Chapter 5 Income Tax Pdf Statutory Interpretation Taxes Cynthia earned various types of interest income totaling p40,750 from loans, time deposits, savings accounts, and promissory notes. the question asks to identify the total amount of interest income that is subject to final tax. Interest income from treasury bills, notes, and bonds is subject to federal income tax but is exempt from all state and local income taxes. you should receive form 1099 int showing the interest (in box 3) paid to you for the year.

Chapter 5 Pdf The questions cover topics like whether certain types of income such as interest, dividends, royalties, prizes winnings are subject to final or regular income tax. Test your knowledge of income taxation with these self test exercises. includes true false and multiple choice questions on final and regular taxes. 2020 national income tax workbook chapter 5: irs issues pages 149 192 issue 1: income tax withholding issue 2: the gig economy. 1040 booklet. a. find the tax amount for a single person with a taxable income of $39,890. b. find the tax amount for a married couple filing jointly with a taxable income of $45,350. c. find. f. r a single dad filing as head of household with a taxable income of . 42,102. more practice 1. use the 2018 tax tabl.

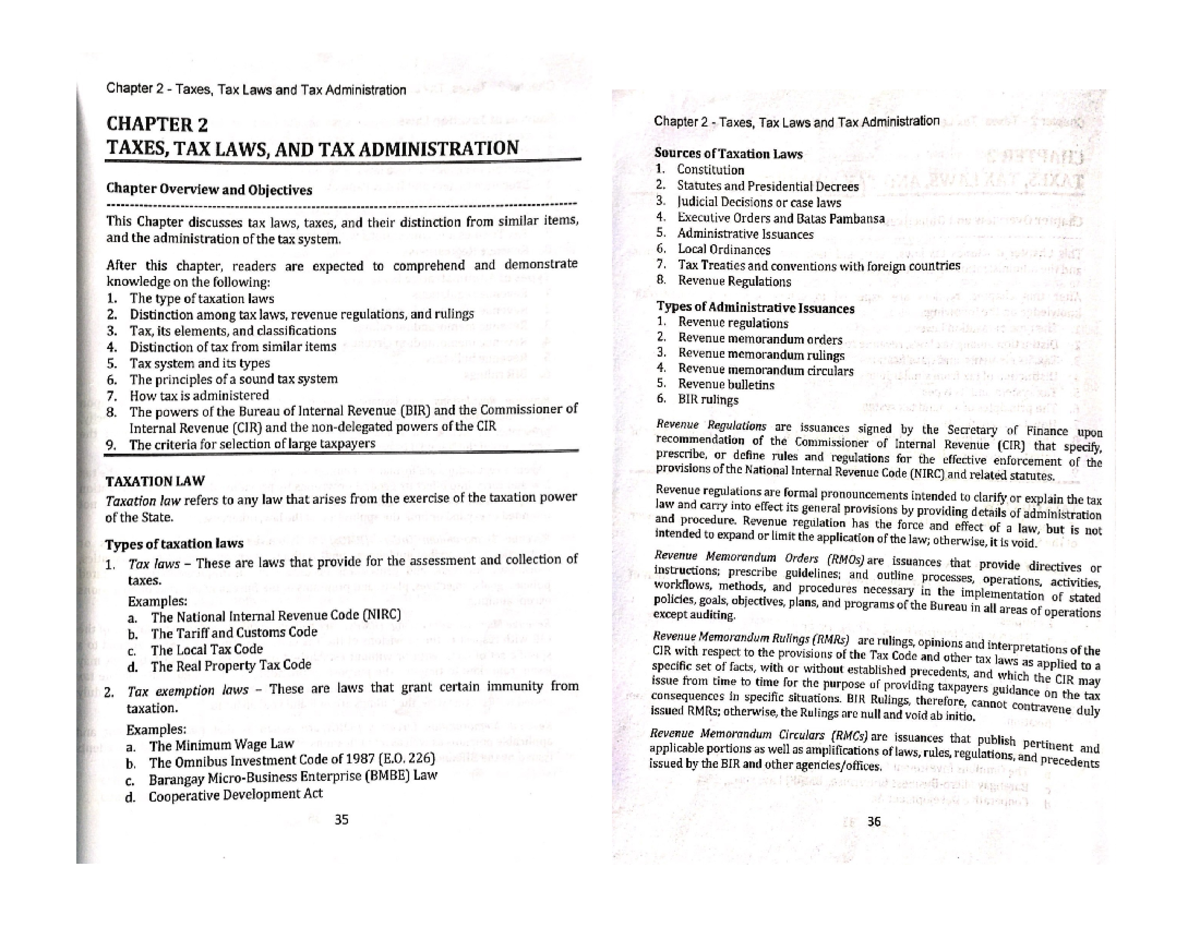

Tax 2 Income Taxation Chapter 2 Accountancy Studocu 2020 national income tax workbook chapter 5: irs issues pages 149 192 issue 1: income tax withholding issue 2: the gig economy. 1040 booklet. a. find the tax amount for a single person with a taxable income of $39,890. b. find the tax amount for a married couple filing jointly with a taxable income of $45,350. c. find. f. r a single dad filing as head of household with a taxable income of . 42,102. more practice 1. use the 2018 tax tabl. Understand the difference between taxable and nontaxable interest. identify where to report interest income. understand how to report dividend income and nontaxable distributions. understand the client interview process. identify the definition of earned income for earned income credit. It also describes the final withholding tax system and various types of passive income subject to final tax such as interest, dividends, prizes, and winnings. 2. specific types of interest income are discussed, including from bank deposits, bonds, and foreign sources. Adjusted gross income. 74, medical & dental. 2, itemized deductions taxes. 8, interest. 11, contributions. other miscellaneous deductions. 4, total itemized deductions. 27, standard deduction. 24, tax computation larger of itemized or standard deduction. 27, taxable income. 46, tax before credits. 3, child tax credit & other dependent. 1, interest income from non bank sources is subject to regular income tax. 2. foreign income is subjected to final tax if the taxpayer is taxable on global income tax 3. items of passive income from abroad are subject to final tax. 4. interest income on government securities are subject to final tax. 5.

