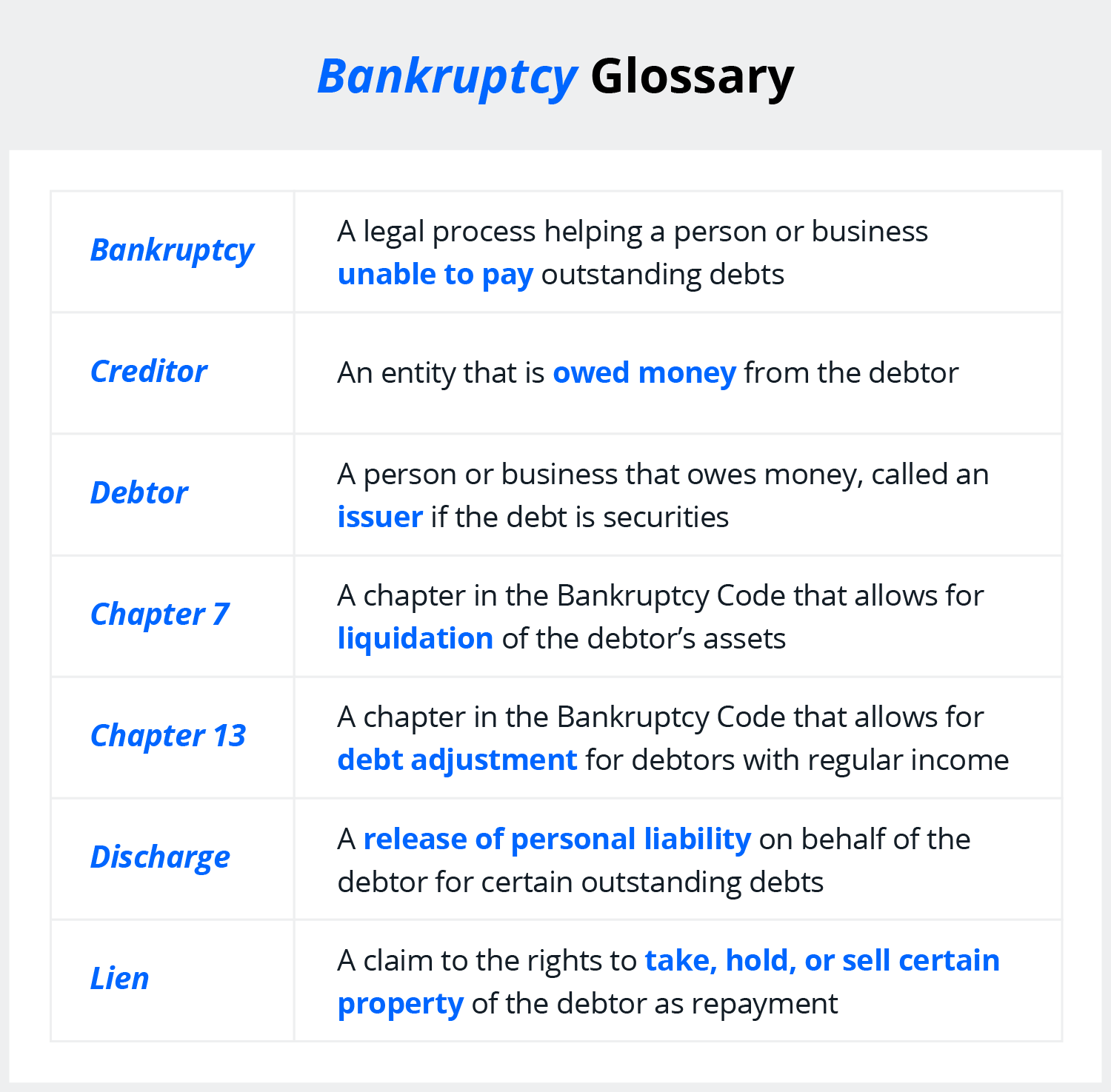

Bankruptcy Explained Types And How It Works 43 Off Bankruptcy is a legal process for relieving debt that the borrower cannot repay. it’s a measure of last resort that typically requires liquidating assets or entering a repayment plan . Bankruptcy is a legal process that eliminates all or part of your debt, though not without serious consequences. understanding the bankruptcy process, including the different options and their ramifications, can help you determine whether the benefits are worth the drawbacks.

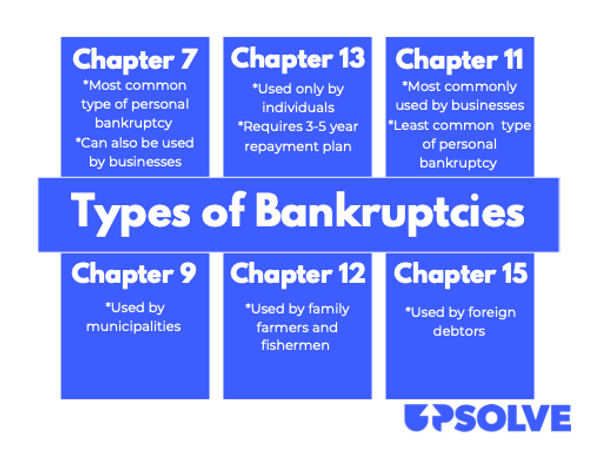

Bankruptcy Explained Types And How It Works 57 Off Bankruptcy is a legal process for individuals and businesses that can’t pay their debt. after filing, the court decides how much debt, if any, will be forgiven and how the remaining balance will be paid off. there are different types of bankruptcies. Even though the general goal of bankruptcy is to clear debt, not all bankruptcies are created equal. in fact, there are six different types of bankruptcies: you may have just taken one look at this list and zoned out for a second. that’s okay. Bankruptcy is a legal process where you declare you can’t pay your debts, and the court decides which debts will be erased and which debts you must be paid back. during bankruptcy, you usually have to sell most of your stuff to pay creditors. In short, bankruptcy is a legal means of getting rid of certain debt or going on a new, more affordable payment plan. you’ll have to pay a fee in order to file, and you can face severe credit damage for years following your bankruptcy, but for some people it may be the only way to become debt free. who its for: individuals and businesses.

Bankruptcy Explained Types And How It Works 57 Off Bankruptcy is a legal process where you declare you can’t pay your debts, and the court decides which debts will be erased and which debts you must be paid back. during bankruptcy, you usually have to sell most of your stuff to pay creditors. In short, bankruptcy is a legal means of getting rid of certain debt or going on a new, more affordable payment plan. you’ll have to pay a fee in order to file, and you can face severe credit damage for years following your bankruptcy, but for some people it may be the only way to become debt free. who its for: individuals and businesses. Chapter 7 bankruptcy involves liquidating assets to pay off debts. chapter 13 bankruptcy allows for debt repayment through a structured plan. chapter 11 bankruptcy is primarily used by businesses. Bankruptcy is a legal process that allows you to reduce or eliminate your debt when you’re otherwise unable to pay it back. chapter 7 bankruptcy requires liquidating most of your valuable. There are six different types of bankruptcies. chapter 7 and chapter 13 are the most common types of personal bankruptcy. chapter 7 is also called a liquidation. it allows the filer to get rid of most of their debts without repaying anything. it works best for individuals without assets like a home. Managed through federal courts, bankruptcy can allow individuals or businesses to either eliminate debts entirely or develop a plan to repay them over time. depending on the type of bankruptcy filed, the process may involve liquidating assets or reorganizing finances under court supervision.