Assets Vs Liabilities What You Need To Know Assets are a representation of things that are owned by a company and produce revenue. liabilities, on the other hand, are a representation of amounts owed to other parties. both assets and liabilities are broken down into current and noncurrent categories. in short, one is owned (assets) and one is owed (liabilities). In this video, i’m going to explain to you exactly what assets are, as well as the difference between assets and liabilities, and how you can acquire assets .more.

Assets Vs Liabilities And How To Generate Assets The Exchange Assets represent a net gain in value, while liabilities represent a net loss in value. a standard accounting equation pits the total assets of a company against its total liabilities, and investors use this ratio of assets vs. liabilities to place a valuation on the company. To understand how the two differ, you have to know the liability vs. asset meaning: liabilities: existing debts a business owes to another business, vendor, employee, organization, lender, or government agency. liabilities can help owners finance their companies (e.g., loans). assets: items or resources of value that the business owns. Assets are what a business owns, while liabilities are what it owes, both affecting overall financial health. tracking assets and liabilities helps businesses make smarter decisions about debt, cash flow, and future investments. Assets bring future economic benefits to its owners, whereas liabilities are the obligations for future payments. therefore, the distinction between assets or liabilities depends on whether something will result in the inflow or outflow of economic benefits in the future.

Assets Vs Liabilities And How To Generate Assets Assets are what a business owns, while liabilities are what it owes, both affecting overall financial health. tracking assets and liabilities helps businesses make smarter decisions about debt, cash flow, and future investments. Assets bring future economic benefits to its owners, whereas liabilities are the obligations for future payments. therefore, the distinction between assets or liabilities depends on whether something will result in the inflow or outflow of economic benefits in the future. Learn the essential components of financial accounting: assets, liabilities, and equity. master balance sheet fundamentals for business success. A healthy assets vs. liabilities ratio ensures adequate cash flow. company culture is an intangible asset that is often overlooked, but it converts to employee retention, and, in turn, revenue generation by minimizing hiring costs and maximizing employee experience. Assets vs liabilities explain the differences between the main components of a business. the former is anything owned by the company to provide economic benefits in the future. in contrast, liabilities are something that the company is obliged to pay it off in the future. There are several key differences between assets and liabilities, which are as follows: nature. assets provide a future economic benefit, while liabilities present a future obligation. an indicator of a successful business is one that has a high proportion of assets to liabilities, since this indicates a higher degree of liquidity.

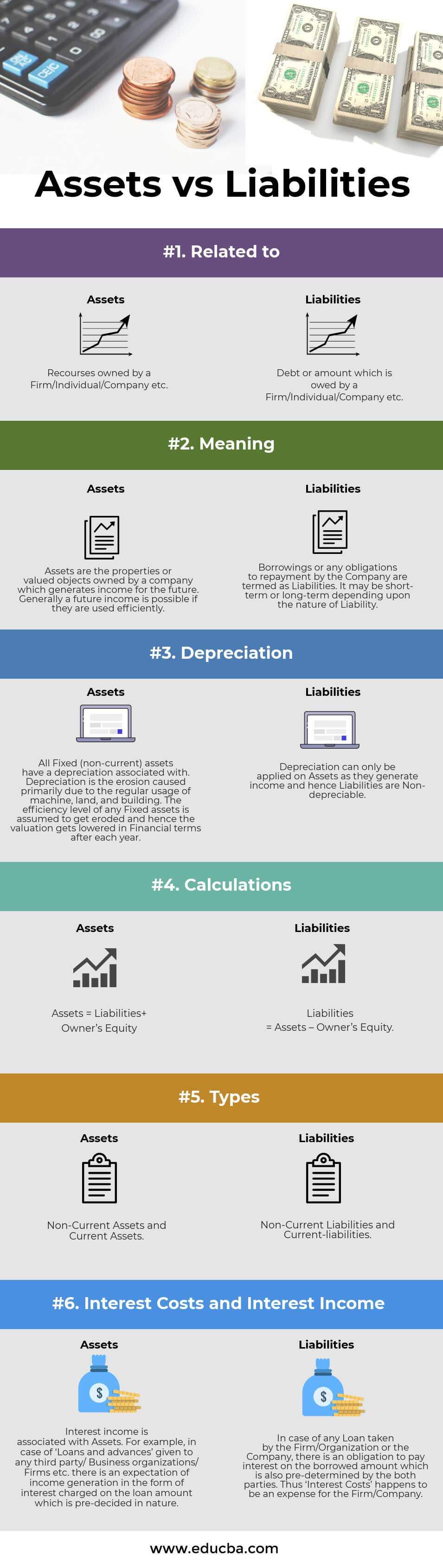

Assets Vs Liabilities Top 6 Differences With Infographics Learn the essential components of financial accounting: assets, liabilities, and equity. master balance sheet fundamentals for business success. A healthy assets vs. liabilities ratio ensures adequate cash flow. company culture is an intangible asset that is often overlooked, but it converts to employee retention, and, in turn, revenue generation by minimizing hiring costs and maximizing employee experience. Assets vs liabilities explain the differences between the main components of a business. the former is anything owned by the company to provide economic benefits in the future. in contrast, liabilities are something that the company is obliged to pay it off in the future. There are several key differences between assets and liabilities, which are as follows: nature. assets provide a future economic benefit, while liabilities present a future obligation. an indicator of a successful business is one that has a high proportion of assets to liabilities, since this indicates a higher degree of liquidity.

Assets Vs Liabilities Top 6 Differences With Infographics Assets vs liabilities explain the differences between the main components of a business. the former is anything owned by the company to provide economic benefits in the future. in contrast, liabilities are something that the company is obliged to pay it off in the future. There are several key differences between assets and liabilities, which are as follows: nature. assets provide a future economic benefit, while liabilities present a future obligation. an indicator of a successful business is one that has a high proportion of assets to liabilities, since this indicates a higher degree of liquidity.