Bitcoin Futures Record Volume Reflects Incremental Institutional Demand Bitcoin’s price surged past us$75,000 after the election, fueling demand, with the cme’s basis—measuring spot to futures price gaps—rising sharply from 7% to over 15%, signaling strong interest among us institutional investors. the bitcoin options market anticipates further gains, targeting $80,000 as november contracts approach. Sovereign wealth funds and other institutional investors were actively accumulating bitcoin during april 2025, according to john d’agostino, head of strategy at coinbase institutional.the trend points to a shift in market dynamics, with retail investors pulling back from etfs and spot markets as large scale buyers increase their exposure in a recent statement shared on cnbc, d’agostino.

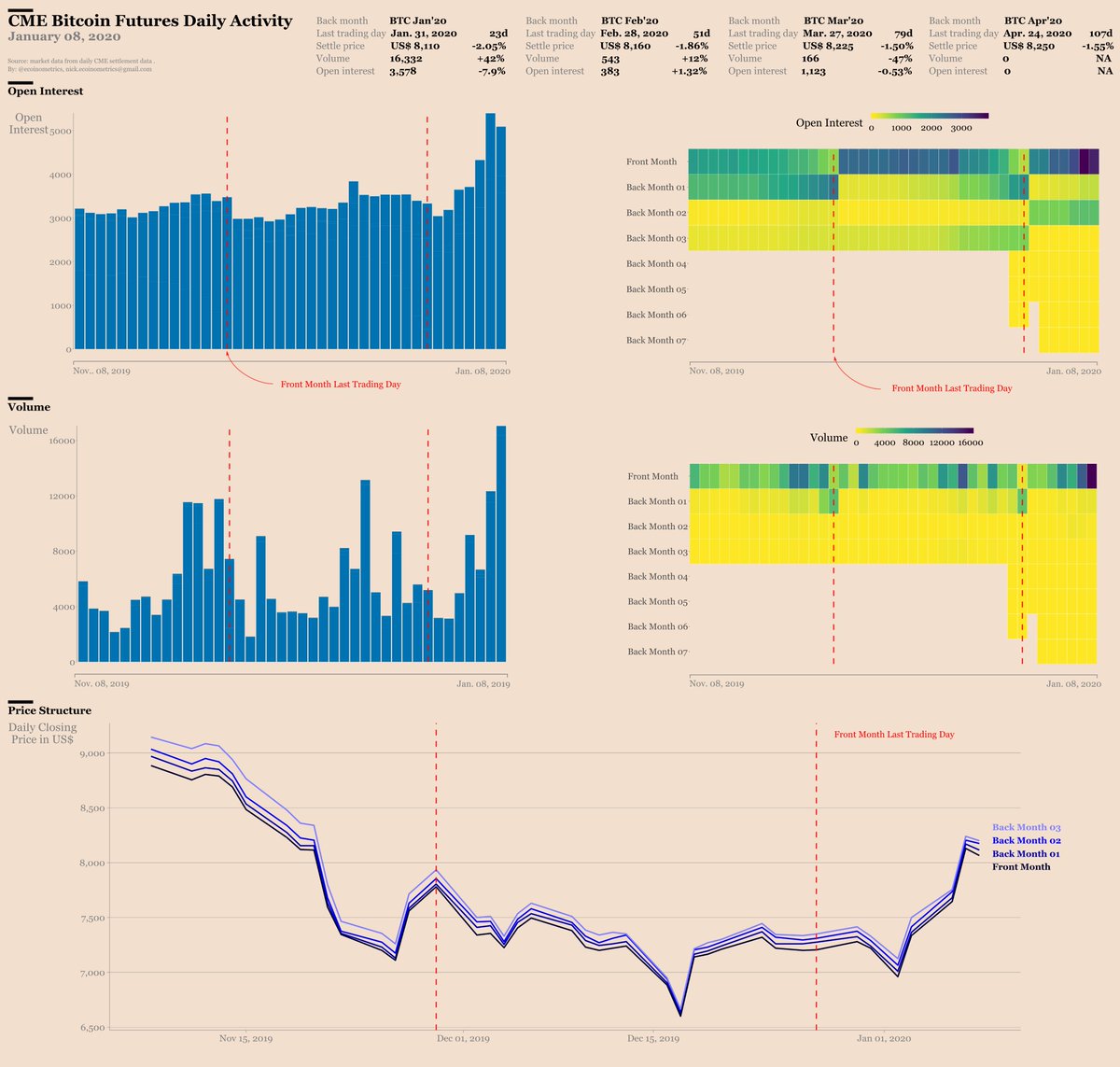

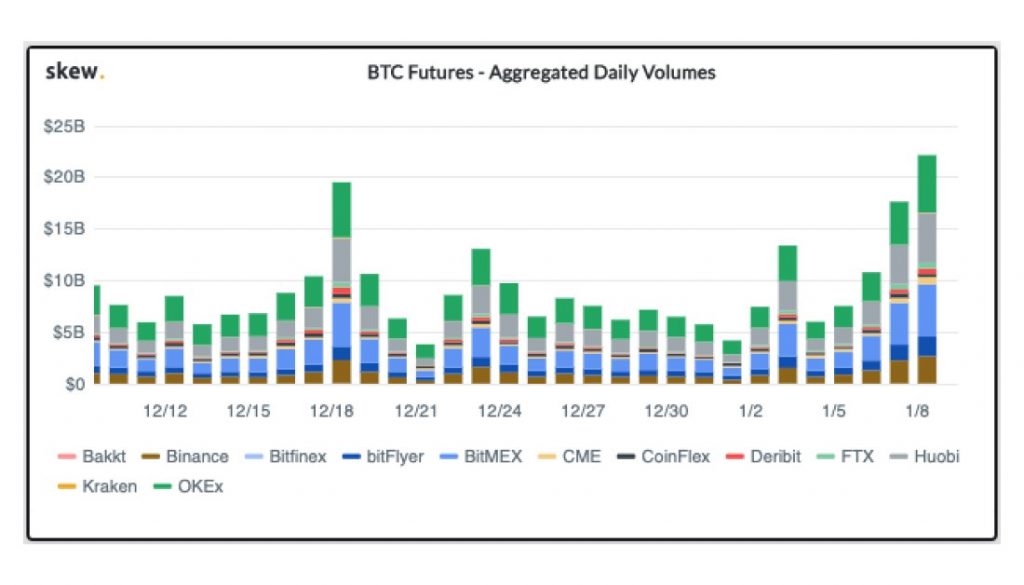

Bitcoin Futures Record Volume Reflects Incremental Institutional Demand Bitcoin futures volumes rise ahead of key april expirations bitcoin futures trading volumes have increased significantly as traders prepare for upcoming expirations on april 4 and april 30, 2025. investors have been active in trading notional values since the issuance of call and put options across different platforms. Futures open interest has increased by 15.6%. however, funding rates turned negative, showing rising short interest, despite the market trading higher. on 22 april, u.s. spot bitcoin etfs saw a record $1.54b in net inflows, showing a substantial influx of institutional demand. The data from cryptoquant reflects an increasing demand for the largest cryptocurrency, indicating just how much new money has entered digital asset markets in the last couple of months. funding rates have jumped to their highest levels since august, suggesting that most of those open positions are long positions expecting further appreciation. Futures premiums hit a 5 month high amid strong institutional interest. institutional investors are driving record breaking bitcoin open interest on the chicago mercantile exchange (cme), pushing futures premiums to 5 month highs. this surge suggests strong confidence in bitcoin’s potential for short term growth.

