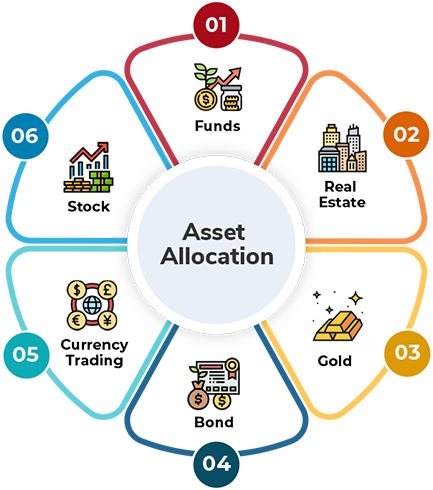

6 Asset Allocation Strategies For A Diversified Portfolio Secvolt Establishing an appropriate asset mix of stocks, bonds, cash, and real estate in your portfolio is a dynamic process. as such, the asset mix should reflect your goals at any point in time . Allocation strategies determine how assets are distributed within a portfolio and play a critical role in achieving these goals. understanding various allocation strategies is essential for enhancing performance and managing risks. here are six key strategies that can improve your investment portfolio. strategic allocation.

6 Asset Allocation Strategies For Successful Portfolio Management Insured asset allocation. insured asset allocation is a strategy that integrates investment with risk management by establishing a portfolio’s value “floor” below which the investor is not willing to allow the total asset value to fall. it combines elements of strategic allocation with a built in safety mechanism, ensuring that if the. With your style of investment portfolio in mind, you can dive deeper to land on the specific asset allocation strategy for building and managing your portfolio over time. your strategy can reflect how much risk you're able to take, ranging from aggressive to conservative to somewhere in between. consider these six common approaches to asset. Asset allocation refers to the way an investor divides their investment portfolio among different asset classes, such as stocks, bonds, and real estate. it plays a crucial role in risk management and return optimization, ensuring that no single market event can significantly derail financial progress. Here we outline some different strategies of establishing asset allocations and examine their basic management approaches. strategic asset allocation. this method establishes and adheres to a.

6 Asset Allocation Strategies For Successful Portfolio Management Asset allocation refers to the way an investor divides their investment portfolio among different asset classes, such as stocks, bonds, and real estate. it plays a crucial role in risk management and return optimization, ensuring that no single market event can significantly derail financial progress. Here we outline some different strategies of establishing asset allocations and examine their basic management approaches. strategic asset allocation. this method establishes and adheres to a. An asset allocation strategy provides exposure to various asset classes that would perform differently during different market environments (i.e. would typically have low correlation), or alternatively would target a limited number of assets (and hence a higher level of risk) in pursuing higher returns. Effective portfolio management is essential for maximizing investment returns while mitigating risk. this ultimate guide provides actionable strategies and insights to achieve successful portfolio management. portfolio management refers to the systematic allocation of assets tailored to meet specific financial goals while effectively managing risk. At schwab asset management ®, asset allocation isn’t just a concept—it’s a research driven process designed to align investments with each client’s financial goals, risk tolerance and time horizon. it serves as the foundation of our model portfolios, helping to create diversified, well balanced investment solutions tailored to clients. Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach.

6 Asset Allocation Strategies For A Diversified Portfolio Secvolt An asset allocation strategy provides exposure to various asset classes that would perform differently during different market environments (i.e. would typically have low correlation), or alternatively would target a limited number of assets (and hence a higher level of risk) in pursuing higher returns. Effective portfolio management is essential for maximizing investment returns while mitigating risk. this ultimate guide provides actionable strategies and insights to achieve successful portfolio management. portfolio management refers to the systematic allocation of assets tailored to meet specific financial goals while effectively managing risk. At schwab asset management ®, asset allocation isn’t just a concept—it’s a research driven process designed to align investments with each client’s financial goals, risk tolerance and time horizon. it serves as the foundation of our model portfolios, helping to create diversified, well balanced investment solutions tailored to clients. Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach.

Asset Allocation Strategies For Balanced Investment Portfolio Management At schwab asset management ®, asset allocation isn’t just a concept—it’s a research driven process designed to align investments with each client’s financial goals, risk tolerance and time horizon. it serves as the foundation of our model portfolios, helping to create diversified, well balanced investment solutions tailored to clients. Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach.

Asset Allocation Strategies To Create And Balance A Portfolio