Dydx Has Launched Layer 2 Perpetual Contracts

Dydx Has Launched Layer 2 Perpetual Contracts To significantly scale trading, dydx and starkware have built a layer 2 protocol for cross margined perpetuals, based on starkware’ starkex scalability engine ("layer 2") and dydx’s perpetual smart contracts. Dydx has launched its layer 2 perpetual swap platform, according to an announcement from the project today. dydx launched its closed alpha in february and reported widespread adoption: “we had 110,000 users sign up for the waitlist, and users traded $90,000,000 in volume across over 25,000 trades,” dydx wrote in its most recent announcement,.

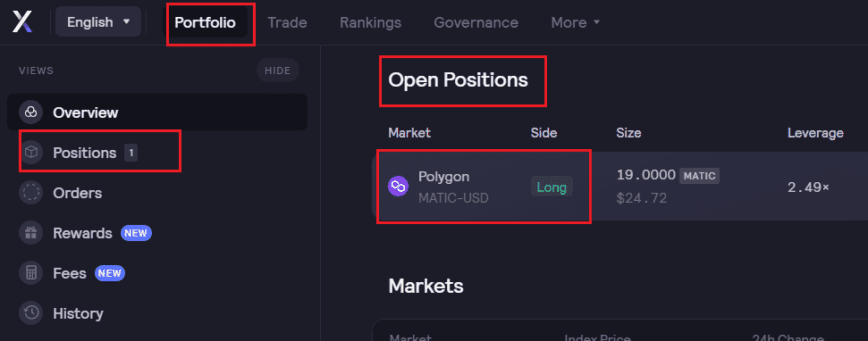

Github Codestheos Dydx Perpetual Contracts Ethereum Smart Contracts In august 2021, the dydx exchange launched layer 2 cross margin perpetual trading enabling users to repurpose their available platform balance to offer liquidity to existing trades to prevent liquidations during periods of extreme volatility. The platform has recently ceased spot trading functionality and shifted its key focus to perpetual trading, which is why that feature was the first tradable instrument made available on the starkware layer 2 in house protocol upgrade. Dydx launched its cross margined perpetuals product on a layer 2 scaling solution powered by blockchain software developer starkware. the move is significant as it highlights how some of ethereum’s most well known defi projects are migrating to scaling solutions amid rising gas costs to operate directly on ethereum’s layer 1. “to scale trading significantly, dydx and starkware have created a layer 2 protocol for perpetual contracts based on the starkware starkex scaling engine and dydx perpetual smart contracts. traders can now trade with zero gas costs, lower trading fees and reduced minimum trade sizes.

Dydx Evaluates Transitioning Token To Native Asset Of Upcoming Layer 1 Dydx launched its cross margined perpetuals product on a layer 2 scaling solution powered by blockchain software developer starkware. the move is significant as it highlights how some of ethereum’s most well known defi projects are migrating to scaling solutions amid rising gas costs to operate directly on ethereum’s layer 1. “to scale trading significantly, dydx and starkware have created a layer 2 protocol for perpetual contracts based on the starkware starkex scaling engine and dydx perpetual smart contracts. traders can now trade with zero gas costs, lower trading fees and reduced minimum trade sizes. The dydx protocol has positioned itself as a prominent decentralized platform for perpetual contracts, leveraging advanced layer 2 scalability solutions and a strong focus on non custodial trading. Since its inception in 2017 by founder antonio juliano, dydx has stood out by employing innovative layer 2 solutions like starkware, which boost transaction speeds and cut down on fees. Perpetuals function similar to futures contracts, only they never expire according to a schedule. dydx is powered by the ethereum layer 2 solution starkware. although it also offers derivatives trading on layer 1, it will move to exclusively layer 2 from november 2021. We are extremely excited to announce that our new cross margined perpetuals are now live on layer 2. this is a milestone for both dydx and the broader ethereum ecosystem. the launch follows seven months of development, which took us from theory to a world class product experience on mainnet.

What Are Perpetual Contracts For Bitcoin Dydx Perpetual Futures Explained The dydx protocol has positioned itself as a prominent decentralized platform for perpetual contracts, leveraging advanced layer 2 scalability solutions and a strong focus on non custodial trading. Since its inception in 2017 by founder antonio juliano, dydx has stood out by employing innovative layer 2 solutions like starkware, which boost transaction speeds and cut down on fees. Perpetuals function similar to futures contracts, only they never expire according to a schedule. dydx is powered by the ethereum layer 2 solution starkware. although it also offers derivatives trading on layer 1, it will move to exclusively layer 2 from november 2021. We are extremely excited to announce that our new cross margined perpetuals are now live on layer 2. this is a milestone for both dydx and the broader ethereum ecosystem. the launch follows seven months of development, which took us from theory to a world class product experience on mainnet.

Beginner S Guide Perpetual Trading On Dydx Perpetuals function similar to futures contracts, only they never expire according to a schedule. dydx is powered by the ethereum layer 2 solution starkware. although it also offers derivatives trading on layer 1, it will move to exclusively layer 2 from november 2021. We are extremely excited to announce that our new cross margined perpetuals are now live on layer 2. this is a milestone for both dydx and the broader ethereum ecosystem. the launch follows seven months of development, which took us from theory to a world class product experience on mainnet.

Comments are closed.