Cme Bitcoin Futures Open Interest Climbs Past Binance Indicating Growing Institutional Demand

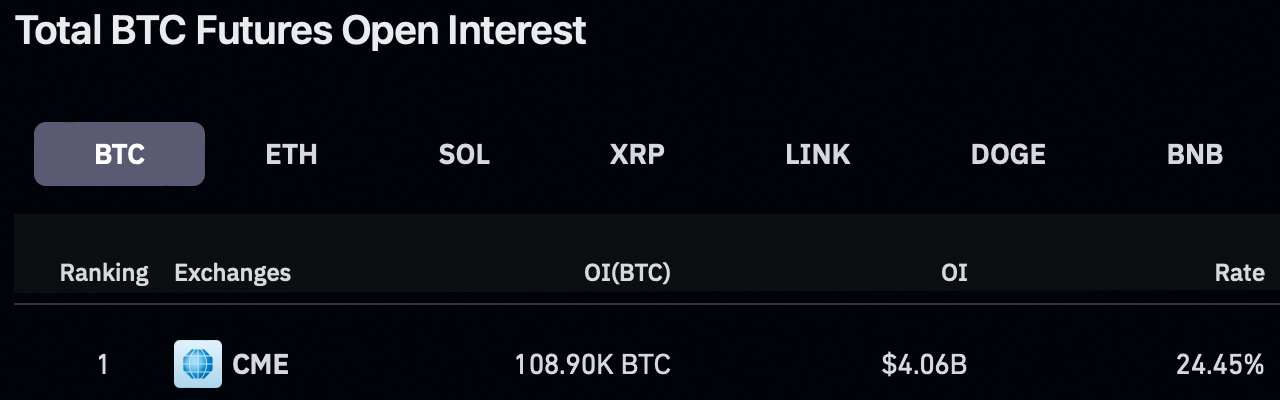

Cme Bitcoin Futures Open Interest Climbs Past Binance Indicating The open interest for bitcoin futures on the cme group has outstripped that of binance's futures, with the former reaching $4.06 billion. The open interest for bitcoin futures on the cme group has outstripped that of binance’s futures market, with the former reaching an open interest of $4.06 billion and the latter at $3.87 billion, as bitcoin’s value climbs to new peaks.

Cme Bitcoin Futures Open Interest Climbs Past Binance Indicating Cme’s rise to become the top bitcoin futures exchange by open interest highlights growing demand from institutional investors to gain exposure to bitcoin through regulated derivatives products. Bitcoin futures led the surge, with cme surpassing binance in open interest, signaling a clear structural change. rising institutional exposure and increased etf flows shaped the evolving landscape and strengthened cme’s position. This growth is primarily driven by institutional investors, with the chicago mercantile exchange (cme) leading at $16.9 billion in btc futures, followed by binance at $12 billion. notably, approximately $1.2 billion in short positions are concentrated between the $107,000 and $108,000 price levels. Total bitcoin futures open interest across all exchanges surged past $70 billion in may, driven by capital inflows and expanding institutional participation. the movement underscores a broader migration away from crypto native platforms toward regulated derivatives markets.

Cme Bitcoin Futures Open Interest Climbs Past Binance Indicating This growth is primarily driven by institutional investors, with the chicago mercantile exchange (cme) leading at $16.9 billion in btc futures, followed by binance at $12 billion. notably, approximately $1.2 billion in short positions are concentrated between the $107,000 and $108,000 price levels. Total bitcoin futures open interest across all exchanges surged past $70 billion in may, driven by capital inflows and expanding institutional participation. the movement underscores a broader migration away from crypto native platforms toward regulated derivatives markets. The regulated derivatives marketplace chicago mercantile exchange (cme) has dethroned binance as the largest bitcoin ( btc) futures exchange. the shift marks the first time in two years that cme has claimed the top spot, indicating a surge in demand from institutional traders. The chicago mercantile exchange (cme) has emerged as a dominant force in bitcoin futures open interest, reflecting a surge in institutional demand. bitcoin futures are financial contracts that obligate the buyer or seller to transact bitcoin at a predetermined future date and price. With cme's cash settled bitcoin futures contracts surpassing the 100,000 btc mark, a record breaking open interest has been observed, indicating an increase in institutional. Open interest on bitcoin futures has seen a notable surge, with binance and cme leading the way. the open interest in bitcoin – the total value in u.s. dollars of all open futures contracts – is experiencing a noticeable uptick, indicating a rise in market activity.

Cme Bitcoin Futures Sees Institutional Interest And Demand From Asia The regulated derivatives marketplace chicago mercantile exchange (cme) has dethroned binance as the largest bitcoin ( btc) futures exchange. the shift marks the first time in two years that cme has claimed the top spot, indicating a surge in demand from institutional traders. The chicago mercantile exchange (cme) has emerged as a dominant force in bitcoin futures open interest, reflecting a surge in institutional demand. bitcoin futures are financial contracts that obligate the buyer or seller to transact bitcoin at a predetermined future date and price. With cme's cash settled bitcoin futures contracts surpassing the 100,000 btc mark, a record breaking open interest has been observed, indicating an increase in institutional. Open interest on bitcoin futures has seen a notable surge, with binance and cme leading the way. the open interest in bitcoin – the total value in u.s. dollars of all open futures contracts – is experiencing a noticeable uptick, indicating a rise in market activity.

Cme Group S Bitcoin Futures See A Surge Of Institutional Interest With cme's cash settled bitcoin futures contracts surpassing the 100,000 btc mark, a record breaking open interest has been observed, indicating an increase in institutional. Open interest on bitcoin futures has seen a notable surge, with binance and cme leading the way. the open interest in bitcoin – the total value in u.s. dollars of all open futures contracts – is experiencing a noticeable uptick, indicating a rise in market activity.

Cme Says It S Launching Bitcoin Futures On Dec 18

Comments are closed.