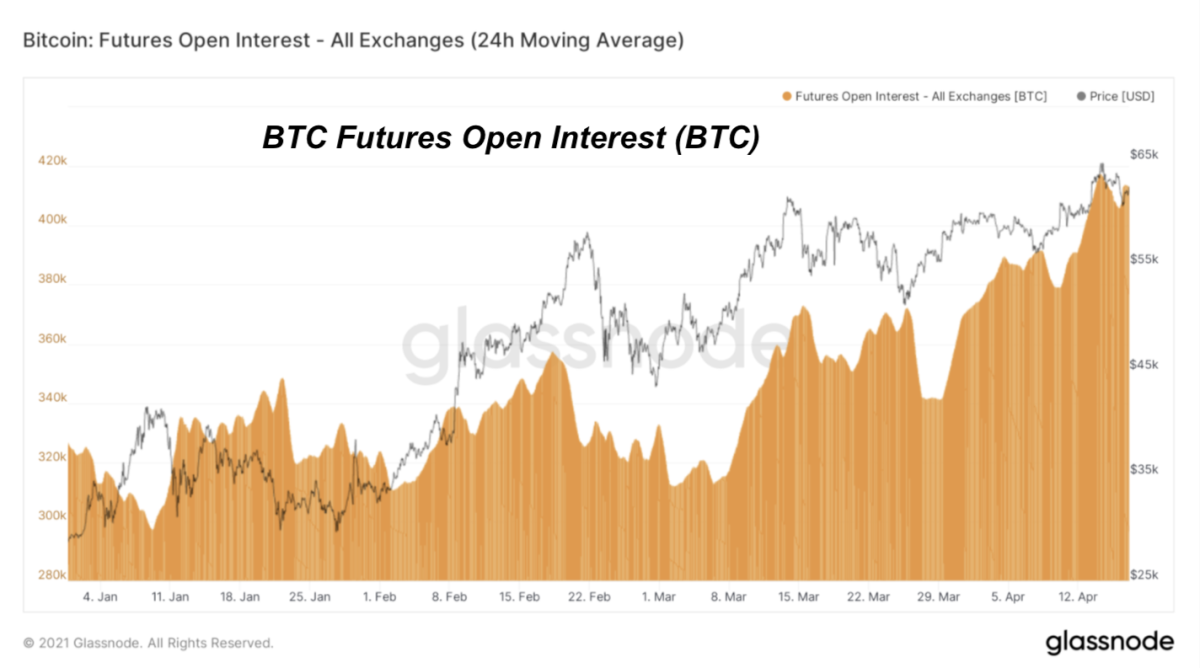

Derivatives Market Breaks Multiple Records As Bitcoin Touched 16 000 Since the market rout on march 12, otherwise known as ‘black thursday,’ bitcoin futures and options contracts have seen significant demand. on may 14, cme group saw the total number of outstanding derivatives contracts (open interest) touch a high of $142 million. four days later, cme broke records again. The bitcoin derivatives market has seen unprecedented activity, with open interest reaching $15 billion. spot bitcoin etfs and growing institutional participation have fueled the derivatives market. while past halvings have seen price surges, the impact of this record breaking open interest remains uncertain.

Examining Bitcoin Derivatives Market Bitcoin Magazine Bitcoin News Sean mcnulty, director of trading at liquidity provider arbelos markets, flagged the risk of a “choppy market” amid the expiry of the derivatives positions. bitcoin and its smaller rivals are. Earlier this week, deribit, a major digital asset derivatives exchange, revealed that bitcoin options open interest on their platform had reached an unprecedented $14.9 billion. this figure. Moreover, bitcoin derivatives markets have crossed record levels as well as open interest in options, and futures have never been so high. following a 1,079 day wait, on november 30, 2020, btc broke its record price high that was recorded in mid december 2017. Deribit, the largest crypto options exchange, reported a record notional value of approximately $14.9 billion in bitcoin options open interest earlier this week. this surpassed the previous $14.4 billion set in october 2021, just before btc reached its all time high of nearly $69,000.

