Bitcoin Miners Hit With Record Difficulty As Profitability Drops Bitcoin miners are facing a challenging landscape in 2025, with key factors squeezing profitability. despite bitcoin's high price, transaction fees have hit their lowest levels since 2012, while network difficulty continues to climb. the 2024 halving has increased competition, and revenue per unit of computational power is rapidly declining. Despite bitcoin trading around $84,000, miner revenue has decreased due to the recent halving event and rising operational costs. 'dire picture' for btc miners as revenue flatlines near record.

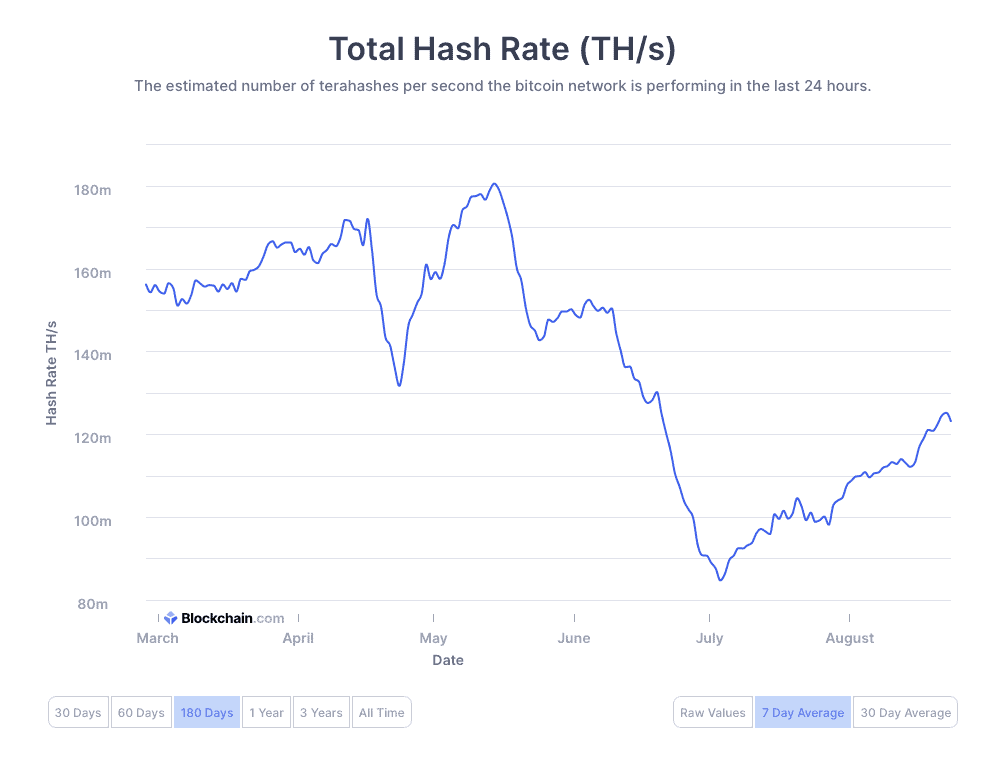

Bitcoin Mining Profitability Difficulty Dropped On march 10, 2025, a solo miner using a bitaxe 204 ultra – a compact, open source asic miner priced around $150 – mined block #887,212 and earned roughly $263,000. operating at approximately. On april 15, bitcoin’s hashrate briefly hit an all time high of 883 eh s (or 0.883 zettahash), just shy of the 1 zh s threshold that many analysts believe could be reached later this year. source: blockchain . this record setting performance coincides with a 6.81% rise in mining difficulty, further increasing the cost of participation. Bitcoin miners’ earnings power and stocks have diverged from the asset they help produce, a stark reminder of the deteriorating economics of an industry us president donald trump has championed. Work is about to become harder for bitcoin (btc) miners, as mining difficulty is set for another all time high (ath) in a matter of hours, which will be the second one in a row, once.

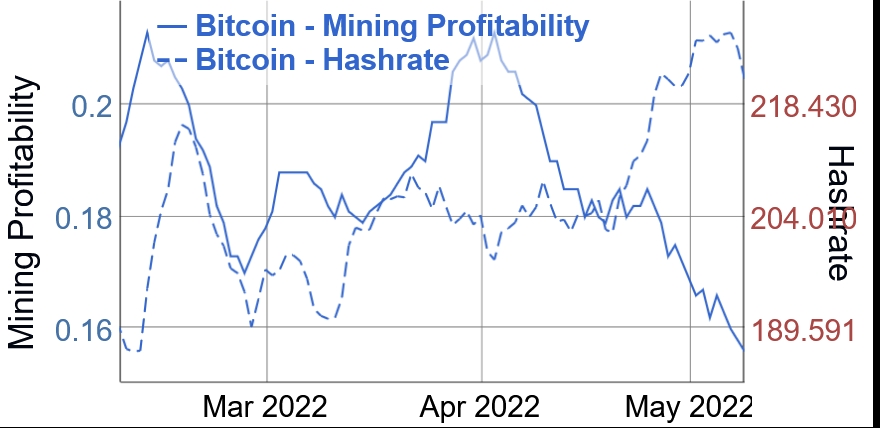

Bitcoin Miners May Soon Face Greater Mining Difficulty Bitcoin miners’ earnings power and stocks have diverged from the asset they help produce, a stark reminder of the deteriorating economics of an industry us president donald trump has championed. Work is about to become harder for bitcoin (btc) miners, as mining difficulty is set for another all time high (ath) in a matter of hours, which will be the second one in a row, once. Bitcoin mining is currently facing an unprecedented profitability crisis, driven by soaring network difficulty and plummeting transaction fees. the 2024 halving has intensified this situation, creating a challenging landscape for miners, particularly smaller operations struggling to stay afloat. Bitcoin mining crisis – the bitcoin (btc) mining landscape in 2025 is proving increasingly difficult for miners as a series of factors contribute to squeezed profitability. with transaction fees at their lowest levels since 2012, and network difficulty continuing to rise, miners are facing mounting pressure to maintain profits. Bitcoin miners feel the squeeze as the network’s hashprice—a key profitability metric—nears its one month low following a record setting difficulty adjustment on sunday. bitcoin’s network difficulty increased 5.61% over the weekend, setting a new all time high at 114.17 trillion. the adjustment has intensified the competitive landscape.

Bitcoin Mining Hits Record High Difficulty Bitcoin mining is currently facing an unprecedented profitability crisis, driven by soaring network difficulty and plummeting transaction fees. the 2024 halving has intensified this situation, creating a challenging landscape for miners, particularly smaller operations struggling to stay afloat. Bitcoin mining crisis – the bitcoin (btc) mining landscape in 2025 is proving increasingly difficult for miners as a series of factors contribute to squeezed profitability. with transaction fees at their lowest levels since 2012, and network difficulty continuing to rise, miners are facing mounting pressure to maintain profits. Bitcoin miners feel the squeeze as the network’s hashprice—a key profitability metric—nears its one month low following a record setting difficulty adjustment on sunday. bitcoin’s network difficulty increased 5.61% over the weekend, setting a new all time high at 114.17 trillion. the adjustment has intensified the competitive landscape.

The Impact Of Increasing Bitcoin Mining Difficulty On Profitability Bitcoin miners feel the squeeze as the network’s hashprice—a key profitability metric—nears its one month low following a record setting difficulty adjustment on sunday. bitcoin’s network difficulty increased 5.61% over the weekend, setting a new all time high at 114.17 trillion. the adjustment has intensified the competitive landscape.