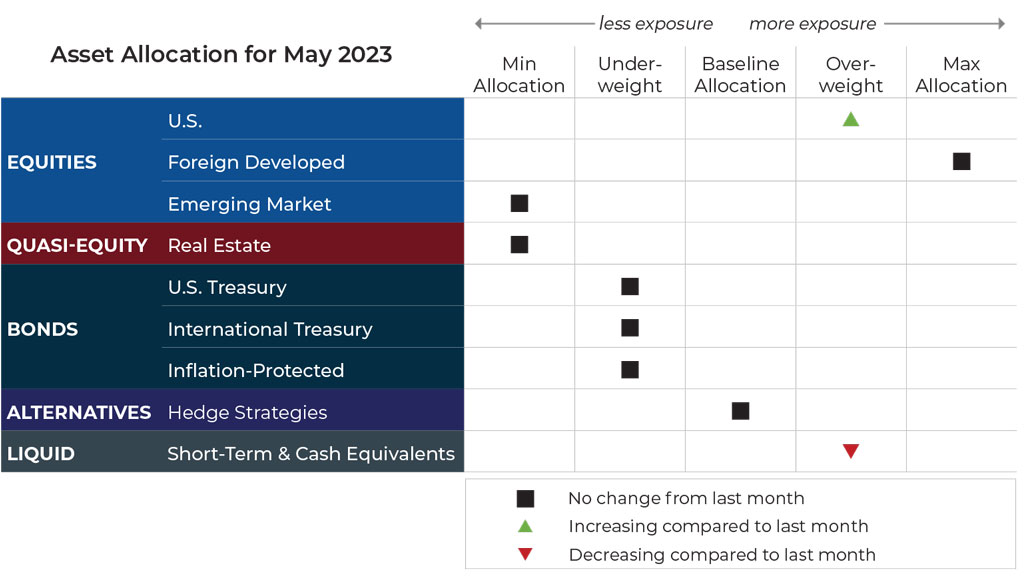

May 2023 Asset Allocation Update Blueprint Investment Partners An update for financial advisors about the asset allocation changes being made within blueprint’s risk managed global portfolios in april 2023. These trades will be implemented across all portfolios (active, index, alpha core, and esg) and all risk profiles. our tactical equity positioning will not change – we remain overweight emerging market stocks underweight u.s. stocks.

Tactical Asset Allocation For February 2023 An update for financial advisors about the asset allocation changes being made within blueprint investment partners risk managed global portfolios for april. Positioning update state street active asset allocation etf portfolio – moderate source: state street global advisors, as of 4 12 2023. allocation changes are only shown for the moderate portfolio. allocation changes, active weights and benchmark weights may vary for other portfolios. the benchmark is a custom active asset allocation benchmark. Net inflows for us listed etfs totaled $29.8 billion in march, bringing total etf assets under management to $6.76 trillion. equity etfs had net inflows totaling $3.3 billion in march, bringing trailing 12 months (ttm) net inflows to $250.4 billion. April 27, 2023 in portfolio updates about us terms & conditions privacy policy regulatory information 2025 im global partner regulated by the amf (autorité des marchés financiers) im global partner asset management regulated by the cssf (commission de surveillance du secteur financier) im global partner fund management, llc.

