Benefits Of Artificial Intelligence In Banking Role Of Ai In Banking Artificial intelligence has affected the banking industry in the best way. in this guide, we shall cover all the main benefits of artificial intelligence in this banking sector in detail. Today, ai powered banks see advantages in applying the technology to a gamut of mission critical needs—from customer service and fraud prevention to meeting environmental, social and governance.

Benefits Of Artificial Intelligence In Banking Cio Views Ai technologies bring operational efficiency and customer benefits to banking. learn how genai and other ai tools are transforming financial services and risks to watch out for. while artificial intelligence has gained momentum in the banking and finance sector, generative ai is taking it by storm. According to the study’s authors, banks that are strategically positioned in ai and agility can achieve transformative growth and efficiency. there are big differences in the way. Avanade’s latest research found that bankers view automation and efficiency as the biggest benefits of generative ai – with ai having the potential to fundamentally change customer onboarding. Ai brings benefits such as automation, efficiency, improved customer service, data analytics, and cost reduction. chatgpt, a language model developed by openai, has shown potential for virtual assistants and enhancing customer service experiences.

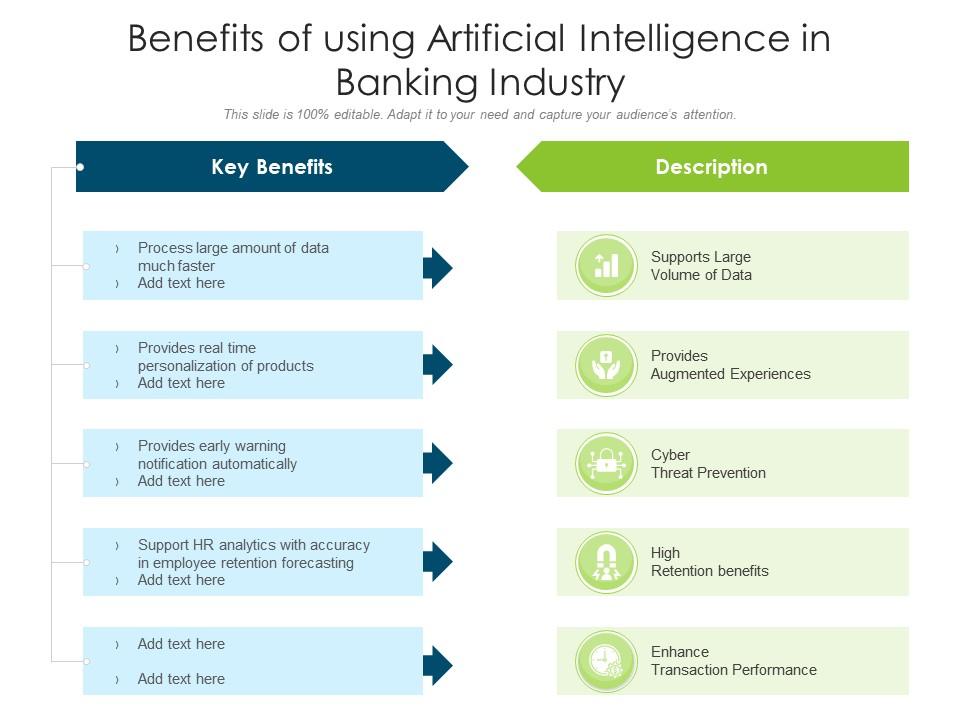

Benefits Of Using Artificial Intelligence In Banking Industry Avanade’s latest research found that bankers view automation and efficiency as the biggest benefits of generative ai – with ai having the potential to fundamentally change customer onboarding. Ai brings benefits such as automation, efficiency, improved customer service, data analytics, and cost reduction. chatgpt, a language model developed by openai, has shown potential for virtual assistants and enhancing customer service experiences. Ai is revolutionizing banking, especially in credit risk management and lending. ai driven credit risk modeling allows banks to assess borrower risk with greater accuracy and speed, enabling more competitive loan terms and broader approval criteria. Banking cio outlook magazine features insightful articles on applications of ai in banking industry and how financial companies are using ai to serve their customers, uses of ai in banking & payments, application of robotics and artificial intelligence (ai) to bank processes and many more. Banks are adopting generative ai, which promises earnings growth, improvements to decision making, and better risk management. but it also comes with new risks, concerns, and costs that banks will have to manage. Conversational ai for banking enables 24 7 automated customer service, handling routine inquiries, fraud alerts, and financial recommendations. ai chatbot for banks powered by azure ai enhances personalization, improves response times, and ensures seamless omnichannel banking experiences.

