Trust Account Management The best practice is to keep your trust account separate from all other firm or personal accounts. law firms may not use trust account funds until they are earned. this practice guarantees that you keep accurate records related to your client matter and help maintain your firm’s integrity. Key takeaway: consistently review and reconcile trust accounts to ensure that every dollar is properly accounted for. 4. establish clear client communication and billing policies.

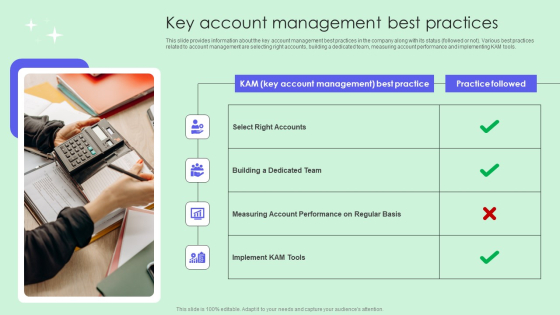

Key Account Management Best Practices Background Pdf Powerpoint Templates Explore trust account management in legal practice, highlighting its importance, regulatory challenges, and best practices to ensure compliance and protect your reputation. To master trust account management, immigration lawyers need to focus on several key areas: 1. establishing proper account structure. effective trust account management begins with setting up the right account structure. this involves creating a dedicated iolta account that's completely separate from your firm's operating account. Best practices for effective trust accounting. effective trust accounting is crucial for a number of reasons. besides ensuring regulatory compliance, it also fosters trust between you and your clients. in this section, we’ll look at some best practices for managing client trust accounts securely and efficiently. 1. avoid commingling of funds. Here are the key steps that every law firm should take to ensure compliance and proper management of trust accounts: 1. open a client trust account. the first step in the trust accounting process is to open a dedicated client trust account at a financial institution.

Key Account Management 101 Best Practices Powerpoint Slideshow View Best practices for effective trust accounting. effective trust accounting is crucial for a number of reasons. besides ensuring regulatory compliance, it also fosters trust between you and your clients. in this section, we’ll look at some best practices for managing client trust accounts securely and efficiently. 1. avoid commingling of funds. Here are the key steps that every law firm should take to ensure compliance and proper management of trust accounts: 1. open a client trust account. the first step in the trust accounting process is to open a dedicated client trust account at a financial institution. Your trust account is a serious matter that requires serious management. these best practices can help you stay on top of your trust account management, but you need to have a clear understanding about the rules of your state. Effective trust account management forms the cornerstone of a successful legal practice. by implementing robust systems, maintaining regular reconciliation practices, and leveraging appropriate technology, practitioners can ensure compliance while building client trust. Best practices for effective trust accounting. implement robust accounting software: utilize specialized law firm accounting software designed to manage trust accounts efficiently. these tools offer features like automated reconciliations, real time reporting, and compliance tracking, reducing the margin for error. Trust accounts perform as essential tools both for protecting client funds and for sustaining ethical professional standards. the precise handling of these client account funds by lawyers demands both detailed account documentation and appropriate fund separation methods.