Bitcoin Price Analysis 11 27 18 Bear Territory Chainbits At present, the level is situated around $75,195. if btc’s current bearish trajectory continues, it’s possible that this line might be put to test. the analyst has pointed out, though, that the coin has dropped under the 200 day ma a few times before and managed to recover before breaking below the 50 week ma. Bitcoin (btc) has dropped over 29% from its january all time high of $109,000, reflecting the broader market correction that has affected both crypto and u.s. stocks. with fear and uncertainty gripping investors, many are now speculating whether this signals the beginning of a bear market or if it’s simply a normal correction before another leg up.

Bitcoin Must Reach This Price Level To Escape Second Longest Bear Market A bitcoin on chain level has historically served as the boundary for bear markets. here’s how far the asset’s price is currently from this line. bitcoin is above realized price of all major cohorts right now. According to the top trader, the deep correction in august that drove btc below $50,000 is the leverage flush out that bitcoin needs to move higher. the analyst highlights that any sign of weakness now will likely put the crypto king in a position to witness an extended bear market. Following bitcoin’s sell off earlier in the week, the flagship cryptocurrency is seemingly struggling to break past the $60,000 mark. notably, there is growing concern regarding the asset’s price trajectory, with an analyst forecasting more challenging times ahead if bitcoin continues to hover around its current levels. An analyst has explained how a moving average (ma) that has historically served as the boundary for bear markets is situated at this level. bitcoin 50 week ma is currently at $75,195. in a new post on x, analyst james van straten has shared a couple of important mas related to bitcoin.

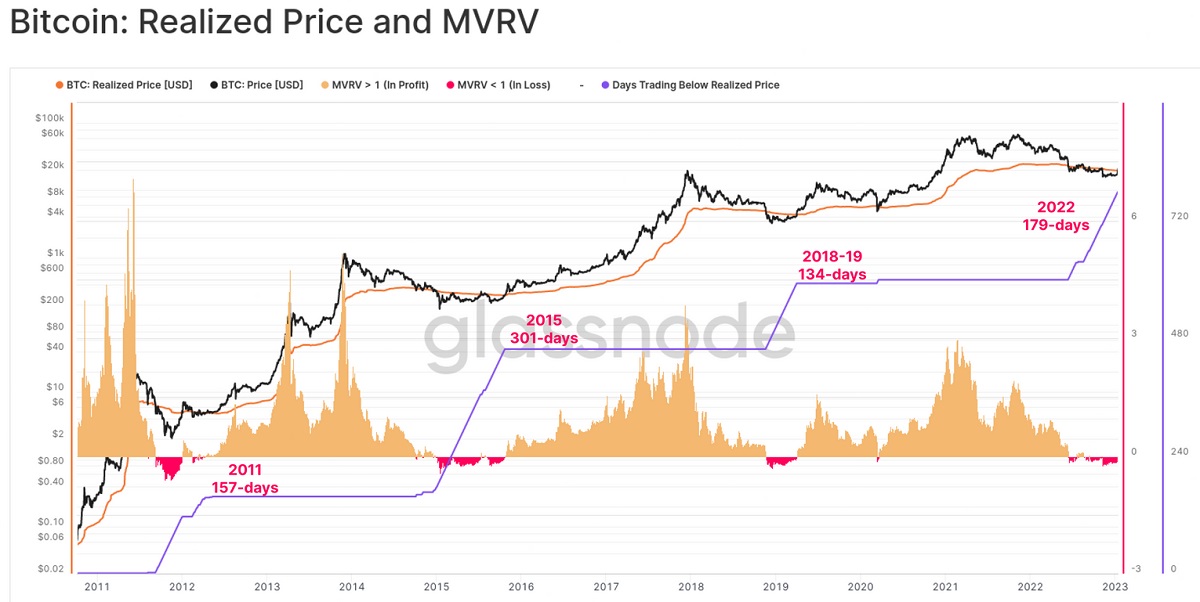

Bitcoin Price Analysis 11 27 18 Bear Territory Chainbits Following bitcoin’s sell off earlier in the week, the flagship cryptocurrency is seemingly struggling to break past the $60,000 mark. notably, there is growing concern regarding the asset’s price trajectory, with an analyst forecasting more challenging times ahead if bitcoin continues to hover around its current levels. An analyst has explained how a moving average (ma) that has historically served as the boundary for bear markets is situated at this level. bitcoin 50 week ma is currently at $75,195. in a new post on x, analyst james van straten has shared a couple of important mas related to bitcoin. Cryptoquant researchers warn bitcoin is teetering between historically undervalued levels and possibly the precipice of a prolonged bear market, with critical onchain metrics signaling heightened downside risks. valuation metrics hit cycle lows: is bitcoin primed for a crash or a rebound?. Now down 20% from all time highs just a month prior, bitcoin entered a technical bear market, as noted by finance and trading resource barchart. “the downside deviation below the range low. Historically, this shift often marked the confirmation of a bear market, though no such regime is evident yet.” source: glassnode. short term bitcoin holders are traders who have held on to their tokens for less than 155 days, while long term holders are defined as those who have kept their digital assets inactive for 155 days or longer.

Bitcoin Just A Bounce In A Bear Market Stormgain Cryptoquant researchers warn bitcoin is teetering between historically undervalued levels and possibly the precipice of a prolonged bear market, with critical onchain metrics signaling heightened downside risks. valuation metrics hit cycle lows: is bitcoin primed for a crash or a rebound?. Now down 20% from all time highs just a month prior, bitcoin entered a technical bear market, as noted by finance and trading resource barchart. “the downside deviation below the range low. Historically, this shift often marked the confirmation of a bear market, though no such regime is evident yet.” source: glassnode. short term bitcoin holders are traders who have held on to their tokens for less than 155 days, while long term holders are defined as those who have kept their digital assets inactive for 155 days or longer.