Asset Allocation And Its Importance In Your Portfolio

Role Of Asset Allocation In Portfolio Management Pdf Asset Asset allocation is how investors divide their portfolios among different assets that might include equities, fixed income assets, and cash and its equivalents. investors ordinarily aim to. This guide will help investors understand the importance of asset allocation and the factors that play the most crucial roles in determining the best asset mix for each investor.

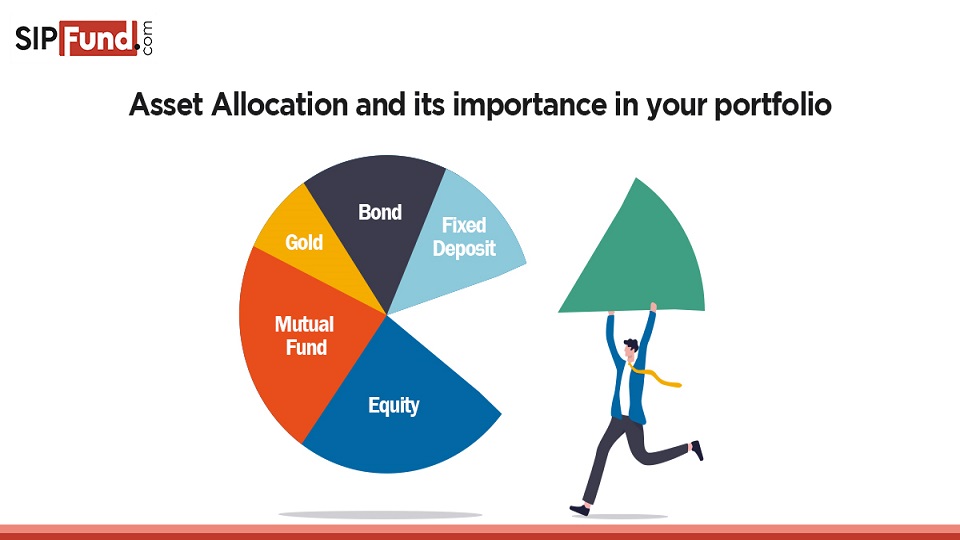

Asset Allocation Pdf Modern Portfolio Theory Asset Allocation Optimize returns: investors are to get assured returns through asset allocation as their wealth is divided into multiple categories of assets as per their preference of time and risks. investing in a balanced fund under asset allocation strategy can fetch higher returns in longer run. Asset allocation is a crucial aspect of investment planning that involves dividing your investment portfolio across different asset classes such as stocks, bonds, real estate, and cash. the purpose of asset allocation is to minimize risk and maximize returns by diversifying your investments. Et allocation and diversification. asset allocation in its most basic form is the decision of how to weight stocks, bonds and cash in a portfolio in a way that provides the potential for the best investment return for the amount . f risk you’re willing to accept. setting these targets appropriately is a critical fir. In this post, we'll explore the most important aspects of asset allocation you need to know, explain how to calculate and interpret asset allocation, and discuss how implementing a thoughtful asset allocation strategy can help you (and your portfolio!) stay balanced and grow over time.

Portfolio Allocation Asset Correlation Its Importance Et allocation and diversification. asset allocation in its most basic form is the decision of how to weight stocks, bonds and cash in a portfolio in a way that provides the potential for the best investment return for the amount . f risk you’re willing to accept. setting these targets appropriately is a critical fir. In this post, we'll explore the most important aspects of asset allocation you need to know, explain how to calculate and interpret asset allocation, and discuss how implementing a thoughtful asset allocation strategy can help you (and your portfolio!) stay balanced and grow over time. Asset allocation is the process of distributing your investments across various asset classes, such as stocks, bonds, real estate, and cash. the primary goal of asset allocation is to balance risk and reward according to an individual's financial goals, risk tolerance, and investment horizon. Learn how to create an effective asset allocation strategy tailored to your goals, time horizon, and risk tolerance. understand the importance of stocks, bonds, and cash in your. Asset allocation is the strategic process of dividing your investment portfolio among asset classes like stocks, bonds, and cash. it’s a fundamental principle in investing that plays a crucial role in managing risk and enhancing returns. Asset allocation plays a vital role in achieving your investment objectives while managing risk. by diversifying your investments across different asset classes, you can minimize the impact of market volatility and increase the potential for long term returns.

Asset Allocation And Its Importance In Your Portfolio Asset allocation is the process of distributing your investments across various asset classes, such as stocks, bonds, real estate, and cash. the primary goal of asset allocation is to balance risk and reward according to an individual's financial goals, risk tolerance, and investment horizon. Learn how to create an effective asset allocation strategy tailored to your goals, time horizon, and risk tolerance. understand the importance of stocks, bonds, and cash in your. Asset allocation is the strategic process of dividing your investment portfolio among asset classes like stocks, bonds, and cash. it’s a fundamental principle in investing that plays a crucial role in managing risk and enhancing returns. Asset allocation plays a vital role in achieving your investment objectives while managing risk. by diversifying your investments across different asset classes, you can minimize the impact of market volatility and increase the potential for long term returns.

Importance Of Asset Allocation In Your Investment Portfolio Asset allocation is the strategic process of dividing your investment portfolio among asset classes like stocks, bonds, and cash. it’s a fundamental principle in investing that plays a crucial role in managing risk and enhancing returns. Asset allocation plays a vital role in achieving your investment objectives while managing risk. by diversifying your investments across different asset classes, you can minimize the impact of market volatility and increase the potential for long term returns.

Comments are closed.