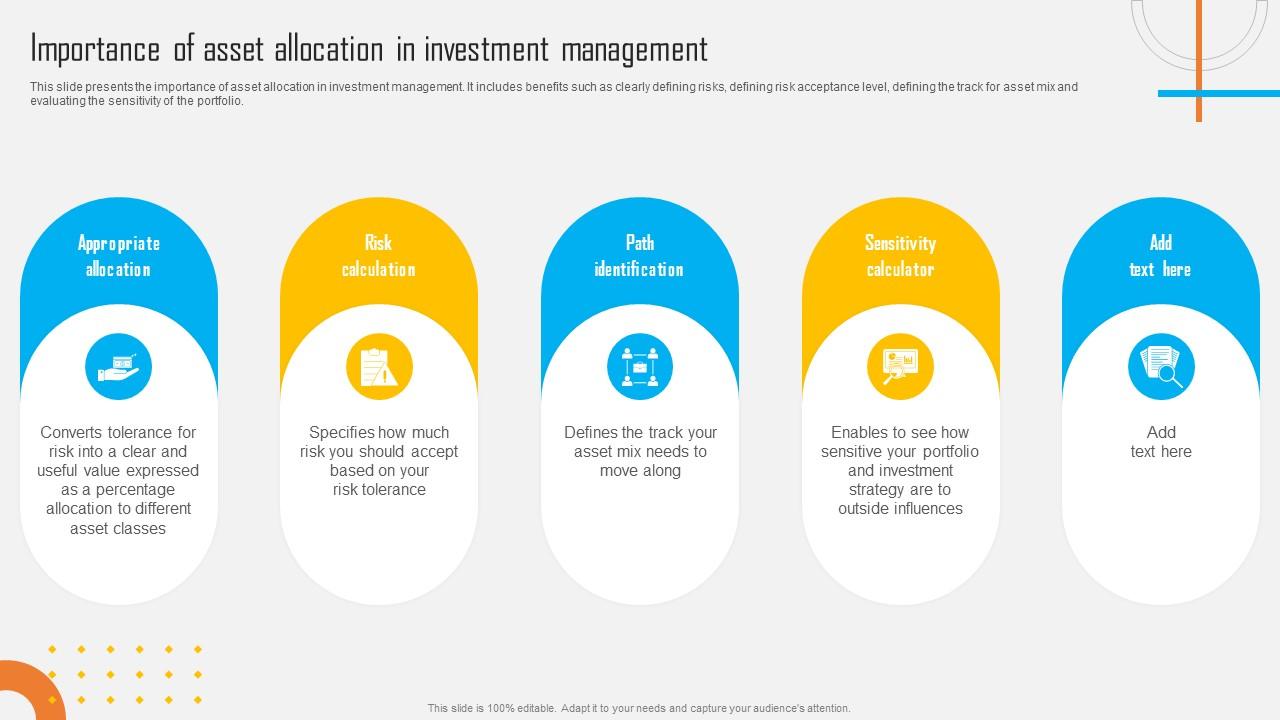

Asset Allocation Investment Importance Of Asset Allocation In

Asset Allocation Investment Importance Of Asset Allocation In Asset allocation is how investors divide their portfolios among different assets that might include equities, fixed income assets, and cash and its equivalents. investors ordinarily aim to. This guide will help investors understand the importance of asset allocation and the factors that play the most crucial roles in determining the best asset mix for each investor.

Asset Allocation Investment Overview Of Integrated Asset Allocation Why asset allocation is still one of the most important strategies an investor can employ. why asset allocation and diversification should be addressed concurrently but thought of separately. how baird views this subject and how our asset allocation models are derived. Asset allocation refers to an investment strategy in which individuals divide their investment portfolios between different diverse asset classes to minimize investment risks. the asset classes fall into three broad categories: equities, fixed income, and cash and equivalents. Asset allocation is a crucial aspect of investment planning that involves dividing your investment portfolio across different asset classes such as stocks, bonds, real estate, and cash. the purpose of asset allocation is to minimize risk and maximize returns by diversifying your investments. Simply put, utilizing different types of investments can help protect your assets when some are underperforming, and capture returns when others are performing well. the process of dividing your portfolio among different categories of investments, or asset classes, is called asset allocation.

Importance Of Asset Allocation Apxway Asset allocation is a crucial aspect of investment planning that involves dividing your investment portfolio across different asset classes such as stocks, bonds, real estate, and cash. the purpose of asset allocation is to minimize risk and maximize returns by diversifying your investments. Simply put, utilizing different types of investments can help protect your assets when some are underperforming, and capture returns when others are performing well. the process of dividing your portfolio among different categories of investments, or asset classes, is called asset allocation. Just as choosing the right layout is crucial for a functional home, selecting the right asset allocation is essential for a sound investment portfolio. in this article we’ll review the basic tenets of asset allocation and why it’s important for long term investment success. Asset allocation is vital because it helps balance risk and reward by distributing investments across various asset classes. this diversification aligns with an investor's financial goals, risk tolerance, and time horizon, aiming to mitigate risks while maximizing potential returns. In this blog, we'll explore the concept of asset allocation, its critical role in investment strategy, and how diversification across different asset classes can reduce risk and improve returns. Asset allocation is a cornerstone of successful investing, influencing portfolio performance and risk management. it involves distributing investments across different asset classes, such as stocks, bonds, and cash equivalents, to achieve desired financial objectives.

Asset Allocation Investment Overview And Workflow Of Asset Allocation Just as choosing the right layout is crucial for a functional home, selecting the right asset allocation is essential for a sound investment portfolio. in this article we’ll review the basic tenets of asset allocation and why it’s important for long term investment success. Asset allocation is vital because it helps balance risk and reward by distributing investments across various asset classes. this diversification aligns with an investor's financial goals, risk tolerance, and time horizon, aiming to mitigate risks while maximizing potential returns. In this blog, we'll explore the concept of asset allocation, its critical role in investment strategy, and how diversification across different asset classes can reduce risk and improve returns. Asset allocation is a cornerstone of successful investing, influencing portfolio performance and risk management. it involves distributing investments across different asset classes, such as stocks, bonds, and cash equivalents, to achieve desired financial objectives.

Asset Allocation Investment Overview Of Dynamic Asset Allocation In this blog, we'll explore the concept of asset allocation, its critical role in investment strategy, and how diversification across different asset classes can reduce risk and improve returns. Asset allocation is a cornerstone of successful investing, influencing portfolio performance and risk management. it involves distributing investments across different asset classes, such as stocks, bonds, and cash equivalents, to achieve desired financial objectives.

Importance Of Asset Allocation Hum Fauji Initiatives

Comments are closed.