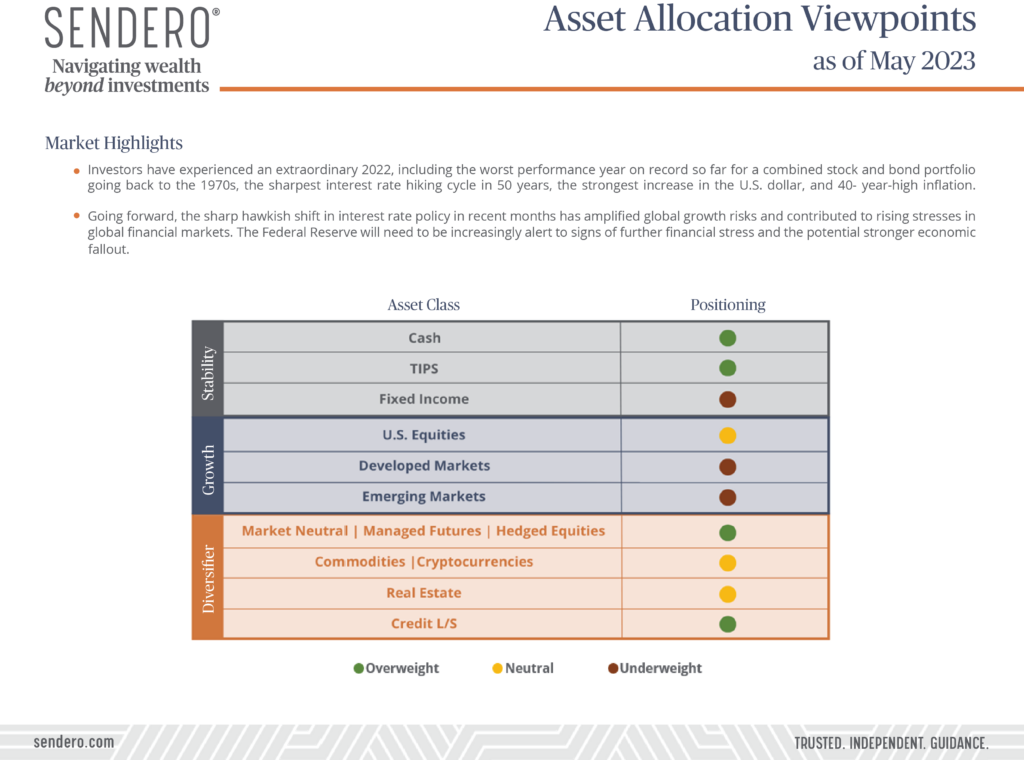

Asset Allocation Viewpoints As Of May 2023 Sendero Net inflows for us listed etfs totaled $29.8 billion in march, bringing total etf assets under management to $6.76 trillion. equity etfs had net inflows totaling $3.3 billion in march, bringing trailing 12 months (ttm) net inflows to $250.4 billion. April 27, 2023 in portfolio updates about us terms & conditions privacy policy regulatory information 2025 im global partner regulated by the amf (autorité des marchés financiers) im global partner asset management regulated by the cssf (commission de surveillance du secteur financier) im global partner fund management, llc. In our latest asset allocation monthly report, we discuss five key changes to our multi asset portfolios. first, we are now underweight european duration to capture valuation dislocations. Faq: the future of asset allocation and smart portfolios. q: what are smart portfolios and how do they differ from traditional portfolios? a: smart portfolios utilize advanced technologies like ai, automation, and blockchain to create dynamic, data driven investment strategies. Early last year, the tail risk of sharply higher real bond yields was a particular focus and our most successful asset market call. at the start of the 2023, we see four key judgements that will be central to market behaviour and investment opportunities for the next 12 months. The s&p 500 index is more concentrated than it has ever been, prompting institutional investors, especially those who obtain equity beta exposures mainly through passive vehicles, to assess potential asset allocation implications.

Multi Asset Portfolio Allocation March 2023 Barclays Private Bank In our latest asset allocation monthly report, we discuss five key changes to our multi asset portfolios. first, we are now underweight european duration to capture valuation dislocations. Faq: the future of asset allocation and smart portfolios. q: what are smart portfolios and how do they differ from traditional portfolios? a: smart portfolios utilize advanced technologies like ai, automation, and blockchain to create dynamic, data driven investment strategies. Early last year, the tail risk of sharply higher real bond yields was a particular focus and our most successful asset market call. at the start of the 2023, we see four key judgements that will be central to market behaviour and investment opportunities for the next 12 months. The s&p 500 index is more concentrated than it has ever been, prompting institutional investors, especially those who obtain equity beta exposures mainly through passive vehicles, to assess potential asset allocation implications.

Multi Asset Portfolio Allocation March 2023 Barclays Private Bank Early last year, the tail risk of sharply higher real bond yields was a particular focus and our most successful asset market call. at the start of the 2023, we see four key judgements that will be central to market behaviour and investment opportunities for the next 12 months. The s&p 500 index is more concentrated than it has ever been, prompting institutional investors, especially those who obtain equity beta exposures mainly through passive vehicles, to assess potential asset allocation implications.

Asset Allocation Q4 2023 Waiting On Interest Rates Agf Perspectives