Cme Bitcoin Futures Sees Institutional Interest And Demand From Asia The data from cryptoquant reflects an increasing demand for the largest cryptocurrency, indicating just how much new money has entered digital asset markets in the last couple of months. funding rates have jumped to their highest levels since august, suggesting that most of those open positions are long positions expecting further appreciation. Futures premiums hit a 5 month high amid strong institutional interest. institutional investors are driving record breaking bitcoin open interest on the chicago mercantile exchange (cme), pushing futures premiums to 5 month highs. this surge suggests strong confidence in bitcoin’s potential for short term growth. Cme’s bitcoin friday futures weekly contracts have seen a significant uptick in institutional interest, reflecting growing demand for exposure to the digital asset market. since their launch in late september, over 380,000 cme bitcoin friday futures contracts have traded, reaching a daily average volume of 12,400 contracts. Open interest in bitcoin futures has climbed to $64.70 billion, indicating heightened activity among both institutional and retail traders, according to an ambcrypto report. the rise in open interest suggests continued confidence in btc, even as profit taking may occur in the short term. Bitcoin futures markets show steady growth with reduced speculation as institutional investors increase their participation, evidenced by blackrock's bitcoin etf surpassing its gold fund and futures contracts trading above $91,000 for december delivery.

Institutional And Retail Bitcoin Futures Demand Continues To Climb Cme’s bitcoin friday futures weekly contracts have seen a significant uptick in institutional interest, reflecting growing demand for exposure to the digital asset market. since their launch in late september, over 380,000 cme bitcoin friday futures contracts have traded, reaching a daily average volume of 12,400 contracts. Open interest in bitcoin futures has climbed to $64.70 billion, indicating heightened activity among both institutional and retail traders, according to an ambcrypto report. the rise in open interest suggests continued confidence in btc, even as profit taking may occur in the short term. Bitcoin futures markets show steady growth with reduced speculation as institutional investors increase their participation, evidenced by blackrock's bitcoin etf surpassing its gold fund and futures contracts trading above $91,000 for december delivery.

Institutional And Retail Bitcoin Futures Demand Continues To Climb Bitcoin futures markets show steady growth with reduced speculation as institutional investors increase their participation, evidenced by blackrock's bitcoin etf surpassing its gold fund and futures contracts trading above $91,000 for december delivery.