Your Investment Risk Tolerance About Retirement Unlike risk tolerance, which is influenced by emotions, risk capacity is grounded in facts. it looks at your income, savings, investment timeline, and overall financial health to determine how much risk you need to take to reach your retirement goals. Are you using outdated metrics like "risk tolerance" or "age" to decide the mix of growth and safety in your portfolio? if so, you are likely leaving money on the table you can schedule an.

Risk Tolerance Wcfs Retirement Retirees today face a challenging conundrum: how to invest in retirement with enough risk to maintain your purchasing power for 30 plus years while not taking so much risk that you leave. Risk tolerance. your tolerance for risk can be determined by understanding how much loss you’re willing to take in order to realize a gain. Risk tolerance: comfort in dealing with portfolio volatility (not being stressed out and losing sleep over the day’s market events) and an ability to “stay the course” and not panic after a market drop. risk capacity: the ability to experience portfolio losses without suffering a major life setback or a major reduction to one’s standard of living. Risk tolerance versus risk capacity. risk tolerance is your willingness to take risks with your money. an aggressive investor, or one with a high risk tolerance, is more likely to risk losing money in order to get better results.

Investment Risk Tolerance Retirement Plan Provise Risk tolerance: comfort in dealing with portfolio volatility (not being stressed out and losing sleep over the day’s market events) and an ability to “stay the course” and not panic after a market drop. risk capacity: the ability to experience portfolio losses without suffering a major life setback or a major reduction to one’s standard of living. Risk tolerance versus risk capacity. risk tolerance is your willingness to take risks with your money. an aggressive investor, or one with a high risk tolerance, is more likely to risk losing money in order to get better results. In this episode, kolin explains the emotional and rational sides of risk and how they influence investment decisions. Here is a breakdown of some possible levels of risk tolerance when it comes to investing for retirement. if you have a high investing risk tolerance, you’re a risk taker or optimist by nature. People are most vulnerable to sequence risk in the first five years of their retirement, and new retirees with equity heavy portfolios are the most vulnerable of all. “if you’re in your 20s and starting to invest for retirement 40 years away, you have a relatively high risk tolerance. but if you’re in your late 50s and looking at retiring soon or paying for your kid’s college, your risk tolerance is lower,” explains mike kremenak, president of thrivent funds.

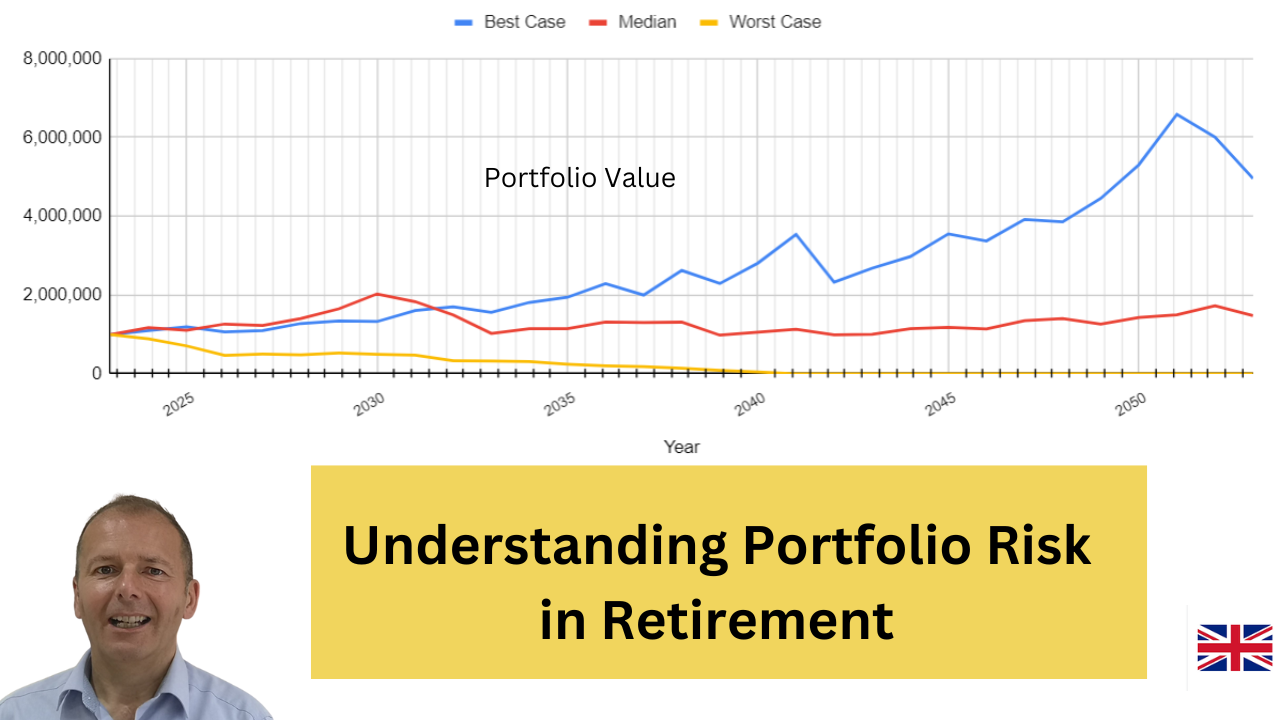

Understanding Portfolio Risk In Retirement Ian Shadrack In this episode, kolin explains the emotional and rational sides of risk and how they influence investment decisions. Here is a breakdown of some possible levels of risk tolerance when it comes to investing for retirement. if you have a high investing risk tolerance, you’re a risk taker or optimist by nature. People are most vulnerable to sequence risk in the first five years of their retirement, and new retirees with equity heavy portfolios are the most vulnerable of all. “if you’re in your 20s and starting to invest for retirement 40 years away, you have a relatively high risk tolerance. but if you’re in your late 50s and looking at retiring soon or paying for your kid’s college, your risk tolerance is lower,” explains mike kremenak, president of thrivent funds.