Asset Allocation Using Etfs Pdf Exchange Traded Fund Asset Allocation An asset allocation fund is a fund that provides investors with a diversified portfolio of investments across various asset classes. the asset allocation of the fund can be fixed or variable. Asset allocation funds are investment instruments that enable investors to invest in equity, debt, and other asset classes. a portfolio manager manages these funds and considers the investor's risk tolerance and investment period. these funds hedge the risks of investments and provide the investor with a diversified portfolio.

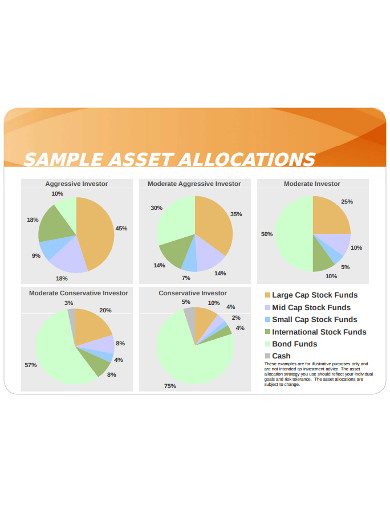

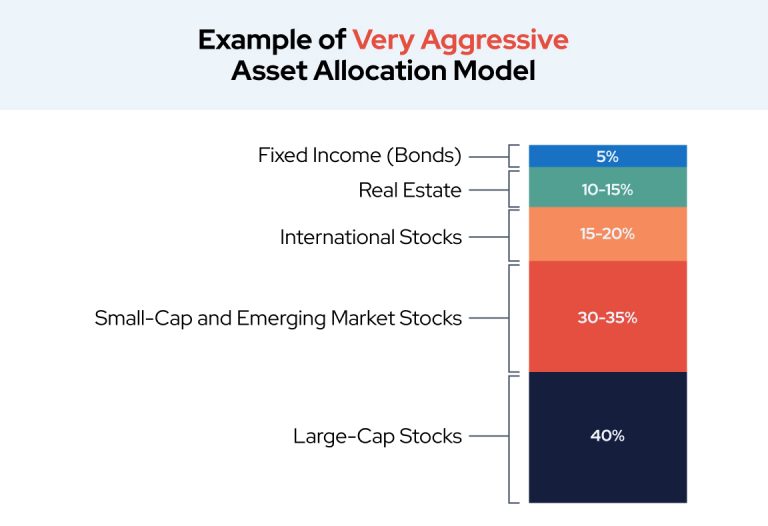

Asset Allocation Fund What Is It Explained Types Examples My Xxx Hot Girl Asset allocation is how investors split up their portfolios among different kinds of assets. the three main asset classes are equities, fixed income, and cash and cash equivalents. each asset. Here are a few examples of how different allocations impact risk and return: aggressive allocation (e.g., 80% stocks, 20% bonds): higher returns but higher volatility. balanced allocation (e.g., 50% stocks, 40% bonds, 10% cash): moderate risk with steady growth. Asset allocation funds are mutual funds that invest across multiple asset classes, such as equities, bonds, and cash, based on a predefined strategy. the allocation can be fixed or dynamic, depending on market conditions and the fund’s objectives. asset allocation examples:. Types of asset allocation funds: 1.target date funds: these funds are also known as life cycle funds and are used for retirement planning. in these types of funds, the risk concentration tends to decrease on approaching maturity. it contains a specific mix of asset classes that roll out with a high risk reward concentration. 2. dynamic asset.

Asset Allocation 8 Examples Format Pdf Asset allocation funds are mutual funds that invest across multiple asset classes, such as equities, bonds, and cash, based on a predefined strategy. the allocation can be fixed or dynamic, depending on market conditions and the fund’s objectives. asset allocation examples:. Types of asset allocation funds: 1.target date funds: these funds are also known as life cycle funds and are used for retirement planning. in these types of funds, the risk concentration tends to decrease on approaching maturity. it contains a specific mix of asset classes that roll out with a high risk reward concentration. 2. dynamic asset. Asset allocation funds are investment vehicles designed to offer a diversified portfolio to investors. these funds pool money from various investors and allocate it across a range of asset classes, such as stocks, bonds, and cash equivalents, in varying proportions. the primary goal is to optimize returns while managing risk. What are asset allocation funds? an asset allocation fund is a type of mutual fund or exchange traded fund (etf) that invests in a diverse mix of assets, such as stocks, bonds, and cash equivalents. the fund's objective is to achieve a balanced risk return profile by allocating assets across different asset classes and investment styles. What is asset allocation? it is actually a roadmap for your financial future. the underlying goal of asset allocation is diversification, i.e., allocating investments across different classes of assets with the goal of avoiding excessive risk while maximising returns. asset classes respond uniquely to movements in markets. There are many diverse types of asset allocation funds, but the most common ones are balanced funds, target date funds, and index funds. balanced funds a balanced fund is an asset allocation fund that invests in a mix of equity, fixed income, and cash and equivalents.

Asset Allocation Examples Choosing Your Gold Ira Asset allocation funds are investment vehicles designed to offer a diversified portfolio to investors. these funds pool money from various investors and allocate it across a range of asset classes, such as stocks, bonds, and cash equivalents, in varying proportions. the primary goal is to optimize returns while managing risk. What are asset allocation funds? an asset allocation fund is a type of mutual fund or exchange traded fund (etf) that invests in a diverse mix of assets, such as stocks, bonds, and cash equivalents. the fund's objective is to achieve a balanced risk return profile by allocating assets across different asset classes and investment styles. What is asset allocation? it is actually a roadmap for your financial future. the underlying goal of asset allocation is diversification, i.e., allocating investments across different classes of assets with the goal of avoiding excessive risk while maximising returns. asset classes respond uniquely to movements in markets. There are many diverse types of asset allocation funds, but the most common ones are balanced funds, target date funds, and index funds. balanced funds a balanced fund is an asset allocation fund that invests in a mix of equity, fixed income, and cash and equivalents.

Dive Into Asset Allocation And Fund Strategies For Success Fincareplan What is asset allocation? it is actually a roadmap for your financial future. the underlying goal of asset allocation is diversification, i.e., allocating investments across different classes of assets with the goal of avoiding excessive risk while maximising returns. asset classes respond uniquely to movements in markets. There are many diverse types of asset allocation funds, but the most common ones are balanced funds, target date funds, and index funds. balanced funds a balanced fund is an asset allocation fund that invests in a mix of equity, fixed income, and cash and equivalents.

What Is Asset Allocation Fund Explained Fincalc Blog