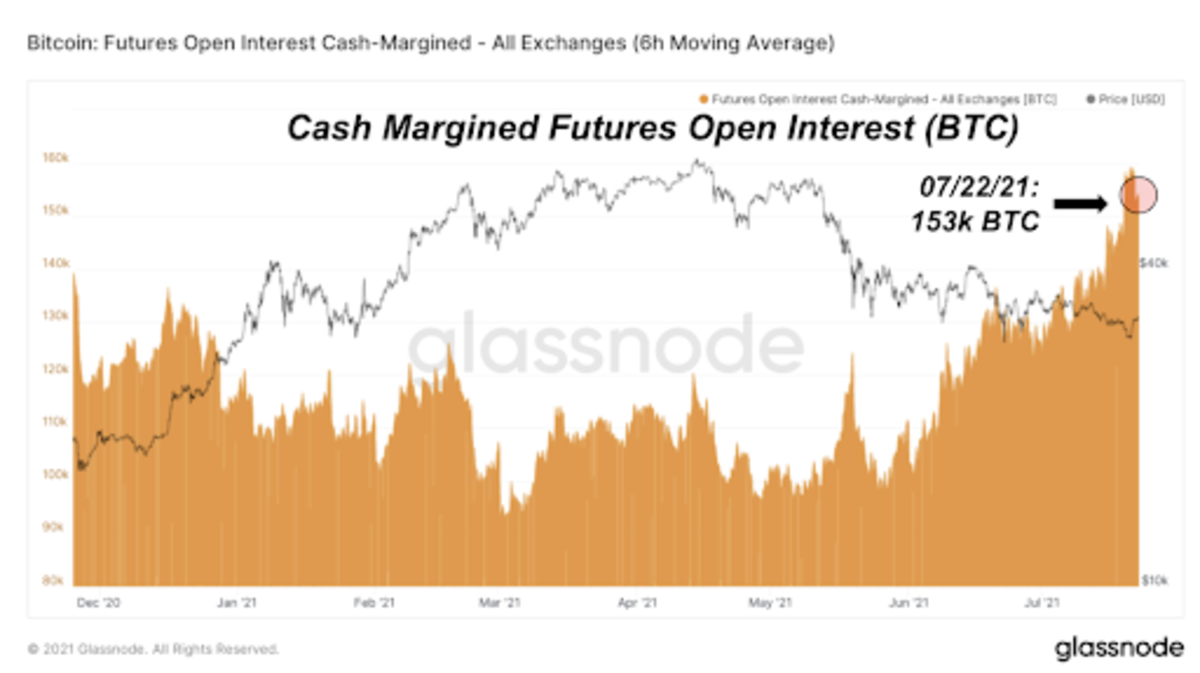

Examining Bitcoin Derivatives Market Bitcoin Magazine Bitcoin News Moreover, bitcoin derivatives markets have crossed record levels as well as open interest in options, and futures have never been so high. following a 1,079 day wait, on november 30, 2020, btc broke its record price high that was recorded in mid december 2017. Deribit, the largest crypto options exchange, reported a record notional value of approximately $14.9 billion in bitcoin options open interest earlier this week. this surpassed the previous $14.4 billion set in october 2021, just before btc reached its all time high of nearly $69,000. The crypto derivatives market has shown robust growth, both in terms of volume and market participants. here are the key statistics that define its size and trajectory: the global crypto derivatives market size hit an estimated $20 trillion in 2023, marking a 15% increase from 2022. The latest bitcoin rally gathering strength since october happened with a dominance of spot trading, while derivative trading slowed down. recent market demand showed renewed spot open interest, as btc grew to over $108,300, a new price record. bitcoin (btc) rallied to its most recent price record as market sentiment shifted to increased spot. The effect of the derivative market on the underlying spot market is huge. already in 2017, when trading in bitcoin derivatives started on regulated exchanges (cme), unprecedented price movements happened, while a huge spike in the value of outstanding derivative contracts blew up bitcoin's volatility.