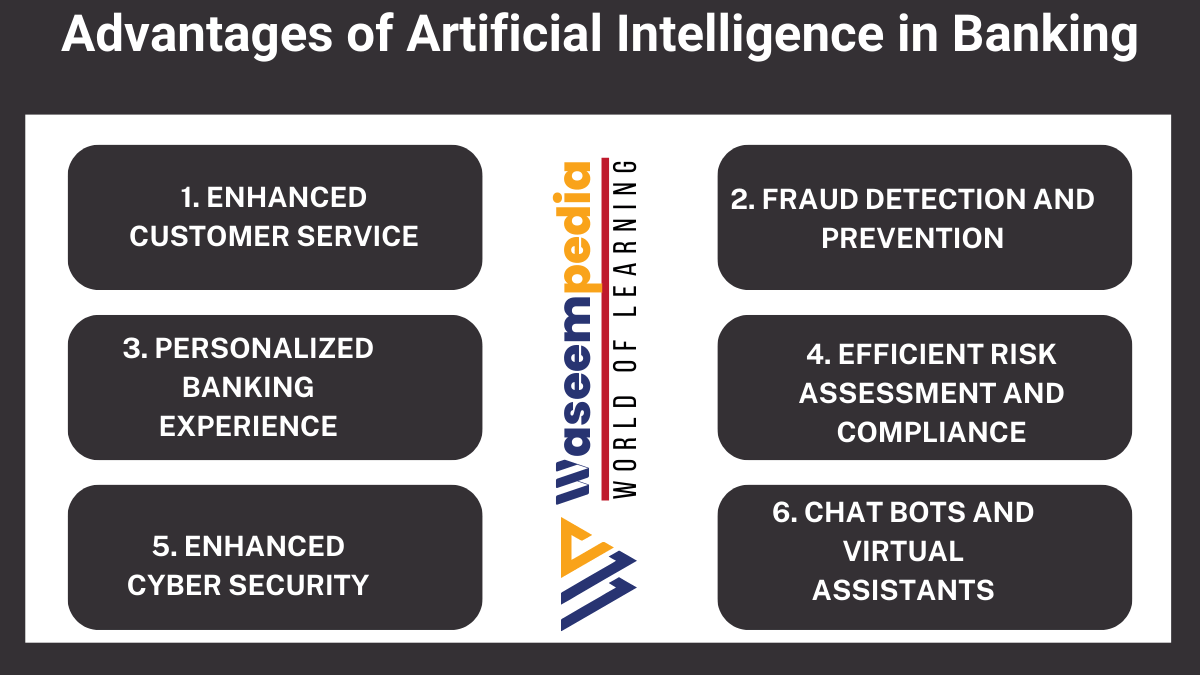

Advantages Of Artificial Intelligence In Banking Ai is revolutionizing banking, especially in credit risk management and lending. ai driven credit risk modeling allows banks to assess borrower risk with greater accuracy and speed, enabling more competitive loan terms and broader approval criteria. Banking cio outlook magazine features insightful articles on applications of ai in banking industry and how financial companies are using ai to serve their customers, uses of ai in banking & payments, application of robotics and artificial intelligence (ai) to bank processes and many more. Banks are adopting generative ai, which promises earnings growth, improvements to decision making, and better risk management. but it also comes with new risks, concerns, and costs that banks will have to manage. Conversational ai for banking enables 24 7 automated customer service, handling routine inquiries, fraud alerts, and financial recommendations. ai chatbot for banks powered by azure ai enhances personalization, improves response times, and ensures seamless omnichannel banking experiences.

Revolutionizing Banking With Artificial Intelligence Applications And Banks are adopting generative ai, which promises earnings growth, improvements to decision making, and better risk management. but it also comes with new risks, concerns, and costs that banks will have to manage. Conversational ai for banking enables 24 7 automated customer service, handling routine inquiries, fraud alerts, and financial recommendations. ai chatbot for banks powered by azure ai enhances personalization, improves response times, and ensures seamless omnichannel banking experiences.