Assignment 01 Pdf Dividend Debt

Assignment 3 Dividen Policy Brigham E F And Houston J F 2015 Assignment 01 free download as pdf file (.pdf), text file (.txt) or read online for free. Financial statements (years ended 2019‐2023); dividends (cash and bonus shares) paid for years ended 2019‐ 2023. the corporation selected should be paying dividends. dividend yield for 5 years. times interest earned ratio for 5 years.

Financial Management Assignment 2 Pdf Dividend Cost Of Capital There are only two ways in which a business can make money. the first is debt. the essence of debt is that you promise to make fixed payments in the future (interest payments and repaying principal). if you fail to make those payments, you lose control of your business. the other is equity. Fpe011 ai v7a1 2 © kaplan higher education assignment details • this assignment covers topics 1 to 9 and accounts for 50% of your final grade. • there are two (2) sections to this assignment: – section a comprises of nine (9) short answer questions worth a total of 80 marks. It has a long 1 point term debt outstanding of inri 1 0 million. its equity capital consists of 1 0 million equity shares of nominal (face) value inr 10 each with inr 5 paid up on each share. Written assignment unit 1 the document provides an analysis of a comic book company's financial ratios, including gross profit margin, current ratio, debt ratio, return on assets, and debt to equity ratio, from 2017 to 2018.

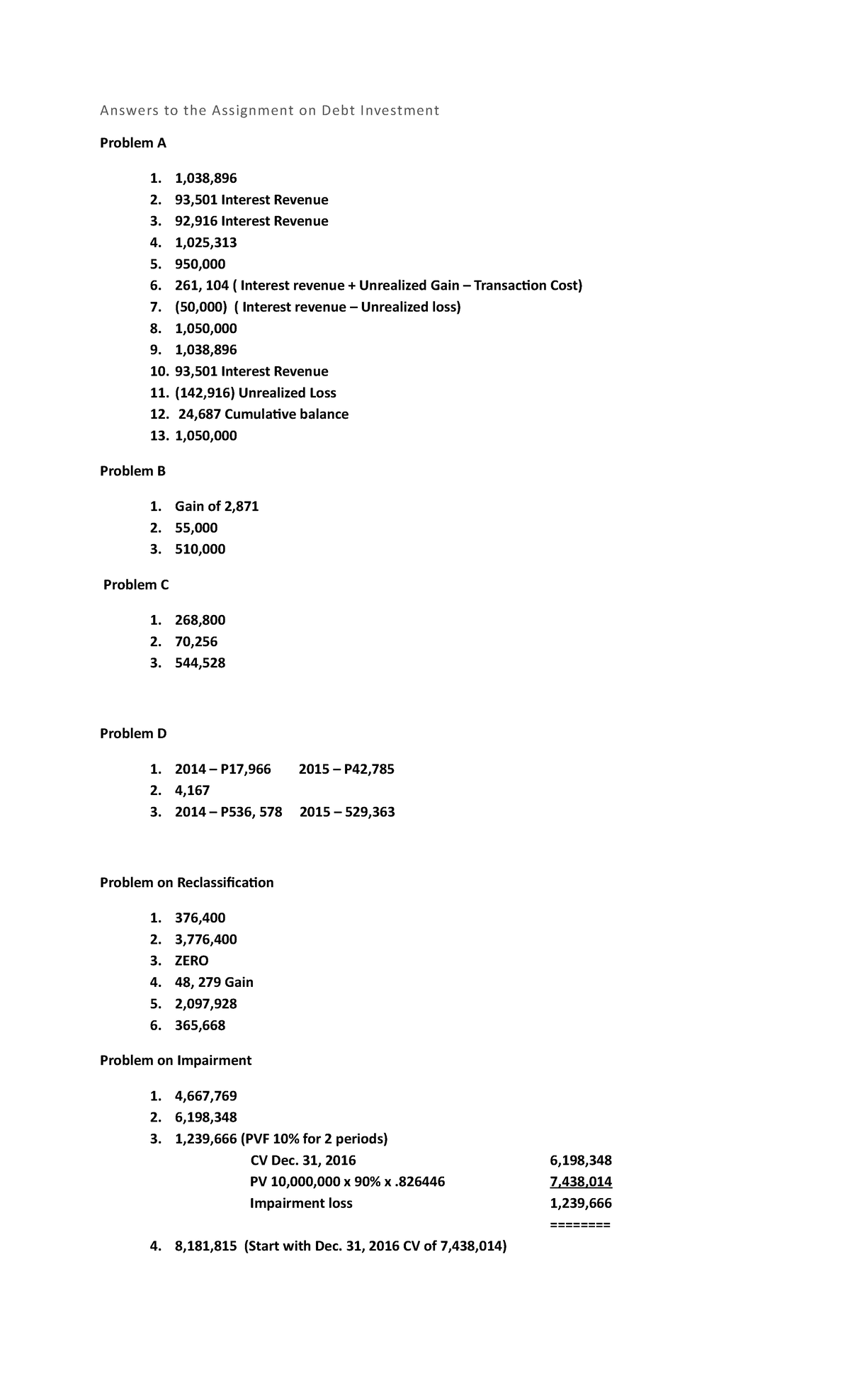

Answers To The Assignment On Debt Investment 31 2016 6 198 Pv On creditors and has a stronger financial cushion in the event of downturns (frankl in et al., figure 1 debt to equity ratio comparison (company a to e) as illustrated in the bar chart “debt to equity ratio compari son” above, the risk company e stands out with a towering ratio of 3.67, depict ed in dark red, signaling very. Dividend is the payment received by a shareholder from a company after distribution of profit. dividend is a reward to equity shareholders for their investment in the company. it is a basic right of equity shareholders to get dividend from the earnings of a company. State law protects the firm's creditors (i.e., bondholders) from paying excessive dividend. [extreme case : selling all the assets and payout all the proceeds as a dividend]. Question 3 provides financial details about a company's debt, preferred stock, and common stock, and asks to calculate the individual costs of each source of financing and the overall wacc.

Comments are closed.