Out Of Debt “do you guys follow dave ramsey’s 7 baby steps?” here’s the short answer: nope. here’s the slightly longer version: emergencies are rarely less than $1,000. baby step #1 directs you to build up a $1,000 emergency fund, so that’s what we did — at first. If you’re working to get out of debt or fix your finances, it’s very likely you’ve heard of dave ramsey and his baby rules are made to be broken, right?! skip to content. Dave ramsey recommends you save $1000 fast as baby step 1, before paying off debt, as your starter emergency fund. once you are debt free, you will increase this to 3 6 months worth of expenses. we broke this rule toward the end of our debt free journey because we didn’t feel that $1000 was enough. I started my baby steps in 2013, i was in debt but wanted to buy a home and qualified for the mortgage, could have had a $1000 mortgage payment. i decided to follow the steps. it took me 7 years to pay off all my debt. now i have no debt, have an emergency fund.

5 Tips For Breaking Down Debt The Dave Ramsey Way Living Sweet Moments Dave ramsey recommends you save $1000 fast as baby step 1, before paying off debt, as your starter emergency fund. once you are debt free, you will increase this to 3 6 months worth of expenses. we broke this rule toward the end of our debt free journey because we didn’t feel that $1000 was enough. I started my baby steps in 2013, i was in debt but wanted to buy a home and qualified for the mortgage, could have had a $1000 mortgage payment. i decided to follow the steps. it took me 7 years to pay off all my debt. now i have no debt, have an emergency fund. Just tell them your situation, then find out your debt relief options. 1

clients who are able to stay with the program and get all their debt settled realize approximate savings of 46% before fees, or 25% including our fees, over 12 to 48 months. all claims are based on enrolled debts. Adults make a plan and stick to it, children do what feels good. it's called delayed gratification. if you're in debt, you shouldn't have the downtime to "feel bored", you should get another job or 2 to fill the time and increase the income to get out of debt faster. Ramsey and kleiner agree that setting $1,000 aside as soon as you can is a key first step toward walking away from debt. being prepared when bad things happen minimizes the damage and avoids borrowing. so make a budget, then set the emergency funds aside. In his how to take control of your money livestream on , dave ramsey dropped some real talk on getting out of debt and taking charge of your finances.

20 Simple Dave Ramsey Tips You Need To Know Now Just tell them your situation, then find out your debt relief options. 1

clients who are able to stay with the program and get all their debt settled realize approximate savings of 46% before fees, or 25% including our fees, over 12 to 48 months. all claims are based on enrolled debts. Adults make a plan and stick to it, children do what feels good. it's called delayed gratification. if you're in debt, you shouldn't have the downtime to "feel bored", you should get another job or 2 to fill the time and increase the income to get out of debt faster. Ramsey and kleiner agree that setting $1,000 aside as soon as you can is a key first step toward walking away from debt. being prepared when bad things happen minimizes the damage and avoids borrowing. so make a budget, then set the emergency funds aside. In his how to take control of your money livestream on , dave ramsey dropped some real talk on getting out of debt and taking charge of your finances.