Ray Dalio Portfolio How Does He Allocate His Money Why Ray says everybody can make money in the market if you have a balanced portfolio. all kinds of assets have always outperformed cash unless we are in the midd. Here’s a classic allocation strategy suggested by ray dalio, a common proponent of building a balanced portfolio: 40% long term bonds; 30% stocks; 15% intermediate term bonds; 7.5% gold; 7.5% commodities; a balanced portfolio will always make money | ray dalio interview.

8 Investing Lessons From Ray Dalio Aayush Bhaskar Ray dalio reveals his 'holy grail' of investing with a focus on diversified, risk balanced portfolios. dalio's investment insights aim to guide investors through market volatility and the. His strategy revolves around developing deep understanding, treading carefully, and maintaining a balanced portfolio of 15 uncorrelated investments to optimize returns while managing risk effectively. here’s an excerpt from the interview: dalio: no, you’re articulating well, and i can answer your question. How to apply dalio’s investment strategies to your portfolio. ray dalio’s investment strategy might seem complex, but you don’t need a team of analysts or a hedge fund to make it work. here’s a step by step guide to applying his principles, broken down in a way anyone can follow: 1. build a diversified portfolio. Ray dalio's all weather portfolio strategy is a unique investment approach that aims to provide a steady return regardless of market conditions. this strategy is a key component of his bridgewater associates investment firm. the all weather portfolio is designed to be a low risk, long term investment that can be held for an extended period.

Ray Dalio S Investment Strategies Unveiling The Billionaire S Blueprint How to apply dalio’s investment strategies to your portfolio. ray dalio’s investment strategy might seem complex, but you don’t need a team of analysts or a hedge fund to make it work. here’s a step by step guide to applying his principles, broken down in a way anyone can follow: 1. build a diversified portfolio. Ray dalio's all weather portfolio strategy is a unique investment approach that aims to provide a steady return regardless of market conditions. this strategy is a key component of his bridgewater associates investment firm. the all weather portfolio is designed to be a low risk, long term investment that can be held for an extended period. All weather is an investment technique by ray dalio, offering diversification and protection in any market. learn how it balances risk and returns for long term success. Check out speak's resource on ray dalio | the all in interview! start your 7 day trial of speak and get 30 minutes of free transcription and ai analysis. 4.9 g2 rating. 100 languages. save 80% of your time and money. Ray dalio, the founder of bridgewater associates, one of the world's largest hedge funds, developed the all weather portfolio to provide a resilient and adaptable investment strategy. this approach is designed to perform well in various economic conditions, making it a robust choice for long term investors. Ray dalio is the founder, co chief investment officer and co chairman of bridgewater associates, the world's largest hedge fund.ray started bridgewater in 19.