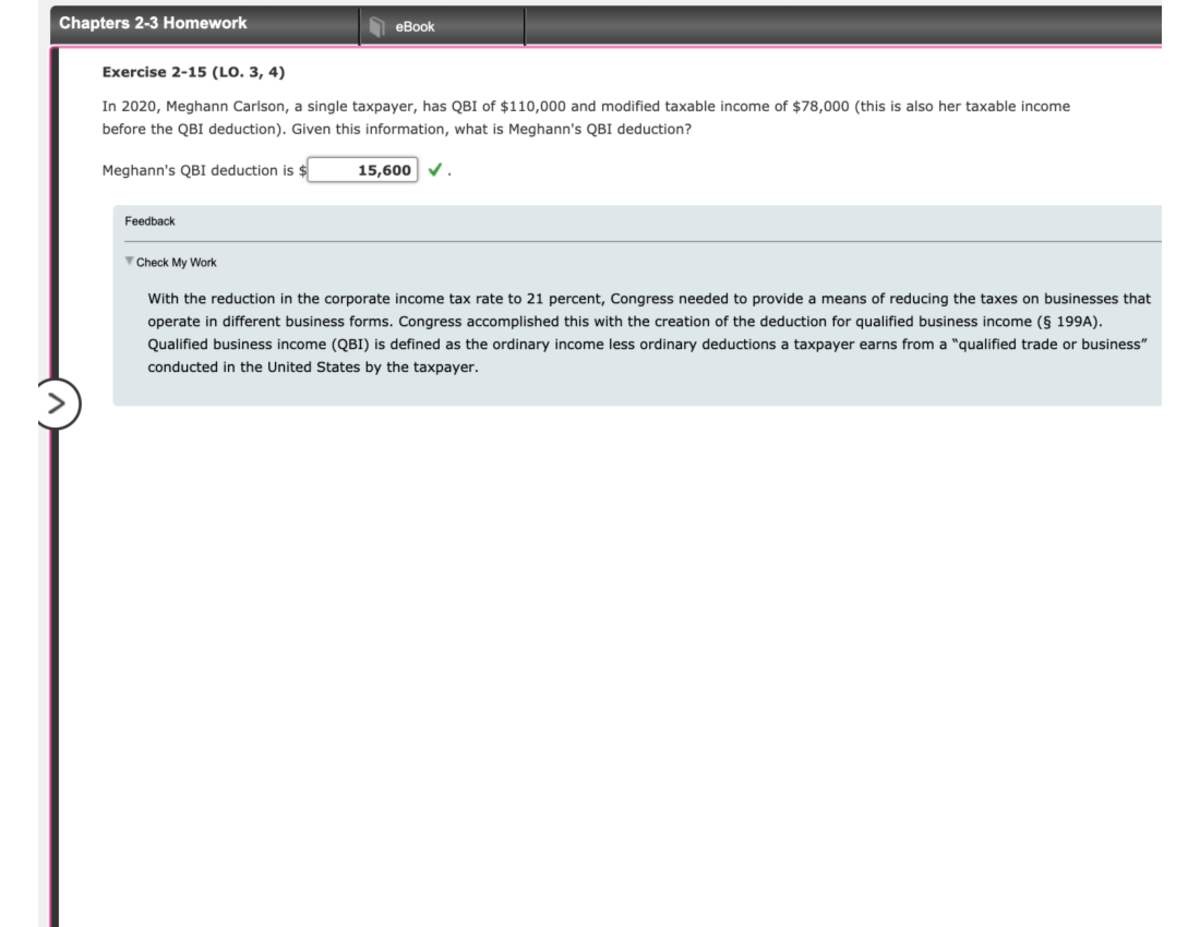

Tax Accounting Ii Chapter 2 Exercise 2 15 Acct 4250 Studocu Understand the difference between taxable and nontaxable interest. identify where to report interest income. understand how to report dividend income and nontaxable distributions. understand the client interview process. identify the definition of earned income for earned income credit. It also describes the final withholding tax system and various types of passive income subject to final tax such as interest, dividends, prizes, and winnings. 2. specific types of interest income are discussed, including from bank deposits, bonds, and foreign sources. Adjusted gross income. 74, medical & dental. 2, itemized deductions taxes. 8, interest. 11, contributions. other miscellaneous deductions. 4, total itemized deductions. 27, standard deduction. 24, tax computation larger of itemized or standard deduction. 27, taxable income. 46, tax before credits. 3, child tax credit & other dependent. 1, interest income from non bank sources is subject to regular income tax. 2. foreign income is subjected to final tax if the taxpayer is taxable on global income tax 3. items of passive income from abroad are subject to final tax. 4. interest income on government securities are subject to final tax. 5.