Implications Of Simple Survey Expectations Inflation Model For This economic commentary summarizes results from the survey of firms’ inflation expectations (sofie), which asks top business executives for their inflation expectations once per quarter alongside a second question from a rotating set. Survey questions pertain to current, past, and future outcomes at respondents’ firms. our primary objective is to elicit the respondent’s subjective forecast distributions over own firm future unit cost growth. we gather qualitative information on firms’ sales levels and margins on a monthly basis.

Business Inflation Expectations Survey Bies 1 July 2020 Ipp Star The bie was created to measure the year ahead inflationary sentiments of businesses in the sixth district. it also helps inform our view of the sources of cost changes and provides insight into the factors driving business' pricing decisions. The survey of firms’ inflation expectations (sofie) is a large quarterly representative panel of firms in the manufacturing and services sectors that was created to measure inflation expectations of chief executive officers (ceos) in the united states. Introducing a new survey of u.s. firms’ inflation expectations, we document key stylized facts involving what u.s. firms know and expect about inflation and monetary policy. the resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters. Abstract: introducing a new survey of u.s. firms’ inflation expectations, we document key stylized facts involving what u.s. firms know and expect about inflation and monetary policy. the resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters.

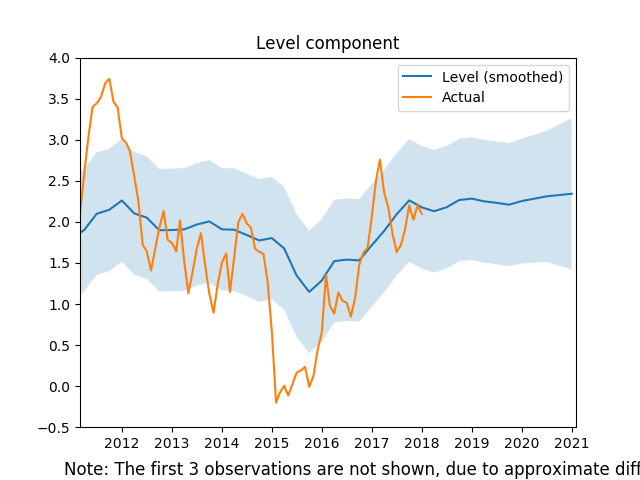

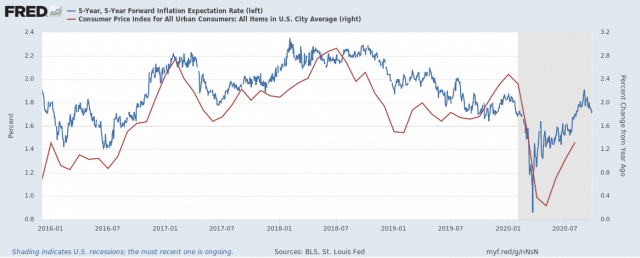

Inflation Expectations Introducing a new survey of u.s. firms’ inflation expectations, we document key stylized facts involving what u.s. firms know and expect about inflation and monetary policy. the resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters. Abstract: introducing a new survey of u.s. firms’ inflation expectations, we document key stylized facts involving what u.s. firms know and expect about inflation and monetary policy. the resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters. The researchers introduce the survey of firms’ inflation expectations (sofie), a module of questions on inflation appended to a leading pre existing private survey of ceos and senior business leaders. In this paper, we focus on the inflation expectations of firms from surveys. specifically, the naïve expectation, adaptive expectation, rational expectation, var, and heterogeneous static expectation formation models are adopted to test the models being used by firms to form inflation expectations. Median year ahead firm inflation expectations (based on the cpi) climbed from 3 percent in last february’s survey to 4 percent among service firms in this year’s survey, and from 3 percent to 3.5 percent among manufacturing firms, both of which are higher than the cpi inflation rate of 3 percent reported in january. Personal wealth management economics why higher inflation expectations don’t mean higher inflation reality doesn’t necessarily follow people’s price projections.

Inflation Expectations Forex Academy The researchers introduce the survey of firms’ inflation expectations (sofie), a module of questions on inflation appended to a leading pre existing private survey of ceos and senior business leaders. In this paper, we focus on the inflation expectations of firms from surveys. specifically, the naïve expectation, adaptive expectation, rational expectation, var, and heterogeneous static expectation formation models are adopted to test the models being used by firms to form inflation expectations. Median year ahead firm inflation expectations (based on the cpi) climbed from 3 percent in last february’s survey to 4 percent among service firms in this year’s survey, and from 3 percent to 3.5 percent among manufacturing firms, both of which are higher than the cpi inflation rate of 3 percent reported in january. Personal wealth management economics why higher inflation expectations don’t mean higher inflation reality doesn’t necessarily follow people’s price projections.

Fed Survey Inflation Expectations Slip In Feb Bond Buyer Median year ahead firm inflation expectations (based on the cpi) climbed from 3 percent in last february’s survey to 4 percent among service firms in this year’s survey, and from 3 percent to 3.5 percent among manufacturing firms, both of which are higher than the cpi inflation rate of 3 percent reported in january. Personal wealth management economics why higher inflation expectations don’t mean higher inflation reality doesn’t necessarily follow people’s price projections.