Cash And Cash Equivalents Theories Pdf Debits And Credits Deposit Cash and cash equivalents (cce) refers to the line item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash immediately. Cash and cash equivalents (cce) is a line item on a balance sheet representing cash or assets that can easily be converted to cash if needed. they are a company’s most liquid assets and.

Lecture 1 Cash And Cash Equivalents Pdf Cash And Cash Equivalents Explore the essential characteristics, types, and financial reporting of cash equivalents in this comprehensive guide. in the realm of financial management, cash equivalents play a crucial role in maintaining liquidity and ensuring operational efficiency. Cash equivalents are investment instruments with high credit quality and high liquidity that are designed for short term investing. along with stocks and bonds, cash equivalents, sometimes known as "cash and equivalents," are one of the three primary asset types in financial investing. In this comprehensive exploration of cash and cash equivalents (cce), we unveil the fundamental role these assets play in a company’s financial well being. you’ll gain a deep understanding of what cce encompasses, the diverse types it comprises, its critical significance, and why businesses hold it. Cash equivalents are low risk, short term investments with original maturity periods of three months or less. examples of cash equivalents include bank certificates of deposit, banker’s acceptances, treasury bills, commercial paper, and other money market instruments.

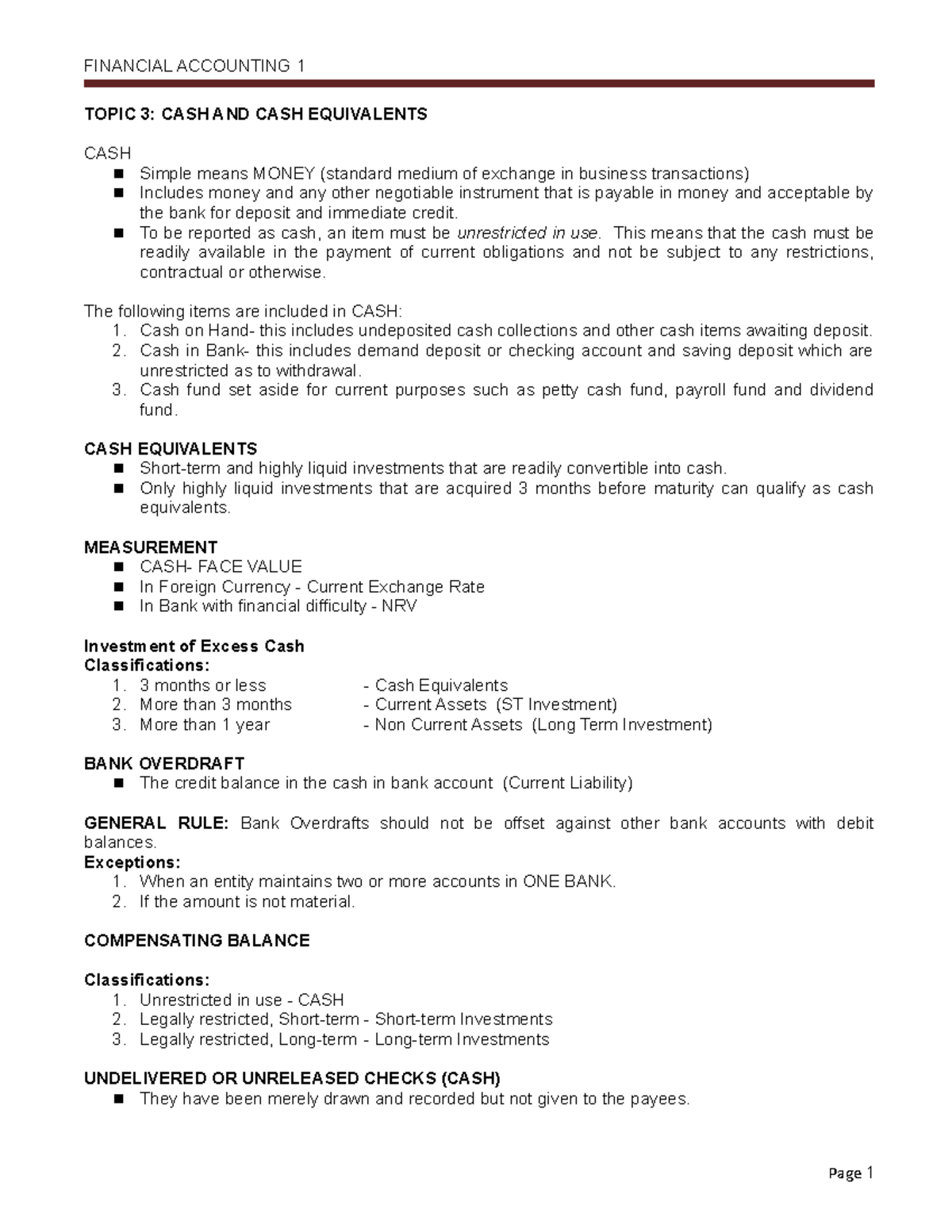

Cash And Cash Equivalents Topic 3 Cash And Cash Equivalents Cash In this comprehensive exploration of cash and cash equivalents (cce), we unveil the fundamental role these assets play in a company’s financial well being. you’ll gain a deep understanding of what cce encompasses, the diverse types it comprises, its critical significance, and why businesses hold it. Cash equivalents are low risk, short term investments with original maturity periods of three months or less. examples of cash equivalents include bank certificates of deposit, banker’s acceptances, treasury bills, commercial paper, and other money market instruments. Explore the significance of cash equivalents in investing, their traits, examples, and how they contribute to a diverse portfolio with our guide. Cash and cash equivalents consist of cash on deposit with banks and highly liquid investments with maturities of 90 days or less from the date of purchase. in another note, the company gives more detail. Accurate financial reporting starts with properly classifying cash and cash equivalents. asc 305, a key part of u.s. gaap, provides essential guidelines for defining, presenting, and disclosing these assets. but what truly qualifies as cash? are money market funds always cash equivalents? how do bank overdrafts and restricted cash fit in?. Here are the general requirements for an asset to be considered a cash equivalent: the reasons for opting for cash equivalents rather than pure cash is that businesses can almost always achieve a better interest rate by investing in cash equivalents.