Eidl Vs Ppp Graphic Passive Income M D Congress took several actions to provide financial relief to individuals, businesses, and nonprofits after the onset of the covid 19 pandemic, including passing the coronavirus aid, relief, and economic security act (cares act; p.l. 116 136) in march 2020. The coronavirus aid, relief, and economic security act (cares act) makes important changes to the small business administration (sba) economic impact disaster loan (eidl) program and creates the paycheck protection program (ppp).

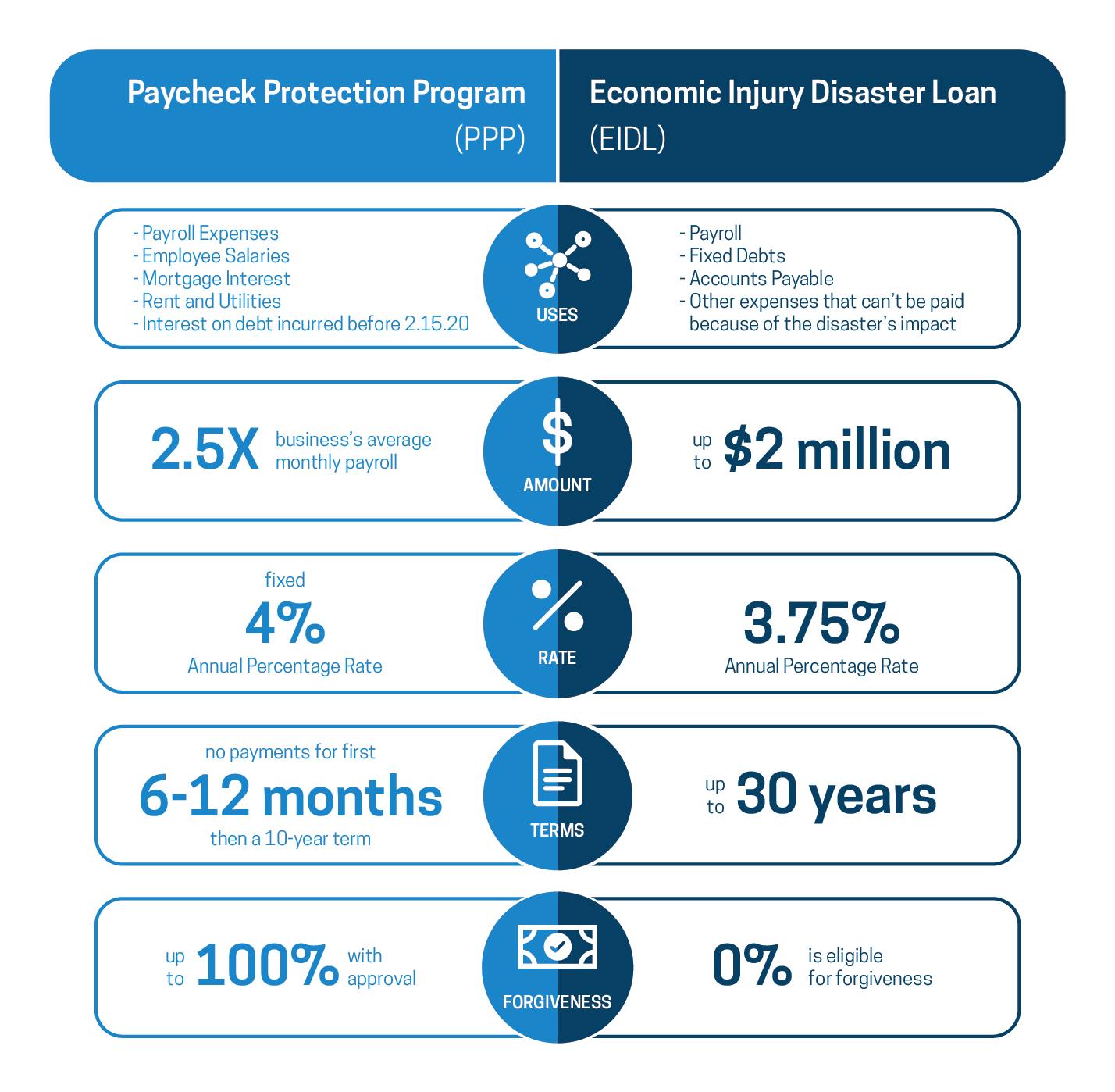

Comparing The Eidl And Ppp Loans Under The Cares Act Paycheck protection loans: the cares act provides funding of $350 billion to the small business administration (“sba”) for authorized sba lenders to make loans to small businesses, including nonprofits with 500 employees or less, impacted by covid 19 under a. Under the expanded eidl program, the sba may provide qualifying businesses both loans and emergency grants, as summarized in the chart below. the cares act established a new, $349 billion paycheck protection program providing for sba guaranteed loans made by sba lenders to eligible recipients. Sba economic injury disaster loans (eidl) are low interest loans available to eligible small businesses; the cares act also established the emergency eidl grant program to provide eidl advance payments of up to $10,000, which do not need to be repaid. The cares act provides two loan options through the small business administration (sba); the paycheck protection program (ppp) and the economic injury disaster loan (eidl). yet the overarching question remains for the 30 million small businesses in america…what is my best option?.

The Cares Act The Basics Of Eidl And Ppp Loans Excelforce Sba economic injury disaster loans (eidl) are low interest loans available to eligible small businesses; the cares act also established the emergency eidl grant program to provide eidl advance payments of up to $10,000, which do not need to be repaid. The cares act provides two loan options through the small business administration (sba); the paycheck protection program (ppp) and the economic injury disaster loan (eidl). yet the overarching question remains for the 30 million small businesses in america…what is my best option?. Comparing paycheck protection program and emergency economic injury disaster loan options for small business under the cares act. who is the lender? other regulated lenders will be available to make these loans once they are approved and enrolled in the program. the application can be found here. apply online here. who is eligible?. The cares act provided deferment relief for ppp loans and existing loans made under the 7(a), 504 cdc, and microloan programs. A: the sba’s eidl program provides small businesses with working capital loans of up to $2 million to help overcome the temporary loss of revenue as the result of a declared disaster. In addition to the ppp loans and eidl grants for small businesses, the cares act authorizes up to $500 billion for loans, loan guarantees, and other investments to support eligible.