Asset Allocation Strategy Minnesota State Retirement System Msrs

Asset Allocation Strategy Minnesota State Retirement System Msrs Now that you know more about an asset allocation strategy and the different investor types, you can choose your investments from the investment options available in the plan. The combined funds represent the assets of active and retired public employees in the three statewide retirement systems, which include minnesota state retirement system (msrs), public employees retirement association (pera), and teachers retirement association (tra).

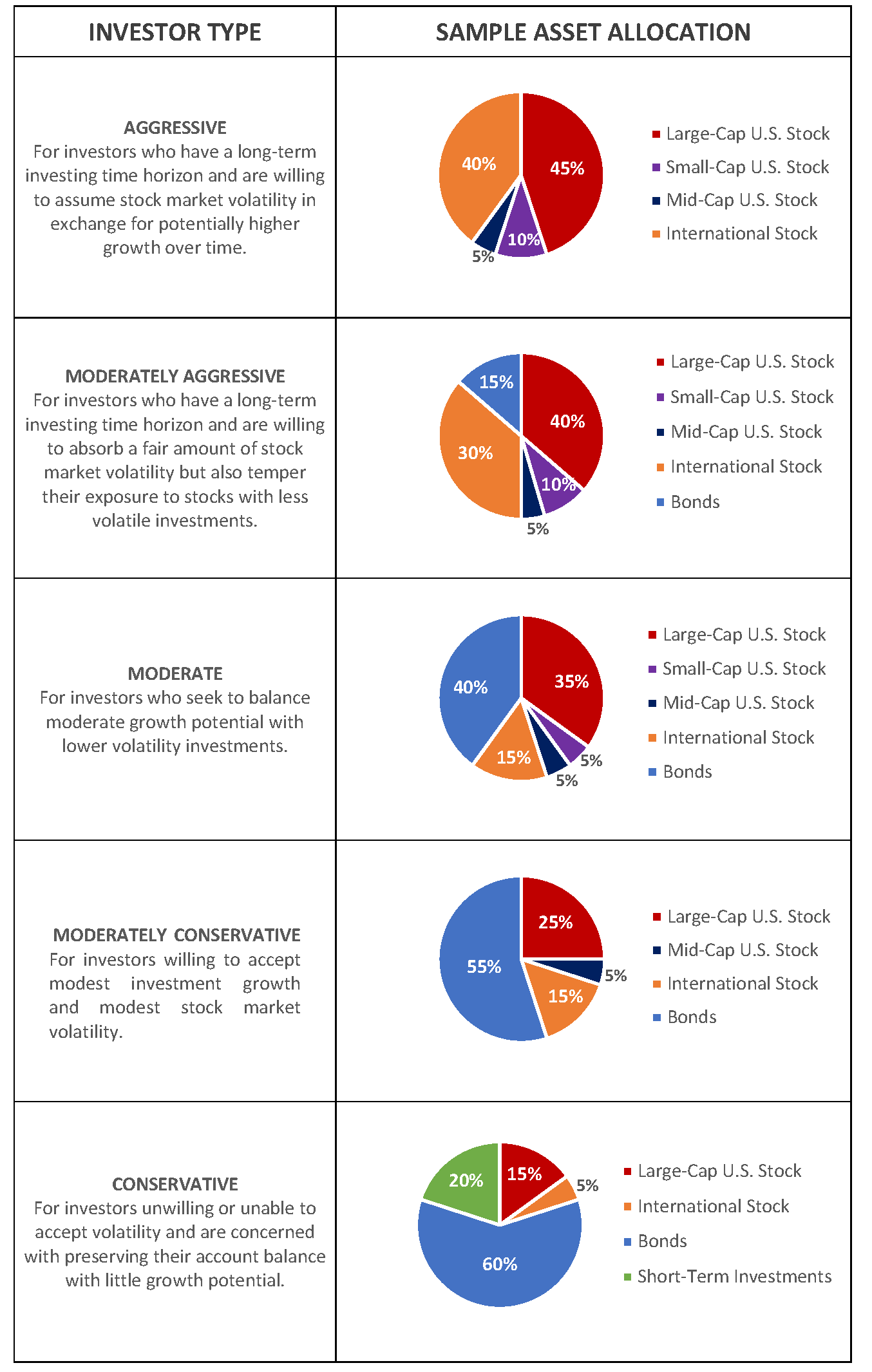

Minnesota State Retirement System Msrs On Linkedin Your Msrs For msrs’ legislators and elective state officers retirement plans, which have been closed to new members since 1997, contributions and net assets are insufficient to pay benefits and administrative expenses, including annual actuarial valuations. Intended to illustrate possible investment portfolio allocations that represent an investment strategy based on risk and return. investing involves risk, including possible loss of principal. Review sample asset allocation strategies from your results of the investor profile quiz in step one. choose your investments based on your desired asset allocation strategy. Equity securities of small and mid sized companies may be more volatile than securities of larger, more established companies. asset allocation and balanced investment options and models are subject to the risks of the underlying funds, which can be a mix of stock stock funds and bond bond funds.

Account Online Account Login Review sample asset allocation strategies from your results of the investor profile quiz in step one. choose your investments based on your desired asset allocation strategy. Equity securities of small and mid sized companies may be more volatile than securities of larger, more established companies. asset allocation and balanced investment options and models are subject to the risks of the underlying funds, which can be a mix of stock stock funds and bond bond funds. The combined funds have a strategic asset allocation based on their investment objectives and the expected long term performance of the capital markets. plan members contribute a meaningful portion of their salaries in return for their retirement security. The minnesota state board of investment (sbi) is responsible for the asset management of pera’s retirement plans. each investment program uses different investment vehicles to help our members reach their savings goals. The following exhibit shows the revenue, expenses and resulting assets of the fund as reported by the minnesota state retirement system for the prior two fiscal years. A single mn target retirement fund (or target date funds) offers a diversified mix of stocks and bonds (also called fixed income) investments. a professional money manager selects and manages the right mix of investments (asset allocation) based on the target retirement date.

Minnesota State Retirement System Msrs On Linkedin Msrs Celebrated The combined funds have a strategic asset allocation based on their investment objectives and the expected long term performance of the capital markets. plan members contribute a meaningful portion of their salaries in return for their retirement security. The minnesota state board of investment (sbi) is responsible for the asset management of pera’s retirement plans. each investment program uses different investment vehicles to help our members reach their savings goals. The following exhibit shows the revenue, expenses and resulting assets of the fund as reported by the minnesota state retirement system for the prior two fiscal years. A single mn target retirement fund (or target date funds) offers a diversified mix of stocks and bonds (also called fixed income) investments. a professional money manager selects and manages the right mix of investments (asset allocation) based on the target retirement date.

Fillable Online Msrs Minnesota State Retirement Systemmsrs The following exhibit shows the revenue, expenses and resulting assets of the fund as reported by the minnesota state retirement system for the prior two fiscal years. A single mn target retirement fund (or target date funds) offers a diversified mix of stocks and bonds (also called fixed income) investments. a professional money manager selects and manages the right mix of investments (asset allocation) based on the target retirement date.

Comments are closed.