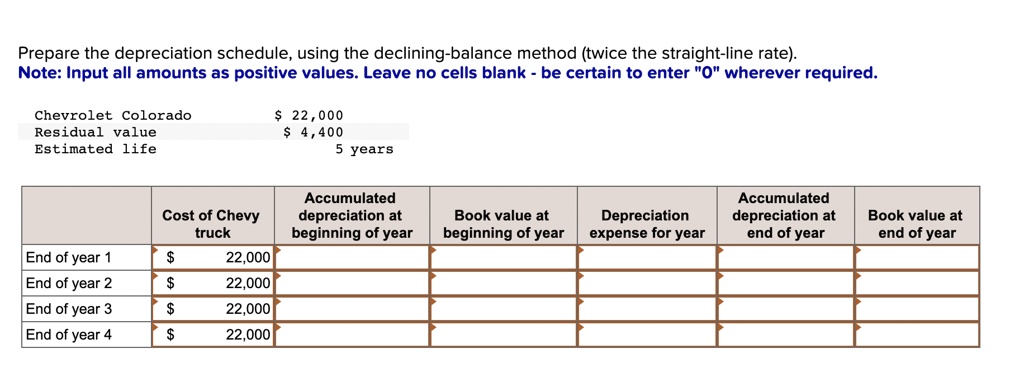

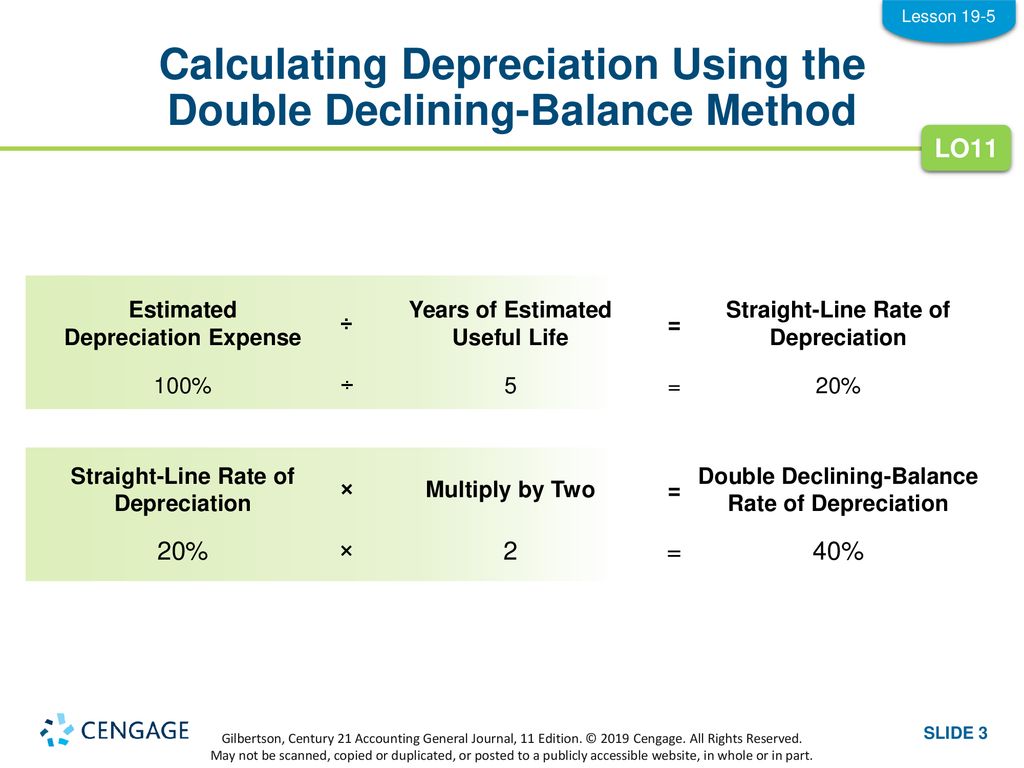

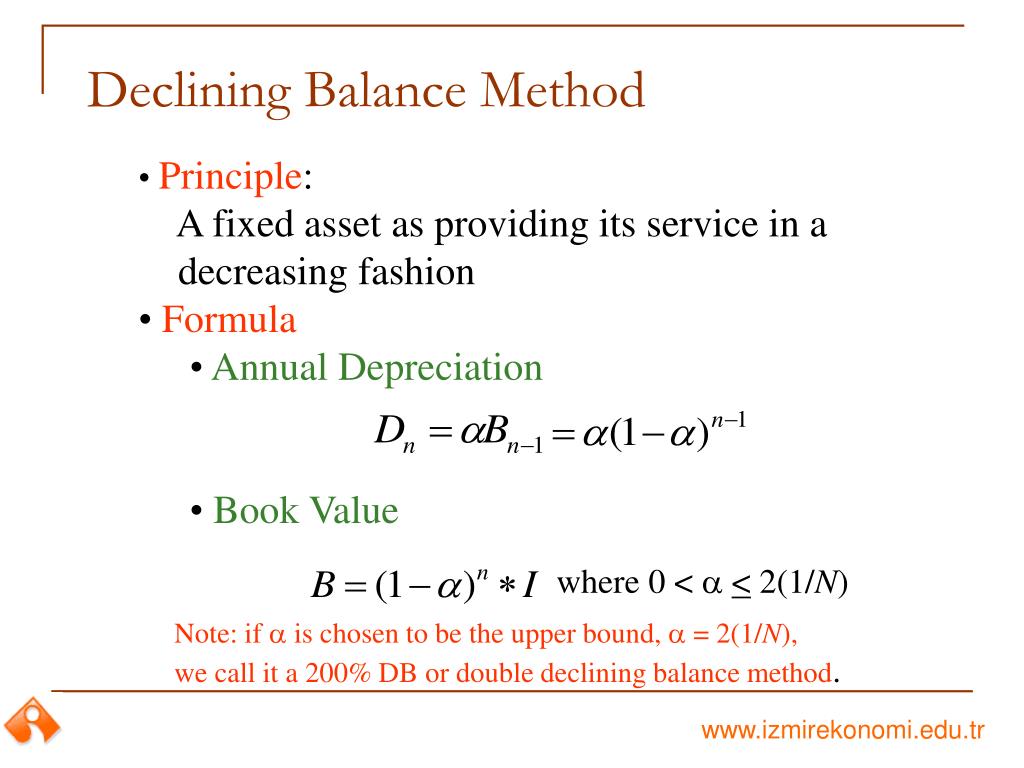

Double Declining Balance Depreciation Template Pdf Download the free excel double declining balance template to play with the numbers and calculate double declining balance depreciation expense on your own! the best way to understand how it works is to use your own numbers and try building the schedule yourself. Double declining balance method formula (ddb) the formula used to calculate annual depreciation expense under the double declining method is as follows. depreciation expense = [(purchase cost – salvage value) ÷ useful life assumption] × 2 × beginning pp&e book value.

Double Declining Balance Method Formula Free Template 53 Off Declining balance depreciation calculator in excel, openoffice calc & google sheet to depreciate your tangible asset on decreasing book value. moreover, you can calculate depreciation by the declining balance method as well as the double declining balance method with this template. Double declining balance is calculated using this formula: 2 x basic depreciation rate x book value. your basic depreciation rate is the rate at which an asset depreciates using the straight line method. to get that, first calculate: cost of the asset recovery period. cost of the asset is what you paid for an asset. This double declining balance depreciation excel template makes it easy to calculate the deprecation of any asset. quickly enter asset data and get deprecation rates for up to 10 years. perfect for accountants, small business owners, and more!. Calculate depreciation of an asset using the double declining balance method and create and print depreciation schedules. calculator for depreciation at a declining balance factor of 2 (200% of straight line). includes formulas, example, depreciation schedule and partial year calculations.

