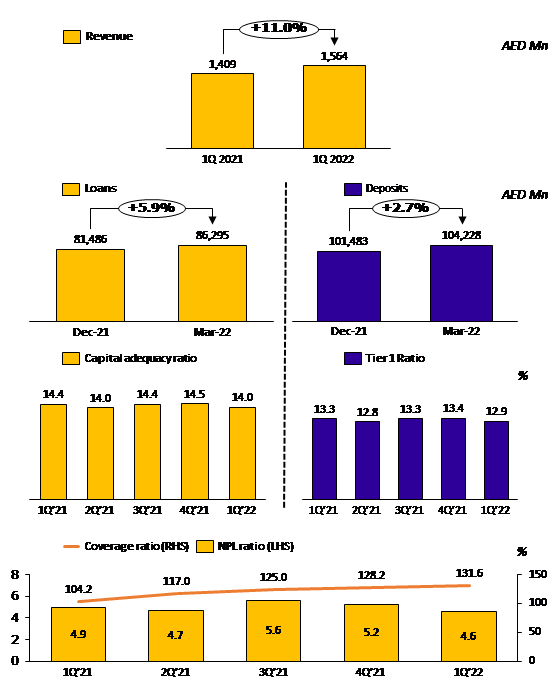

Mashreq Posts Aed 606 Million Net Profit For 1q 2022 On 21 july 2022, meed and mashreq will host a live webinar where finance experts will discuss ways scf programmes can help both buyers and suppliers to enhan. Experts from mashreq bank advise that it is crucial to regard the strategic benefits that supply chain finance programmes can bring for buyers and their suppliers in the current macroeconomic.

