How Does Leverage Trading In Crypto Work Leverage trading is one of the most powerful yet dangerous tools in cryptocurrency markets. by borrowing funds to amplify positions, traders can magnify profits—but also losses—exponentially. this guide breaks down how leverage works, its key risks, and strategies to trade smarter. 1. what is crypto leverage trading?. In cryptocurrency, leverage trading refers to the process of borrowing funds in order to increase long or short exposure to a digital asset. in this article, we’ll explore leverage in the decentralized finance (defi) space.

Unlocking The Mystery What Is Leverage In Crypto Trading Bybit Learn Leverage trading in cryptocurrencies enables you to increase your exposure to the market without committing a substantial amount of capital upfront. essentially, you are borrowing funds to magnify your trading position beyond what would be possible with your account balance alone. Leverage cryptocurrency trading is when you borrow assets from exchanges to amplify your trading capacity. in other words, you borrow to increase your buying and selling power in the market. this way, you end up operating with more capital than you actually have. moreover, there are various leverages based on the exchange you use. Leverage trading is the act of using borrowed capital to make larger trades. it can amplify your buying or selling power, allowing you to trade with more capital than what you have in your wallet. leverage trading is often done through margin trading, futures contracts, and options contracts. Leverage trading has become a popular strategy in the crypto market, offering traders the ability to amplify their positions with borrowed funds. while leverage can maximize profits, it also increases risks, making it a double edged sword—especially for retail investors.

Understanding Leverage Trading In Crypto Coinbase Leverage trading is the act of using borrowed capital to make larger trades. it can amplify your buying or selling power, allowing you to trade with more capital than what you have in your wallet. leverage trading is often done through margin trading, futures contracts, and options contracts. Leverage trading has become a popular strategy in the crypto market, offering traders the ability to amplify their positions with borrowed funds. while leverage can maximize profits, it also increases risks, making it a double edged sword—especially for retail investors. Leverage refers to using borrowed capital to open a trading position, which can amplify the potential gains or losses. the main leverage methods available in crypto are margin trading, futures, and options contracts. By borrowing funds from an exchange, you can control a much larger position in a crypto asset than your initial investment allows. leverage acts as a multiplier to your crypto gains if the market. In the simplest terms, leverage amplifies the value of your available capital by a predetermined factor, which in turn amplifies any subsequent gains and losses. traders often use leverage to trade bitcoin (btc), ethereum (eth) and other digital assets.

How Does Leverage Trading Work In Cryptocurrency Crypto Trading Plus Leverage refers to using borrowed capital to open a trading position, which can amplify the potential gains or losses. the main leverage methods available in crypto are margin trading, futures, and options contracts. By borrowing funds from an exchange, you can control a much larger position in a crypto asset than your initial investment allows. leverage acts as a multiplier to your crypto gains if the market. In the simplest terms, leverage amplifies the value of your available capital by a predetermined factor, which in turn amplifies any subsequent gains and losses. traders often use leverage to trade bitcoin (btc), ethereum (eth) and other digital assets.

What Is Leverage Trading In Crypto Cryptoatlas In the simplest terms, leverage amplifies the value of your available capital by a predetermined factor, which in turn amplifies any subsequent gains and losses. traders often use leverage to trade bitcoin (btc), ethereum (eth) and other digital assets.

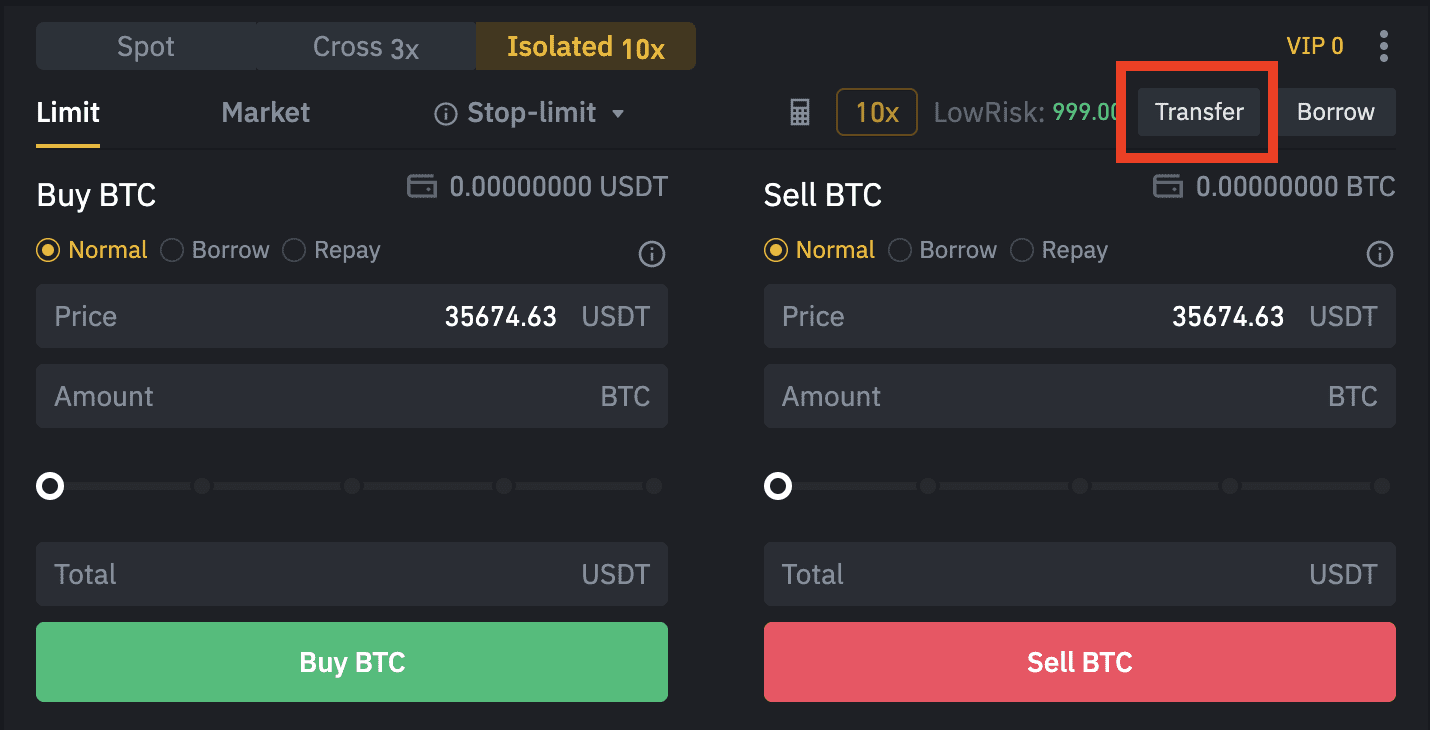

How Does Leverage Trading In Crypto Work Binance Blog