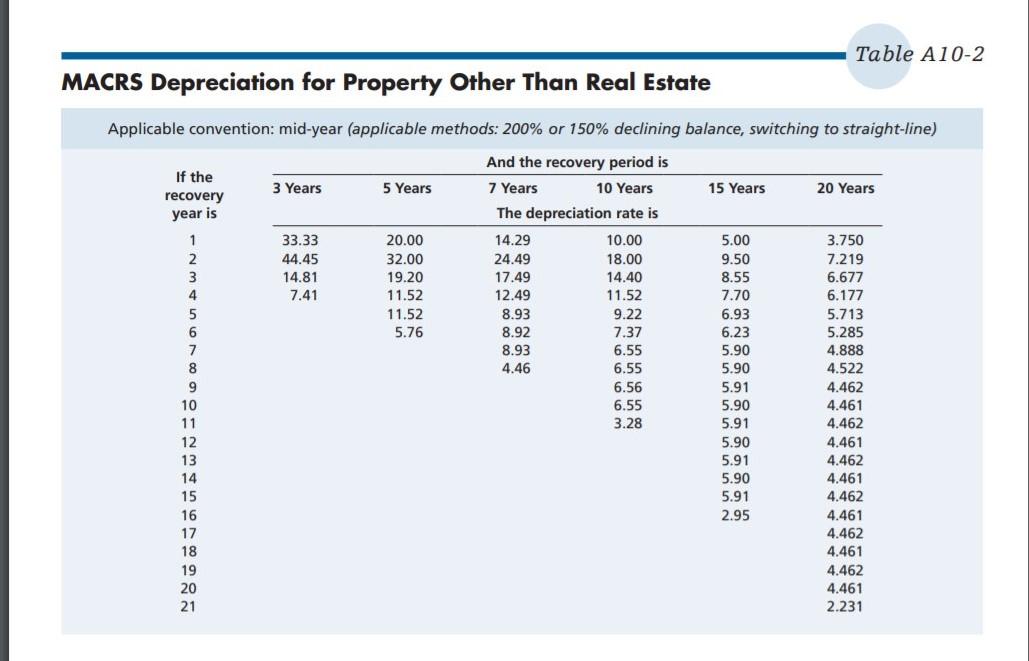

Double Declining Balance Method Formula Free Template 53 Off This double declining balance depreciation excel template makes it easy to calculate the deprecation of any asset. quickly enter asset data and get deprecation rates for up to 10 years. perfect for accountants, small business owners, and more!. Calculate depreciation of an asset using the double declining balance method and create and print depreciation schedules. calculator for depreciation at a declining balance factor of 2 (200% of straight line). includes formulas, example, depreciation schedule and partial year calculations. Double declining balance depreciation isn’t a tongue twister invented by bored irs employees—it’s a smart way to save money up front on business expenses. both ddb and ordinary declining depreciation are accelerated methods. Download the free excel double declining balance template to play with the numbers and calculate double declining balance depreciation expense on your own! the “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the. The “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the accounting period. as an alternative to systematic allocation schemes, several declining balance methods for calculating depreciation expenses have been developed.

Double Declining Balance Method Formula Free Template 53 Off Double declining balance depreciation isn’t a tongue twister invented by bored irs employees—it’s a smart way to save money up front on business expenses. both ddb and ordinary declining depreciation are accelerated methods. Download the free excel double declining balance template to play with the numbers and calculate double declining balance depreciation expense on your own! the “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the. The “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the accounting period. as an alternative to systematic allocation schemes, several declining balance methods for calculating depreciation expenses have been developed.

Double Declining Balance Method Formula Free Template Vrogue Co The “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the accounting period. as an alternative to systematic allocation schemes, several declining balance methods for calculating depreciation expenses have been developed.

Double Declining Balance Method Formula Free Template