Chaptert 10 Hw Solutions Pdf Internal Rate Of Return Capital

Chapter 10 Hw Solutions Pdf Beta Finance Capital Asset Capital investments are the most important decisions made by a firms management, because they usually involve large cash outflows and once made are not easily reversed. The irr, or the internal rate of return, is the discount rate that makes the net present value of the project’s future cash flows zero. the irr determines whether the project’s return rate is higher or lower than the required rate of return, which is the firm’s cost of capital.

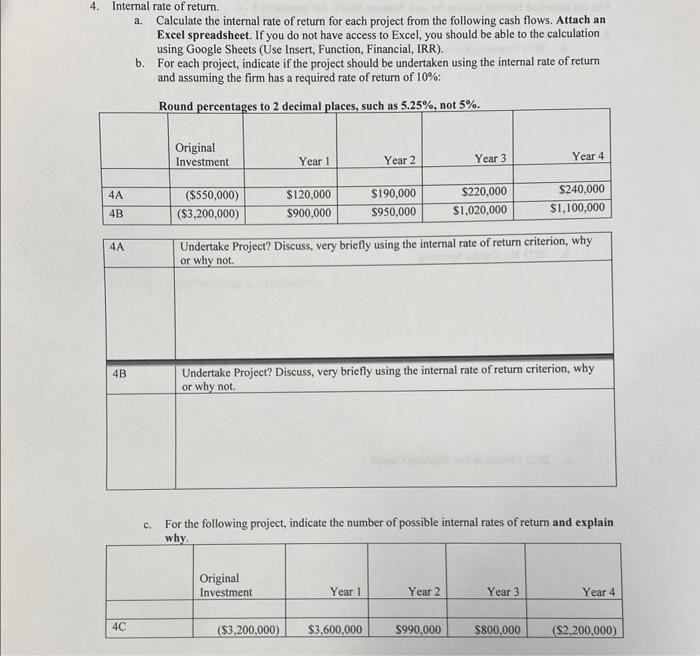

Chaptert 10 Hw Solutions Pdf Internal Rate Of Return Capital The document details various capital budgeting problems and solutions, focusing on payback periods, net present value (npv), and internal rate of return (irr) assessments for multiple projects. Solve magnitude of cash flow problem and multiple irr problem by using modified internal rate of return (mirr) [note: still does not solve for different timing of cash flows]. In the case of mutually exclusive investments it is possible for the net present value and internal rate of return approaches to give conflicting rankings. this is most likely to occur when the two or more projects being considered are significantly different in size or have very different patterns of cash flows. 3. Chapter 10 fin man solution free download as pdf file (.pdf), text file (.txt) or read online for free. the document provides sample questions and answers related to capital budgeting techniques discussed in chapter 10. it defines key terms like payback period and how it is calculated.

Ch08 Hw Solutions Pdf Internal Rate Of Return Net Present Value In the case of mutually exclusive investments it is possible for the net present value and internal rate of return approaches to give conflicting rankings. this is most likely to occur when the two or more projects being considered are significantly different in size or have very different patterns of cash flows. 3. Chapter 10 fin man solution free download as pdf file (.pdf), text file (.txt) or read online for free. the document provides sample questions and answers related to capital budgeting techniques discussed in chapter 10. it defines key terms like payback period and how it is calculated. The irr of a project is equal to the firm's cost of capital if the npv of a project is $0. Since the cost of capital is the better proxy for opportunity cost, npv uses the better proxy, while the irr may use an unrealistically higher rate as proxy. 10 the modified irr (mirr) alleviates two concerns with using the irr method for evaluating capital investments. Chapter 10 discusses various capital budgeting methods, focusing on the discounted payback period, net present value (npv), profitability index (pi), and internal rate of return (irr). This document provides answers to capital budgeting problems from chapter 10. it includes solutions to problems involving payback period, net present value (npv), and internal rate of return (irr) calculations for multiple investment projects.

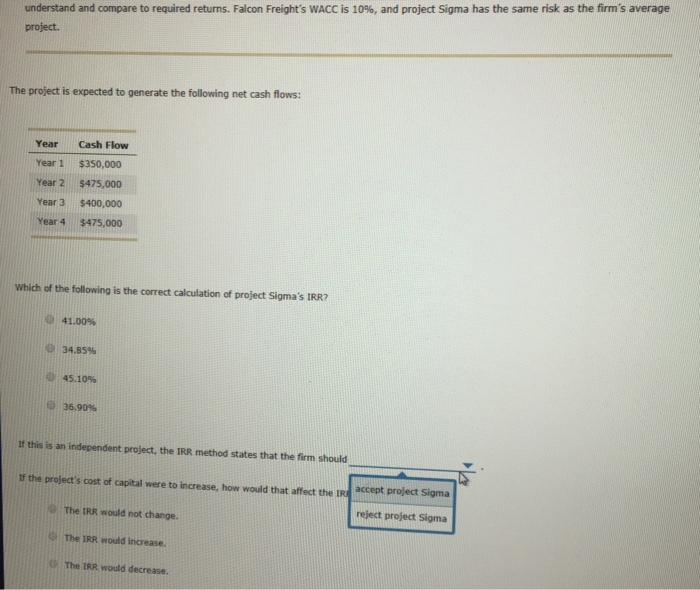

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg The irr of a project is equal to the firm's cost of capital if the npv of a project is $0. Since the cost of capital is the better proxy for opportunity cost, npv uses the better proxy, while the irr may use an unrealistically higher rate as proxy. 10 the modified irr (mirr) alleviates two concerns with using the irr method for evaluating capital investments. Chapter 10 discusses various capital budgeting methods, focusing on the discounted payback period, net present value (npv), profitability index (pi), and internal rate of return (irr). This document provides answers to capital budgeting problems from chapter 10. it includes solutions to problems involving payback period, net present value (npv), and internal rate of return (irr) calculations for multiple investment projects.

Solved 2 Internal Rate Of Return Irr The Internal Rate Of Chegg Chapter 10 discusses various capital budgeting methods, focusing on the discounted payback period, net present value (npv), profitability index (pi), and internal rate of return (irr). This document provides answers to capital budgeting problems from chapter 10. it includes solutions to problems involving payback period, net present value (npv), and internal rate of return (irr) calculations for multiple investment projects.

Solved 4 Internal Rate Of Return A Calculate The Internal Chegg

Comments are closed.