Asset Allocation Pdf My answer: there are a few principles to doing asset allocation correctly, but there are two prerequisites you need to do first. the prerequisites #1 develop a specific asset allocation plan. The investment objectives of asset only asset allocation approaches focus on the asset side of the economic balance sheet; approaches with a liability relative orientation focus on funding liabilities; and goals based approaches focus on achieving financial goals.

Asset Allocation Pdf Asset Allocation Investing An allocation to alternatives is not for all investors, so the reading describes issues that should be addressed when considering an allocation to alternatives. we then discuss approaches to asset allocation when incorporating alternatives in the opportunity set and the need for liquidity planning in private investment alternatives. Spreading investments across different asset classes, rather than relying on one, is a key strategy to balance risk and potential returns over time. known as asset allocation, this approach. Strategic asset allocation is a long term investment approach where a fixed percentage of assets is allocated to different asset classes based on an investor’s risk tolerance, goals, and time horizon. if, however, you need quick access to cash, hold liquid assets like cash or money market funds. 4. market conditions and economic indicators. At schwab asset management ®, asset allocation isn’t just a concept—it’s a research driven process designed to align investments with each client’s financial goals, risk tolerance and time horizon. it serves as the foundation of our model portfolios, helping to create diversified, well balanced investment solutions tailored to clients.

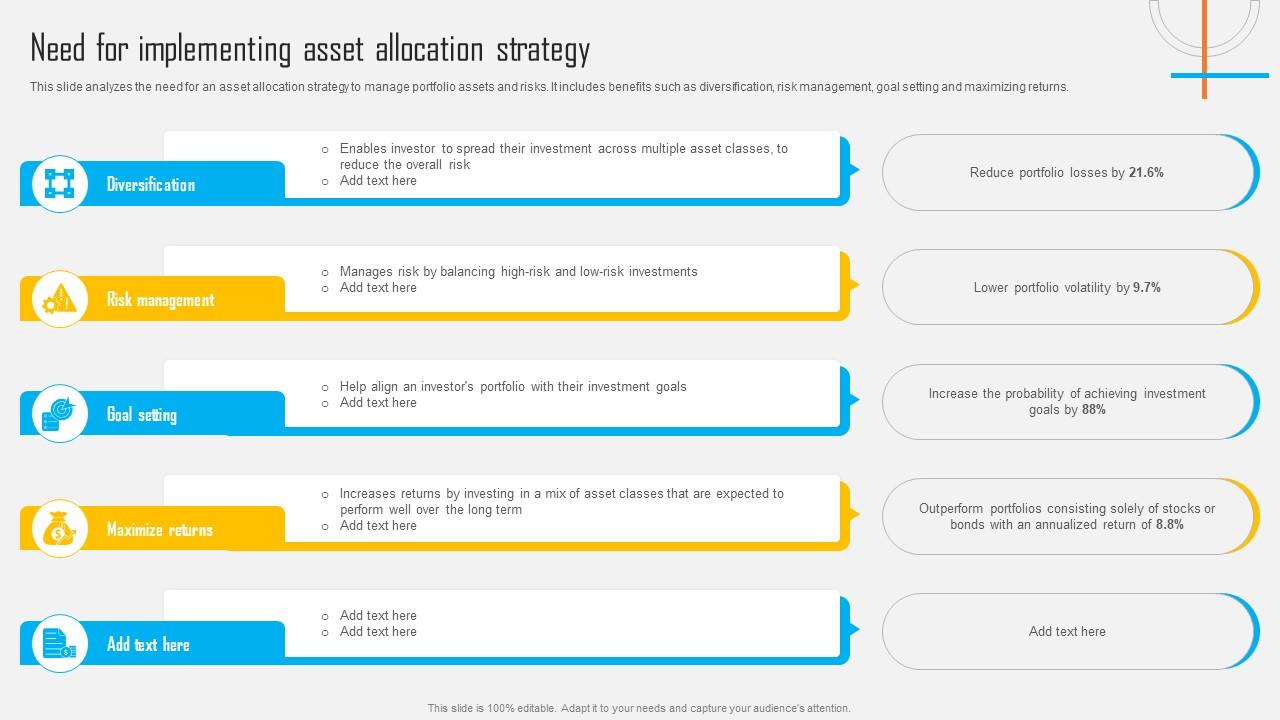

Asset Allocation Investment Need For Implementing Asset Allocation Strategic asset allocation is a long term investment approach where a fixed percentage of assets is allocated to different asset classes based on an investor’s risk tolerance, goals, and time horizon. if, however, you need quick access to cash, hold liquid assets like cash or money market funds. 4. market conditions and economic indicators. At schwab asset management ®, asset allocation isn’t just a concept—it’s a research driven process designed to align investments with each client’s financial goals, risk tolerance and time horizon. it serves as the foundation of our model portfolios, helping to create diversified, well balanced investment solutions tailored to clients. Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. the goal is to balance risk and reward by apportioning assets according to an individual's goals, risk tolerance, and investment horizon. Asset allocation is the process of balancing a portfolio’s risk and return by investing across various asset classes to help investors pursue their investment goals. what is asset allocation?. Asset allocation is a fundamental investment activity that involves building and managing a portfolio of different asset classes such as equities, bonds, property, alternatives (including private equity, commodities, and hedge funds), or cash. Asset allocation is a fundamental investment strategy that helps investors strike a balance between risk and reward by diversifying their portfolios across different asset classes, such as stocks, bonds, and cash.

Asset Allocation Investment Examining Insured Asset Allocation Process Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. the goal is to balance risk and reward by apportioning assets according to an individual's goals, risk tolerance, and investment horizon. Asset allocation is the process of balancing a portfolio’s risk and return by investing across various asset classes to help investors pursue their investment goals. what is asset allocation?. Asset allocation is a fundamental investment activity that involves building and managing a portfolio of different asset classes such as equities, bonds, property, alternatives (including private equity, commodities, and hedge funds), or cash. Asset allocation is a fundamental investment strategy that helps investors strike a balance between risk and reward by diversifying their portfolios across different asset classes, such as stocks, bonds, and cash.

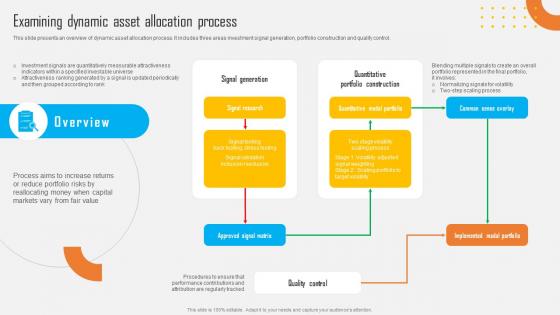

Asset Allocation Investment Examining Dynamic Asset Allocation Process Asset allocation is a fundamental investment activity that involves building and managing a portfolio of different asset classes such as equities, bonds, property, alternatives (including private equity, commodities, and hedge funds), or cash. Asset allocation is a fundamental investment strategy that helps investors strike a balance between risk and reward by diversifying their portfolios across different asset classes, such as stocks, bonds, and cash.