Essentials Of Effective Budgeting Pdf Learn budgeting best practices for your business in this trulysmall guide. budgeting is not a "set it and forget it" type of exercise. need tax filing help and guidance?. Creating and sticking to a small business budget is an essential practice for financial success. by following the step by step process outlined in this guide and utilizing our free budgeting templates, you can gain control over your business’s finances, make informed decisions, and set yourself up for long term success.

Budgeting Best Practices Trulysmall These are a few best practices that you can use to manage your business budget. set it, evaluate it and reset it creating a business budget … continue reading budgeting best practices. Once you have one or more expenses recorded, create a budget by following these steps: go to the home page and select set a budget. select a category for your budget and enter a monthly amount. view your budget summary and get insights on your spending activity. you can track budgets on a weekly, monthly, quarterly or annual basis. Our trulysmall budget template can help guide you in your financial planning. in our budget template, we’ve included common income and expense categories that small businesses typically deal with. helping you avoid the guesswork and start planning right away. using a budget template is a helpful exercise to plan your business’ finances. Learn how to manage expenses and budgets for your small business! the future of small business expense management and budgeting has arrived with trulysmall expenses. this innovative and powerful application lets you simultaneously manage your business and personal expenses in one place.

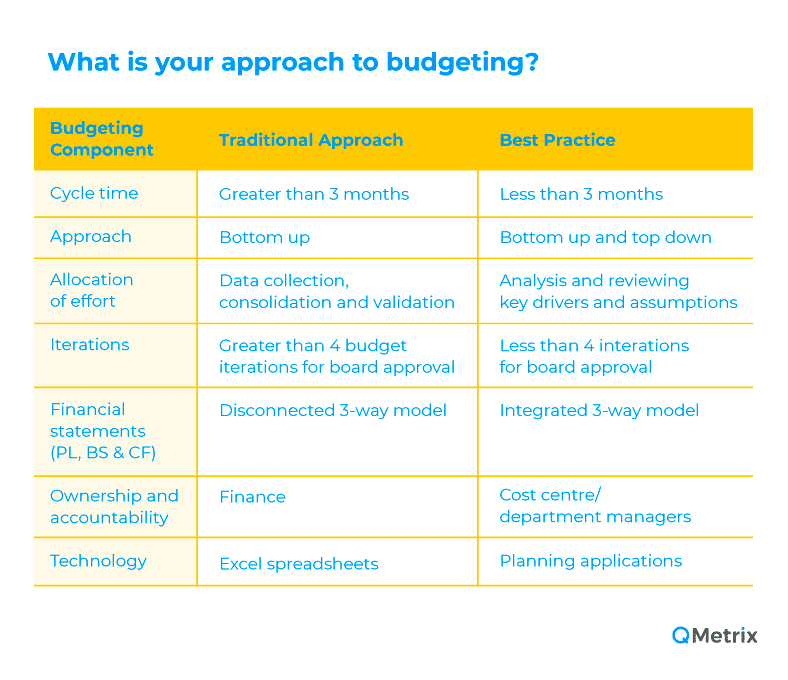

Five Budgeting Best Practices Fyisoft Financial Reporting Software Our trulysmall budget template can help guide you in your financial planning. in our budget template, we’ve included common income and expense categories that small businesses typically deal with. helping you avoid the guesswork and start planning right away. using a budget template is a helpful exercise to plan your business’ finances. Learn how to manage expenses and budgets for your small business! the future of small business expense management and budgeting has arrived with trulysmall expenses. this innovative and powerful application lets you simultaneously manage your business and personal expenses in one place. Key characteristics of best practice processes • control the number of budget iterations developed • reduce the number of budget line items • flexibility modelling of scenarios based on differing business assumptions • standardize budgeting methods with the rest of the company and what senior management is expecting to see. Here are seven of my favorite budgeting best practices to help you get started. 1. set clear goals. setting clear financial goals is key to keeping yourself on track with analyzing your spending. you’ll know how much money you need to save or put towards your debt with a clear goal. for setting clear goals, i always recommend the smart goal method. Learn how to use our trulysmall budget template for your small business. choose a budgeting technique and get started today. as a business owner, rainy days, or even seasons, are in inevitable. as a result, we need to understand the fundamentals of budgeting and apply it to our businesses, just like we would for our personal finances. Big companies around the world are following these practices and are making big money through these methods the best ones are stated as below, and you can learn from them to get started with your organization’s budget management. 1. identify the infrastructure supporting the budgeting process.

An Expert Shares 3 Budgeting Best Practices For Businesses Capterra Key characteristics of best practice processes • control the number of budget iterations developed • reduce the number of budget line items • flexibility modelling of scenarios based on differing business assumptions • standardize budgeting methods with the rest of the company and what senior management is expecting to see. Here are seven of my favorite budgeting best practices to help you get started. 1. set clear goals. setting clear financial goals is key to keeping yourself on track with analyzing your spending. you’ll know how much money you need to save or put towards your debt with a clear goal. for setting clear goals, i always recommend the smart goal method. Learn how to use our trulysmall budget template for your small business. choose a budgeting technique and get started today. as a business owner, rainy days, or even seasons, are in inevitable. as a result, we need to understand the fundamentals of budgeting and apply it to our businesses, just like we would for our personal finances. Big companies around the world are following these practices and are making big money through these methods the best ones are stated as below, and you can learn from them to get started with your organization’s budget management. 1. identify the infrastructure supporting the budgeting process.

Top 3 Budgeting Best Practices For A Better Budgeting Cycle Qmetrix Learn how to use our trulysmall budget template for your small business. choose a budgeting technique and get started today. as a business owner, rainy days, or even seasons, are in inevitable. as a result, we need to understand the fundamentals of budgeting and apply it to our businesses, just like we would for our personal finances. Big companies around the world are following these practices and are making big money through these methods the best ones are stated as below, and you can learn from them to get started with your organization’s budget management. 1. identify the infrastructure supporting the budgeting process.

7 Effective Budgeting Best Practices Onlinephone Org