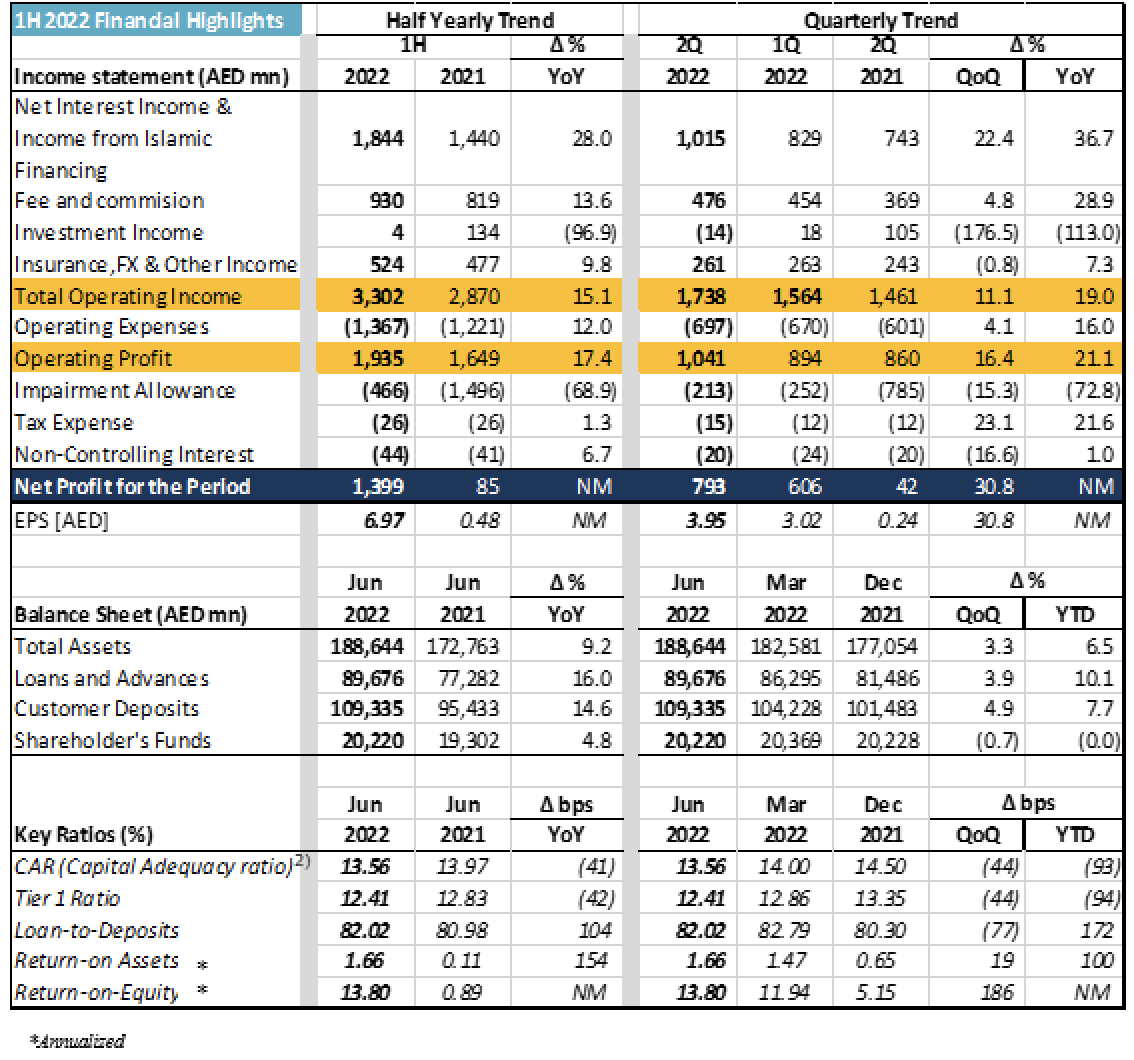

Mashreq Achieves 17 Increase In Operating Profit And Posts Aed 1 4 Experts from mashreq bank advise that it is crucial to regard the strategic benefits that supply chain finance programmes can bring for buyers and their suppliers in the current macroeconomic. As economies in the gcc regain their strength after the challenges of recent years, islamic finance too is growing in tandem.benefitting from higher oil pric. Hear from experts on ‘how can digital banking offerings be leveraged to maximize their benefits on financial inclusivity and literacy?’. Resilience is about people, adaptability and a mindset of continuous evolution. and mashreq we see operational resilience as a journey integrating cyber security, modernization and talent strategy because the businesses that invest in resilience today will lead the digital economy of tomorrow.

Building Financial Resilience Hear from experts on ‘how can digital banking offerings be leveraged to maximize their benefits on financial inclusivity and literacy?’. Resilience is about people, adaptability and a mindset of continuous evolution. and mashreq we see operational resilience as a journey integrating cyber security, modernization and talent strategy because the businesses that invest in resilience today will lead the digital economy of tomorrow. Experts from mashreq bank advise that it is crucial to regard the strategic benefits that supply chain finance programmes can bring for buyers and their suppliers in the current macroeconomic. Since our inception in 1967, mashreq has adopted the principles of social responsibility, integrity, and transparency into every aspect of its business thus contributing towards building a sustainable planet. Claire chamberlain, chief investment officer, corporate sustainability and social impact – blackrock. In 2022 the personal savings rate fell to just 6 8% with an average total savings account balance of just $41,600. (hint: do the math.) building financial resilience for an uninsurable future; the impact of climate change on personal finances and the wealth of the nation.

Building Financial Resilience Canadian Club Toronto Experts from mashreq bank advise that it is crucial to regard the strategic benefits that supply chain finance programmes can bring for buyers and their suppliers in the current macroeconomic. Since our inception in 1967, mashreq has adopted the principles of social responsibility, integrity, and transparency into every aspect of its business thus contributing towards building a sustainable planet. Claire chamberlain, chief investment officer, corporate sustainability and social impact – blackrock. In 2022 the personal savings rate fell to just 6 8% with an average total savings account balance of just $41,600. (hint: do the math.) building financial resilience for an uninsurable future; the impact of climate change on personal finances and the wealth of the nation.

Mashreq Bank Headquarters The Skyscraper Center Claire chamberlain, chief investment officer, corporate sustainability and social impact – blackrock. In 2022 the personal savings rate fell to just 6 8% with an average total savings account balance of just $41,600. (hint: do the math.) building financial resilience for an uninsurable future; the impact of climate change on personal finances and the wealth of the nation.

Community Centred Services Support Residents To Build Financial