Asset Allocation Using Etfs Pdf Exchange Traded Fund Asset Allocation Doing your homework means more than just reading the name of the etf. × “with market movements removed, asset allocation and active management are equally important in determining portfolio. With the dramatic growth in number of exchange traded funds (etfs), individual investors have gained access to a wicie variety of funds including funds representing non traditional asset classes.

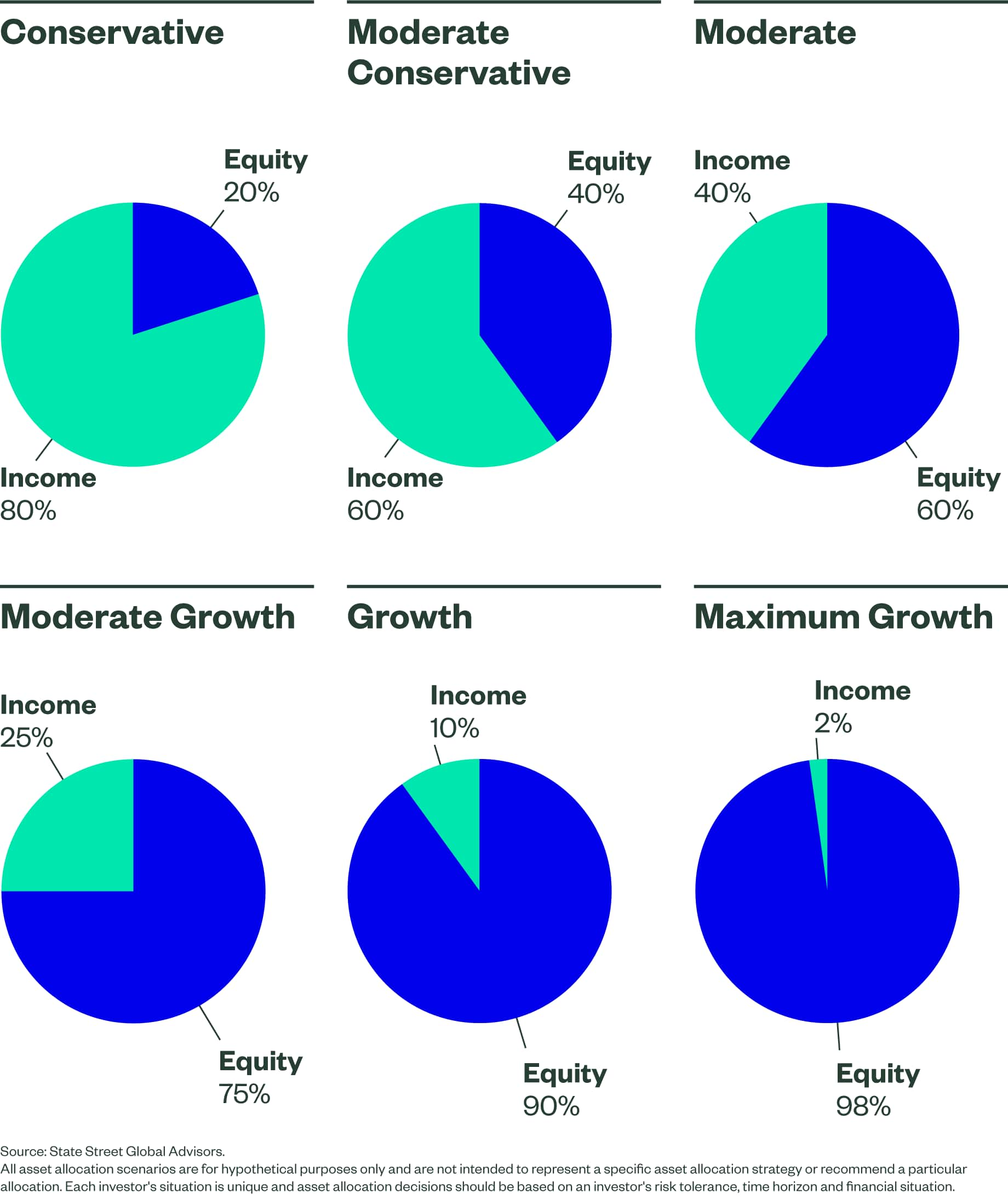

State Street Strategic Asset Allocation Etf Portfolios Etfs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the etfs net asset value. brokerage commissions and etf expenses will reduce returns. asset allocation is a method of diversification which positions assets among major investment categories. Investment tools such as mutual funds, futures contracts and exchange traded funds enable investors to gain exposure to multiple assets with a single investment. in particular, etfs allow investors to implement asset alloca tion decisions at every level from the bond equity mix to sector rotation. 3. where there’s an index. We develop a dynamic investment strategy with markov regime switching (mrs) in asset allocation with international ishares exchange traded funds (etfs). using daily etf data, we show that a portfolio based on the dynamic mrs strategy outperforms one based on static mean variance strategies after transaction costs. Abstract the paper shows that country specific exchange traded funds (hereafter etfs) enhance global asset allocation strategies. because etfs can be sold short even on a downtick, global strategies that diversify risk across country specific etfs generate efficiency gains that cannot be achieved by simply investing in a global index open or.