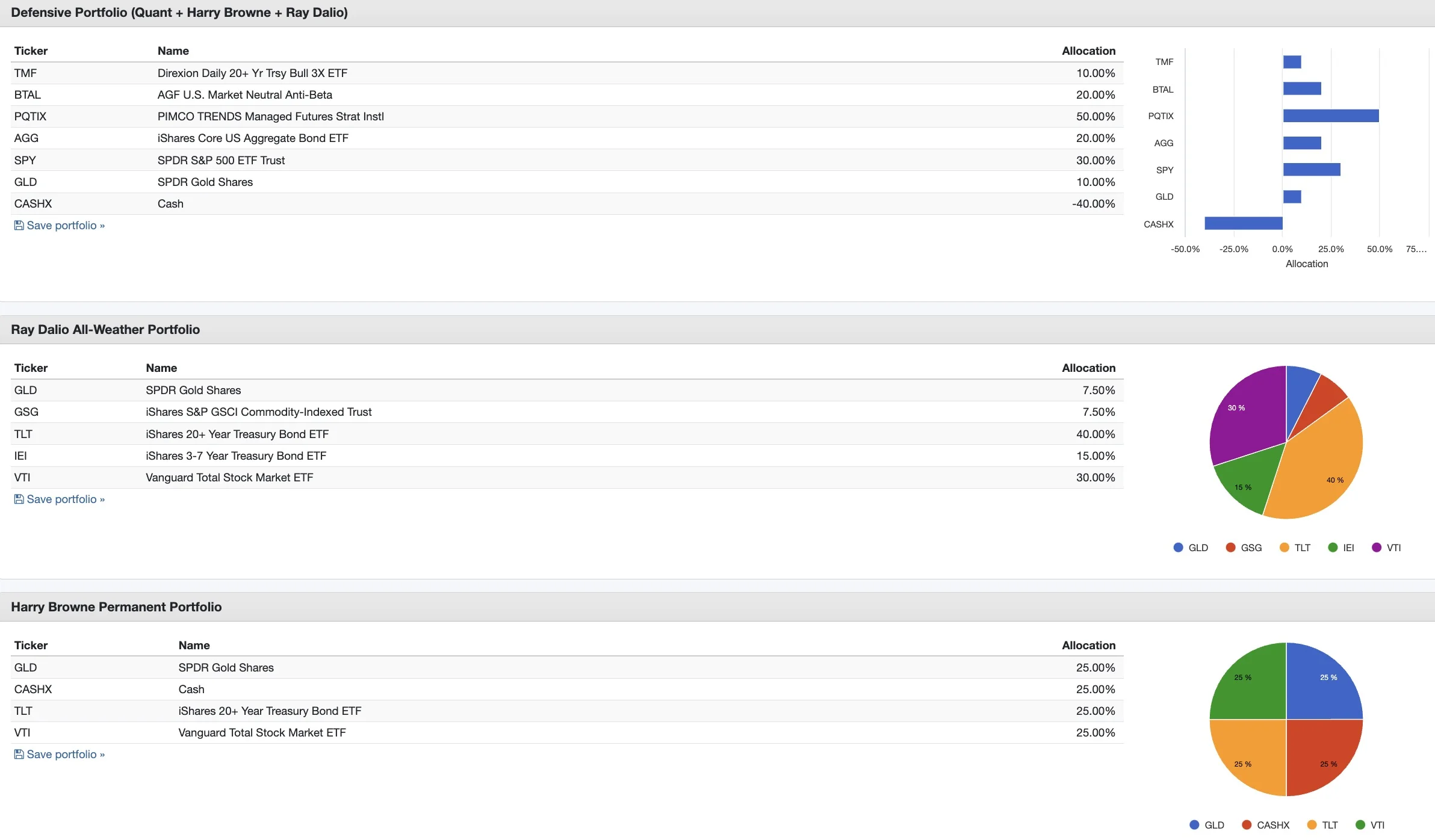

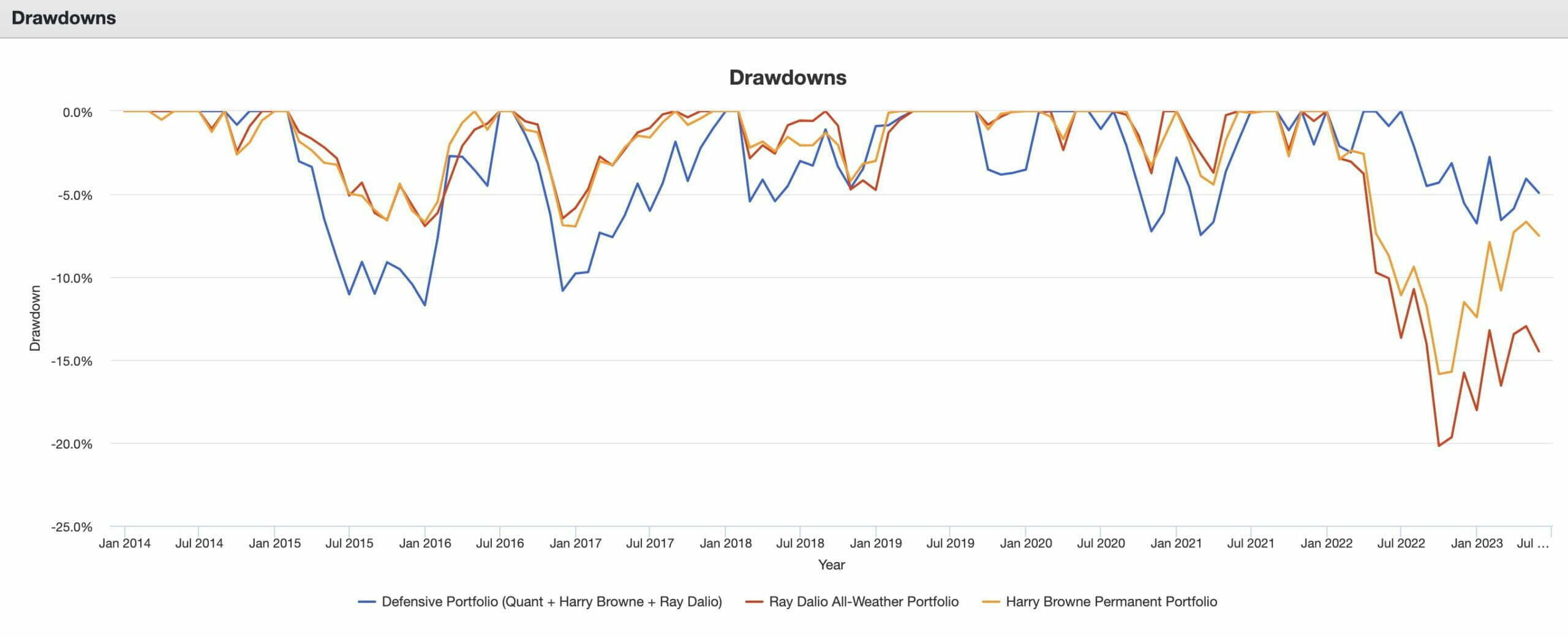

Defensive Portfolio Inspired By Ray Dalio Harry Browne Quants All weather is an investment technique by ray dalio, offering diversification and protection in any market. learn how it balances risk and returns for long term success. Check out speak's resource on ray dalio | the all in interview! start your 7 day trial of speak and get 30 minutes of free transcription and ai analysis. 4.9 g2 rating. 100 languages. save 80% of your time and money. Ray dalio, the founder of bridgewater associates, one of the world's largest hedge funds, developed the all weather portfolio to provide a resilient and adaptable investment strategy. this approach is designed to perform well in various economic conditions, making it a robust choice for long term investors. Ray dalio is the founder, co chief investment officer and co chairman of bridgewater associates, the world's largest hedge fund.ray started bridgewater in 19.

Defensive Portfolio Inspired By Ray Dalio Harry Browne Quants Ray dalio, the founder of bridgewater associates, one of the world's largest hedge funds, developed the all weather portfolio to provide a resilient and adaptable investment strategy. this approach is designed to perform well in various economic conditions, making it a robust choice for long term investors. Ray dalio is the founder, co chief investment officer and co chairman of bridgewater associates, the world's largest hedge fund.ray started bridgewater in 19.

Defensive Portfolio Inspired By Ray Dalio Harry Browne Quants