Building An Effective Investment Portfolio Through Diversification

The Importance Of Diversification In Your Investment Portfolio Discover how to build a diversified investment portfolio. learn about asset allocation, balancing risk, and why diversification is key to your financial success. Learn core diversification strategies every investor should apply. together, these approaches form a comprehensive framework for building a more resilient portfolio.

Investment Portfolio Diversification Learn why diversification is so important to investing, and find out what it takes to make it work. In this article, we'll provide an overview of diversification and give you some insight into how you can make it work to your advantage. the idea of diversification is to create a portfolio. Our research shows that a balanced mix of diversified assets, combined with a disciplined, cost conscious approach to investing, can help improve investors’ chances of achieving their long term investment goals, as long as they stay the course. Diversification remains a cornerstone of smart investing, enabling individuals to balance risk and reward effectively. by spreading investments across different assets, industries, and geographical locations, investors can build a more resilient portfolio that has the potential to weather the storms of market volatility.

5 Effective Diversification Strategies For Your Investment Portfolio Our research shows that a balanced mix of diversified assets, combined with a disciplined, cost conscious approach to investing, can help improve investors’ chances of achieving their long term investment goals, as long as they stay the course. Diversification remains a cornerstone of smart investing, enabling individuals to balance risk and reward effectively. by spreading investments across different assets, industries, and geographical locations, investors can build a more resilient portfolio that has the potential to weather the storms of market volatility. How to build a diversified investment portfolio what is portfolio diversification? portfolio diversification is simply spreading your investments across different assets, industries, and even countries to lower your overall risk and promote stable returns. it's a fundamental strategy for effective investment risk management, helping to build a more diversified investment portfolio. Whether you’re just beginning your investment journey or refining an established portfolio, implementing the diversification strategies outlined in this guide will help you build a diversified investment portfolio tailored to your unique financial situation. Long term (10 years): typically favors higher equity exposure to capture growth, with some allocation to real estate or alternative investments for added diversification. medium term (5–10 years): balanced mix of equities, bonds, and possibly real estate, aiming for steady growth without excessive volatility. Learn how to build a diversified portfolio with strategies to balance risk, capture opportunities, and improve portfolio stability.

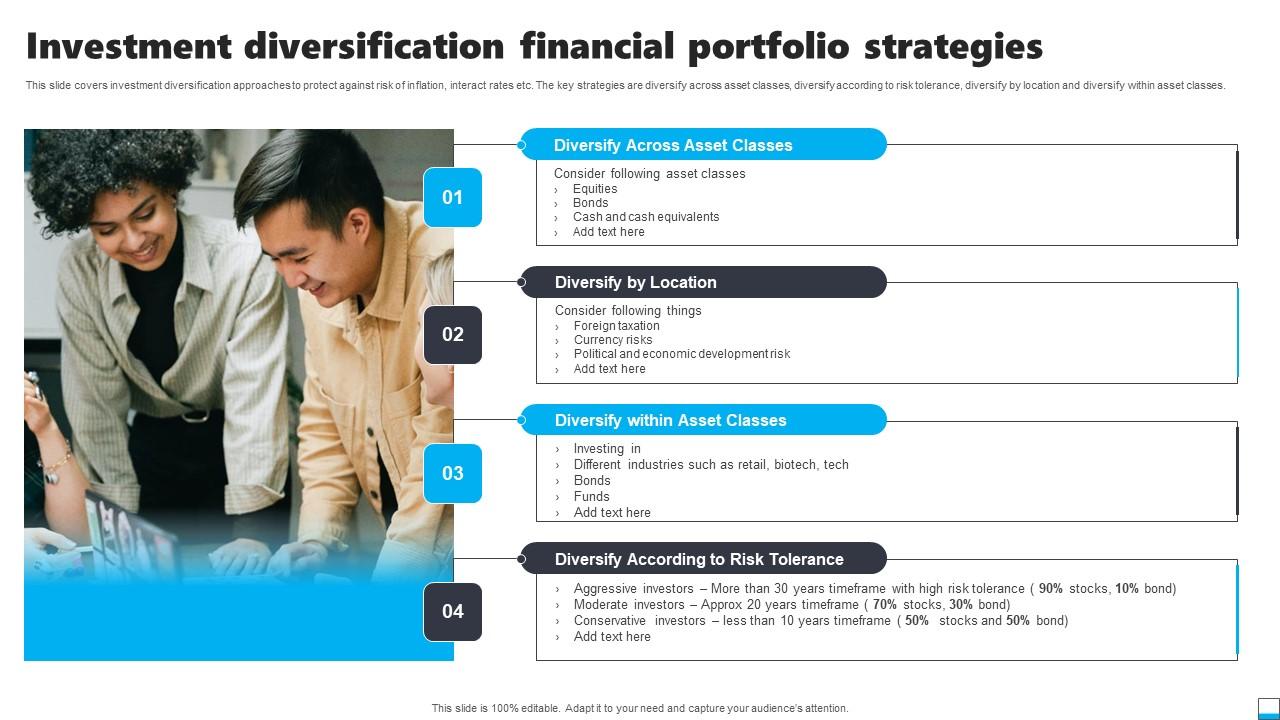

Investment Diversification Financial Portfolio Strategies Ppt Sample How to build a diversified investment portfolio what is portfolio diversification? portfolio diversification is simply spreading your investments across different assets, industries, and even countries to lower your overall risk and promote stable returns. it's a fundamental strategy for effective investment risk management, helping to build a more diversified investment portfolio. Whether you’re just beginning your investment journey or refining an established portfolio, implementing the diversification strategies outlined in this guide will help you build a diversified investment portfolio tailored to your unique financial situation. Long term (10 years): typically favors higher equity exposure to capture growth, with some allocation to real estate or alternative investments for added diversification. medium term (5–10 years): balanced mix of equities, bonds, and possibly real estate, aiming for steady growth without excessive volatility. Learn how to build a diversified portfolio with strategies to balance risk, capture opportunities, and improve portfolio stability.

Comments are closed.