Bitcoin New Records For Derivatives Volumes The Cryptonomist The crypto derivatives market has shown robust growth, both in terms of volume and market participants. here are the key statistics that define its size and trajectory: the global crypto derivatives market size hit an estimated $20 trillion in 2023, marking a 15% increase from 2022. The latest bitcoin rally gathering strength since october happened with a dominance of spot trading, while derivative trading slowed down. recent market demand showed renewed spot open interest, as btc grew to over $108,300, a new price record. bitcoin (btc) rallied to its most recent price record as market sentiment shifted to increased spot. The effect of the derivative market on the underlying spot market is huge. already in 2017, when trading in bitcoin derivatives started on regulated exchanges (cme), unprecedented price movements happened, while a huge spike in the value of outstanding derivative contracts blew up bitcoin's volatility.

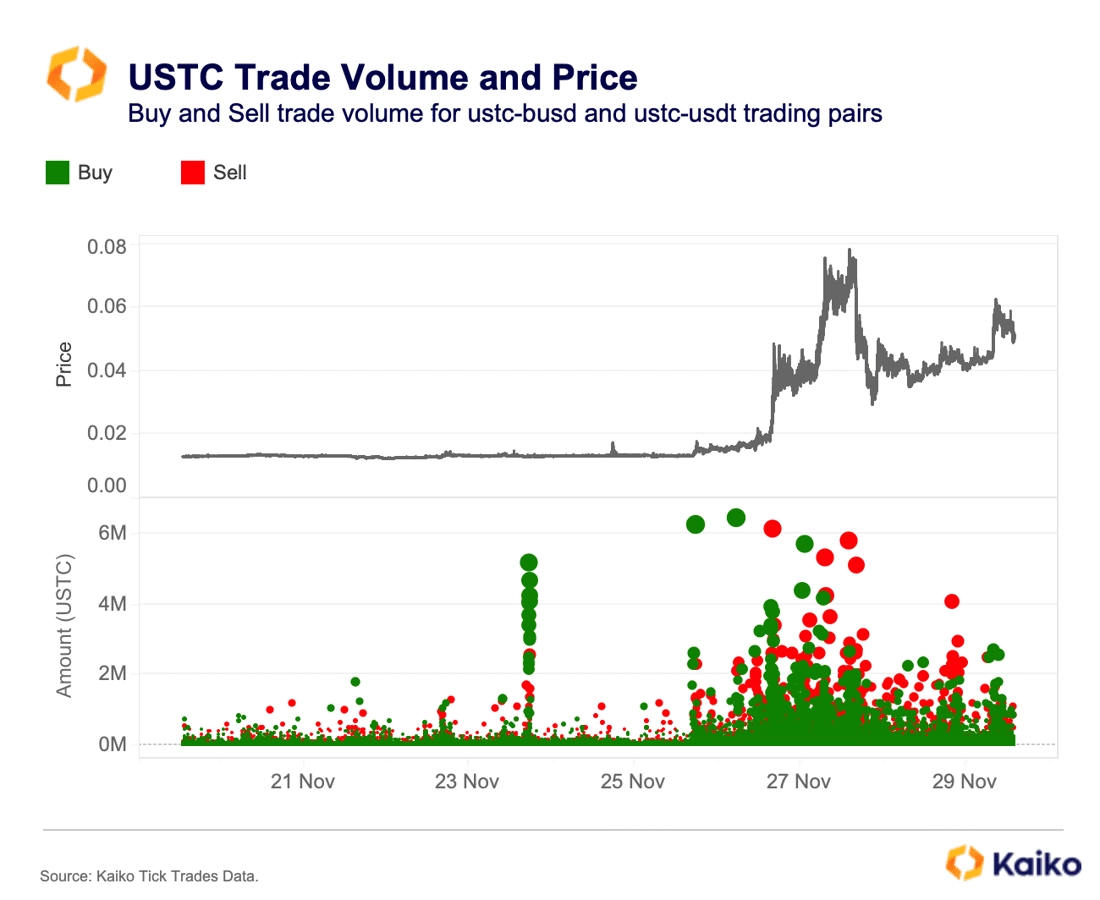

Bitcoin Breaks 41k As Rally Continues Kaiko Research The effect of the derivative market on the underlying spot market is huge. already in 2017, when trading in bitcoin derivatives started on regulated exchanges (cme), unprecedented price movements happened, while a huge spike in the value of outstanding derivative contracts blew up bitcoin's volatility.