Diversified Profitable Portfolio Major Asset Class In Investment Diversification is a strategy of spreading investments across a variety of assets to reduce risk. this way, if one investment performs poorly, others may compensate. for instance, if you only owned apple stock and it dropped by 10%, your portfolio would fall 10%. In our recently published 2024 diversification landscape report, my colleagues christine benz, karen zaya, and i took a deep dive into the diversification potential of several major asset.

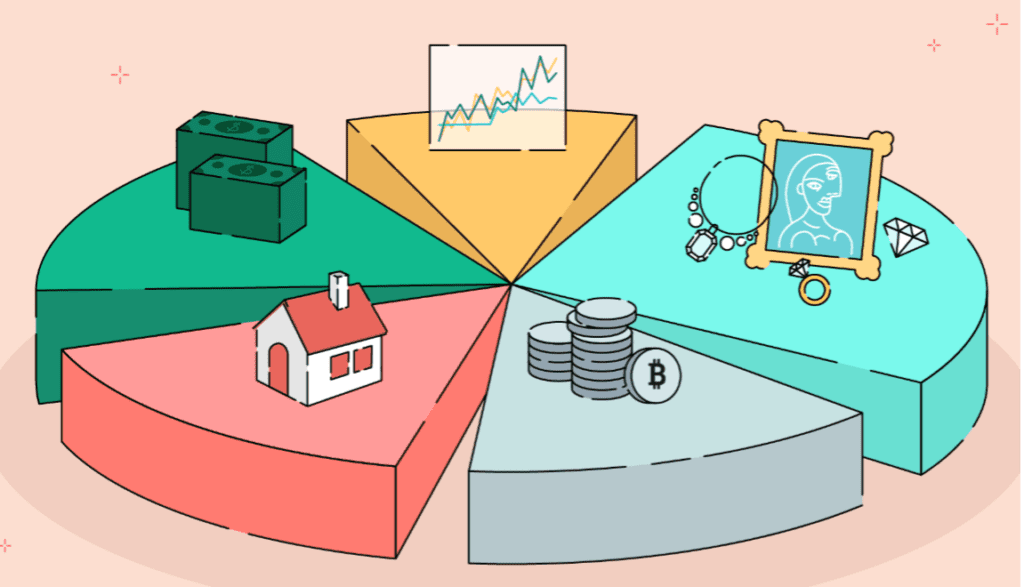

Diversified Investment Portfolio Thesan Private Wealth The strength of this strategy lies in combining assets that are not closely correlated, so that when one underperforms, others may hold steady or gain. a well balanced mix ensures that no single asset class dominates your portfolio’s performance, enhancing its ability to withstand market volatility and achieve more consistent long term outcomes. Effective diversification involves several key strategies: asset allocation: your portfolio’s foundation. this is the foundation of portfolio diversification and involves distributing your investments across major asset classes like stocks, bonds, and cash (or cash equivalents). each asset class has its own risk and return characteristics. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. in this article, we’ll explore why diversification matters, outline key asset classes, and share strategies to balance your investments for long term success . Diversification spreads your investments across different asset classes, sectors, and geographical regions, reducing the impact of any single asset's poor performance on your overall portfolio. for australian investors, understanding how to effectively diversify within the context of the local market and global opportunities is key to.

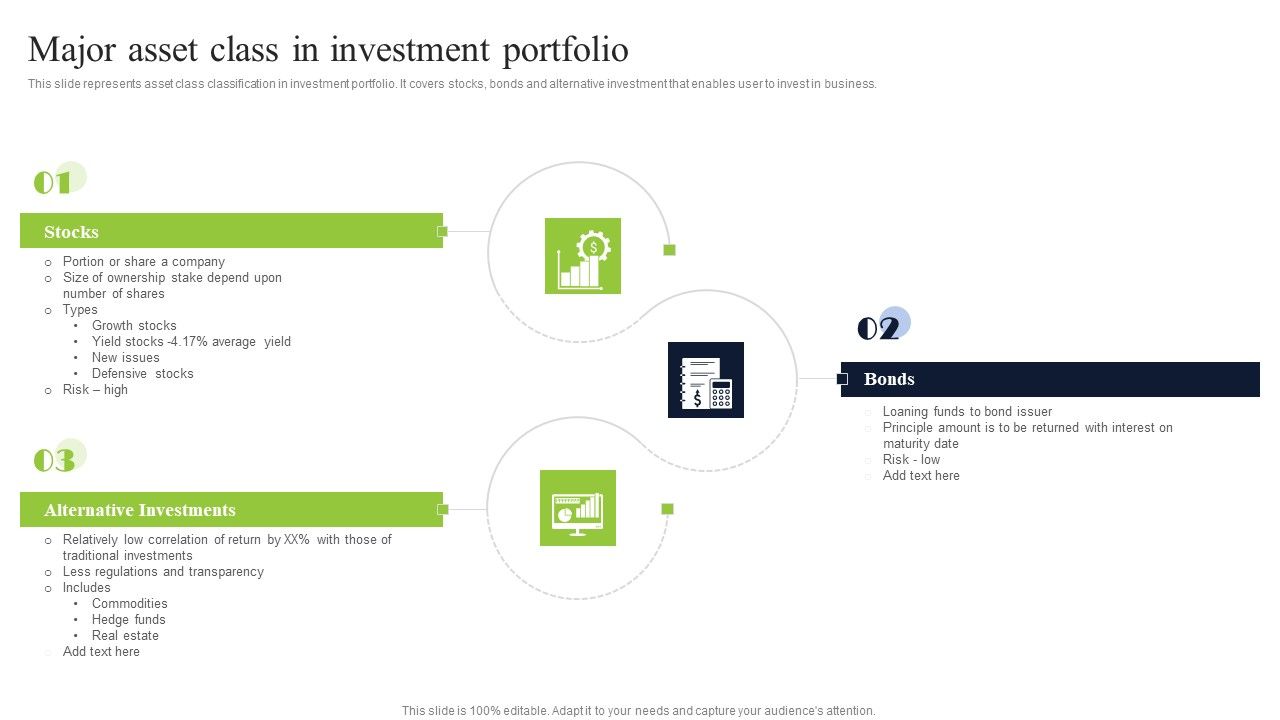

The Power Of Diversified Investment Portfolio Asset Vantage By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. in this article, we’ll explore why diversification matters, outline key asset classes, and share strategies to balance your investments for long term success . Diversification spreads your investments across different asset classes, sectors, and geographical regions, reducing the impact of any single asset's poor performance on your overall portfolio. for australian investors, understanding how to effectively diversify within the context of the local market and global opportunities is key to. Understanding asset classes is crucial for any investor looking to build a diversified portfolio. in this post, we'll break down the main asset classes, explain their characteristics, and describe how including different asset classes in your portfolio can help you manage risk and potentially increase returns. Asset class diversification; diversifying across asset classes ensures your portfolio isn’t overly dependent on one type of investment. here’s a breakdown: equities (stocks): include domestic and international stocks for exposure to various markets and economic growth. domestic stocks focus on local businesses, while international stocks. A diversified portfolio is a collection of investments spread across different asset classes, industries, or geographies to reduce risk and enhance returns. diversification is a crucial strategy for investors because it helps safeguard against losses by balancing potential risks across various investment areas. Diversification landscape: building diversified portfolios.