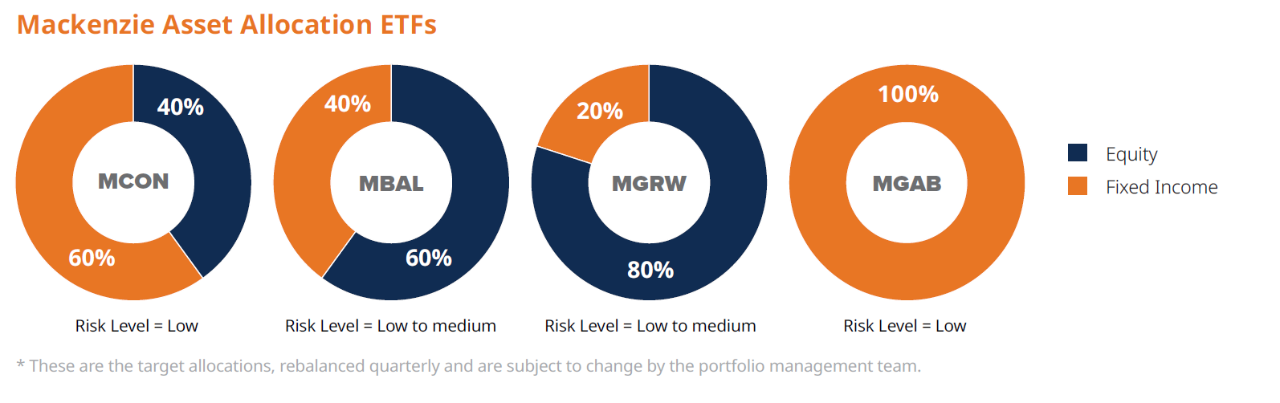

Asset Allocation Etfs Mackenzie Investments We develop a dynamic investment strategy with markov regime switching (mrs) in asset allocation with international ishares exchange traded funds (etfs). using daily etf data, we show that a portfolio based on the dynamic mrs strategy outperforms one based on static mean variance strategies after transaction costs. Abstract the paper shows that country specific exchange traded funds (hereafter etfs) enhance global asset allocation strategies. because etfs can be sold short even on a downtick, global strategies that diversify risk across country specific etfs generate efficiency gains that cannot be achieved by simply investing in a global index open or. Assetallocationusingetfs free download as pdf file (.pdf), text file (.txt) or read online for free. etfs provide exposure not just to equity, but to commodity, currency, fixedincome and international categories. the number of etf offerings has more than doubled in the last 18 months. (ebook) the investor's guide to active asset allocation: using technical analysis and etfs to trade the markets by martin j. pring isbn 9780071466851, 0071466851 own the complete ebook set now in pdf and docx formats free download as pdf file (.pdf), text file (.txt) or read online for free. The study shows how index funds and exchange traded funds (etfs) can be used for tacti cal asset allocation by using a modified kelly criterion. index funds and etfs are good for. In this study, we construct a multi asset allocation portfolio of ishares exchange traded funds (etfs) using mean–variance (mv) and bl models. two investment strategies, namely lump sum investment and a systematic investment plan (sip), are also investigated and applied to etf portfolios.