Cashflow Budget Excel Spreadsheet Worksheet Xlcsv Xl Bundle Ppt Sample

Cashflow Budget Excel Spreadsheet Worksheet Xlcsv Xl Bundle Ppt Sample That’s why we designed cashflow, to teach the basics of investing through real world scenarios which allow you to test your financial knowledge and learn from your mistakes—all without losing your own money. Cash flow is the movement of money into and out of a company over a certain period of time. if the company’s inflows of cash exceed its outflows, its net cash flow is positive. if outflows exceed.

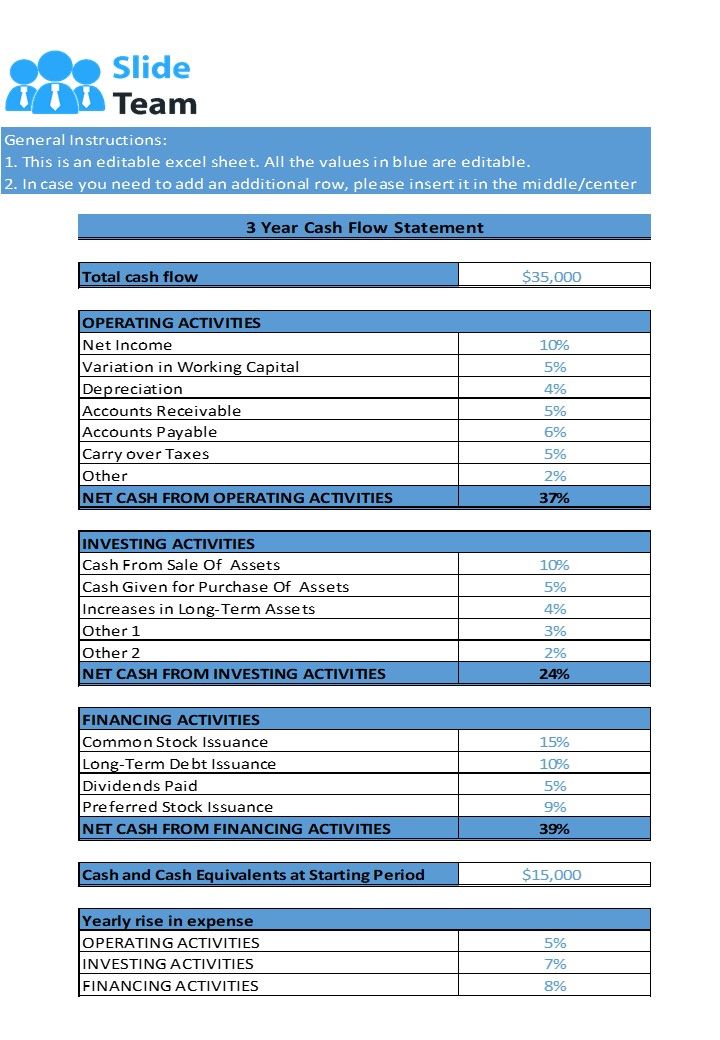

Cashflow Budget Excel Spreadsheet Worksheet Xlcsv Xl Bundle Ppt Sample There are many types of cf, with various important uses for running a business and performing financial analysis. this guide will explore all of them in detail. there are several types of cash flow, so it’s important to have a solid understanding of what each of them is. Cash flow represents revenue received — or inflows — and expenses spent, or outflows. the total net balance over a specific accounting period is reported on a cash flow statement, which shows the. A cash flow (cf) shows inflows (receipts) and outflows (payments) of cash during a particular period. in other words, it summarizes the sources and applications of cash during a particular period. in addition, it analyzes the reasons for changes in the balance of cash between the two balance sheet dates. We begin with reasons why the statement of cash flows (scf, cash flow statement) is a required financial statement. the accounting profession realizes that reading only one or two financial statements is not sufficient for understanding a company’s finances and operations.

Cash Budget Excel Spreadsheet Worksheet Xlcsv Xl Bundle Ppt Example A cash flow (cf) shows inflows (receipts) and outflows (payments) of cash during a particular period. in other words, it summarizes the sources and applications of cash during a particular period. in addition, it analyzes the reasons for changes in the balance of cash between the two balance sheet dates. We begin with reasons why the statement of cash flows (scf, cash flow statement) is a required financial statement. the accounting profession realizes that reading only one or two financial statements is not sufficient for understanding a company’s finances and operations. Cash flow is the money that streams in and out of your small business—and it’s a key indicator of your company’s overall financial health. the term cash flow is used to describe the amount of cash that is generated or spent within a certain time frame. it’s important to remember that cash flow differs from profit. To calculate cash flow, follow these steps: identify your cash inflows and outflows: start by listing all sources of cash coming in (revenue, investments, loans) and all outgoing payments (expenses, salaries, loan repayments). Cash flow is a critical indicator of a company's financial health, representing the net amount of cash and cash equivalents moving into and out of a business. To assess a company's financial health, you have to understand its cash flow statement. it reveals how cash moves through a business, including operations, investments, and financing activities.

Comments are closed.