Connect Financial Accounting Homework Answers Pdf Depreciation Connect financial accounting homework answers free download as pdf file (.pdf), text file (.txt) or read online for free. This month's depreciation on the computer equipment is $500. d. employees earned $420 of unpaid and unrecorded salaries as of month end. e. the company earned $1,750 of commissions that are not yet billed at month end. 2. award: connect chapter 4 1 homework.

Connect Chapter 7 Homework Accounting Fill Online Printable Exercise 3 3 preparing adjusting entries lo p1 depreciation on the company’s equipment for 2017 is computed to be $11,000. the prepaid insurance account had a $7,000 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. Green valley company prepared the following trial balance at the end of its first year of operations ending december 31. to simplify. the case, the amounts given are in thousands of dollars. a. insurance expired during the current year, $6. b. wages payable, $4. c. depreciation expense for the current year, $9. d. income tax expense, $7. 1. Southern new hampshire university acc 308 intermediate accounting ii note: this workbook contains instructions and financial information you will need to complete the workbook portions of milestones one and two. for full instructions for the milestone a. Solution manual for financial accounting 11th edition by robert libby, covering all chapters 1 13. includes answers and solutions for college level accounting students.

Mcgraw Hill Accounting Chapter 4 Homework Answers Accounting Southern new hampshire university acc 308 intermediate accounting ii note: this workbook contains instructions and financial information you will need to complete the workbook portions of milestones one and two. for full instructions for the milestone a. Solution manual for financial accounting 11th edition by robert libby, covering all chapters 1 13. includes answers and solutions for college level accounting students. A depreciation method in which a property, plant and equipment asset's depreciation expense for the period is determined by applying a constant depreciation rate each year to the asset's beginning book value. Depreciation on the company's equipment for 2017 is $11,680. the office supplies account had a $350 debit balance on december 31, 2016. during 2017, $4,676 of office supplies are purchased. a physical count of supplies at december 31, 2017, shows $518 of supplies available. the prepaid insurance account had a $5,000 balance on december 31, 2016. On december 31 (the end of the accounting period), o’connor recorded depreciation on the machine using the straight line method with an estimated useful life of 10 years and an estimated residual value of $2,700. required:1. Depreciation expense of $3,600 for the equipment as of december 31, 2013. (if no entry is required for a particular transaction, select "no journal entry required" in the first account field.).

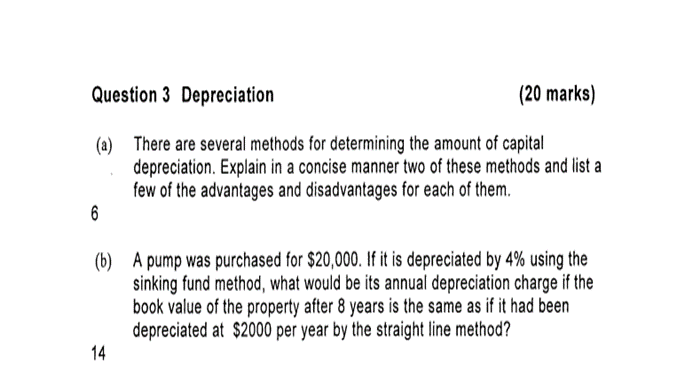

Solved Question 3 Depreciation A There Are Several Methods Chegg A depreciation method in which a property, plant and equipment asset's depreciation expense for the period is determined by applying a constant depreciation rate each year to the asset's beginning book value. Depreciation on the company's equipment for 2017 is $11,680. the office supplies account had a $350 debit balance on december 31, 2016. during 2017, $4,676 of office supplies are purchased. a physical count of supplies at december 31, 2017, shows $518 of supplies available. the prepaid insurance account had a $5,000 balance on december 31, 2016. On december 31 (the end of the accounting period), o’connor recorded depreciation on the machine using the straight line method with an estimated useful life of 10 years and an estimated residual value of $2,700. required:1. Depreciation expense of $3,600 for the equipment as of december 31, 2013. (if no entry is required for a particular transaction, select "no journal entry required" in the first account field.).

Introduction To Financial Accounting Homework Answers Pdf Homework On december 31 (the end of the accounting period), o’connor recorded depreciation on the machine using the straight line method with an estimated useful life of 10 years and an estimated residual value of $2,700. required:1. Depreciation expense of $3,600 for the equipment as of december 31, 2013. (if no entry is required for a particular transaction, select "no journal entry required" in the first account field.).