Cpf Life Vs Retirement Sum Scheme What S The Difference

Cpf Life Vs Retirement Sum Scheme Rss What S The Difference This guide explains how these schemes work, their differences, and how to make the most of cpf tools like the retirement sum topping up scheme (rstu) to secure your dream retirement. While younger singaporeans and prs will find themselves on the cpf life scheme when they turn 55, the retirement sum scheme is currently the main retirement payout plan for those born.

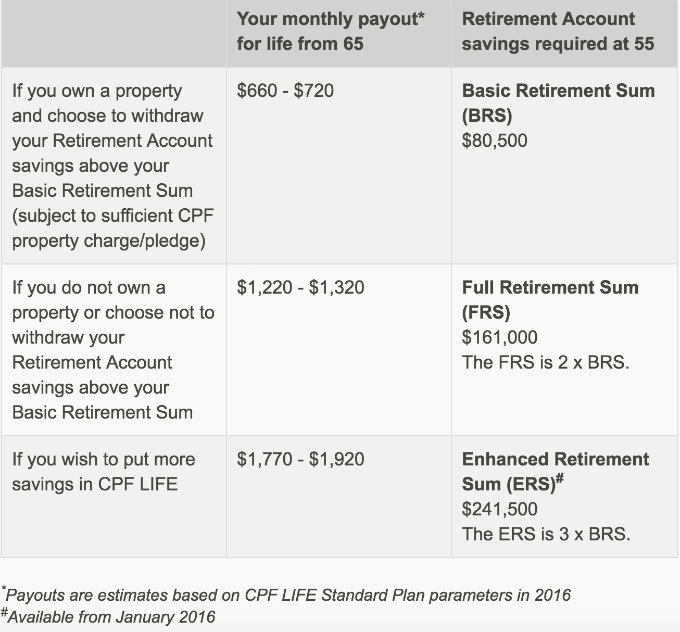

Cpf Life Vs Retirement Sum Scheme Rss What S The Difference Compare cpf life and the retirement sum scheme (rss) to discover which provides better retirement security, benefits, and flexibility for singaporeans. In this article, we will discuss two essential elements — the cpf life and retirement sum scheme (rss). we will take a closer look at the differences between these schemes and how they can impact your cpf monthly payouts in singapore when you turn 65 years old. Want to be financially ready for retirement? there are 2 annuity options under cpf the retirement sum scheme (rss) and cpf life. read on to learn more. Your retirement sum can be used to join cpf life which provides you with life long monthly payout or the rss which provides you with a monthly payout until your ra balance is depleted.

Cpf Retirement Sum New Condo Launch Want to be financially ready for retirement? there are 2 annuity options under cpf the retirement sum scheme (rss) and cpf life. read on to learn more. Your retirement sum can be used to join cpf life which provides you with life long monthly payout or the rss which provides you with a monthly payout until your ra balance is depleted. Cpf life was introduced to mitigate longevity risks. a key difference was that the retirement sum scheme provided one a monthly income until funds in his her retirement account (ra) runs out while that of cpf life monthly income is for as long as one lives. Cpf life is now the main way for singaporeans to get their cpf payouts during retirement. it has taken the place of the old retirement sum scheme (rss). however, some people still use the old rss, so we will explain how it works too. here's a quick overview of cpf life and rss:. Although they are automatically enrolled for the retirement sum scheme, they also have the option to switch to cpf life at anytime before the age of 80. how should they choose between these two options, and when should they do it?. Are you wondering which retirement plan to choose between the cpf life and retirement sum scheme? here is a detailed guide to help you make the right choice.

Comments are closed.