Elliott Wave View Bitcoin Btcusd Entering Into A Wave Five Lower The short term elliott wave view in btcusd suggests that the decline from march 28, 2022, high is unfolding as an impulse structure favoring some more downside. down from 03 28 2022 high, wave (1) ended in 5 waves at $38550 low. wave (2) ended at $42974 high, and wave (3) ended in 5 waves at $25384 low. Short term elliott wave view in bitcoin (btcusd) suggests rally from 6 september 2024 low is in progress as a 5 waves impulse. up from 6 september, wave 1 ended at 66508 and dips in wave 2.

Elliott Wave View Bitcoin Btcusd Entering Into A Wave Five Lower Short term elliott wave view in bitcoin (btcusd) suggests that cycle from jan 13, 2025 low is in progress as a 5 waves impulse diagonal. up from jan 13, 2025 low, wave (1) ended at 109,356. wave (2) pullback unfolded as a double three elliott wave structure. down from wave (1), wave ((a)) ended at 100,087 and wave ((b)) ended at 105,424. This article provides a thorough btcusd elliott wave analysis for bitcoin, covering price trends, corrective and impulse waves, and trading strategies based on day and 4 hour charts. learn how to utilize technical indicators like the ma200 and wave o. Short term elliott wave view in bitcoin (btcusd) suggests that rally from 8.5.2024 low is in 5 swing. as 5 swing is a motive sequence, this favors further upside in bitcoin. 1 hour chart below shows the decline to 58,867 ended wave 2. the crypto currency has extended higher in wave 3 with internal subdivision as a 5 waves impulse elliott wave. Short term elliott wave view in bitcoin (btcusd) suggests rally from 6 september 2024 low is in progress as a 5 waves impulse. up from 6 september, wave 1 ended at 66508 and dips in wave 2 ended at 58867. the crypto currency has extended higher in wave 3 towards 103647 as the 1 hour chart below.

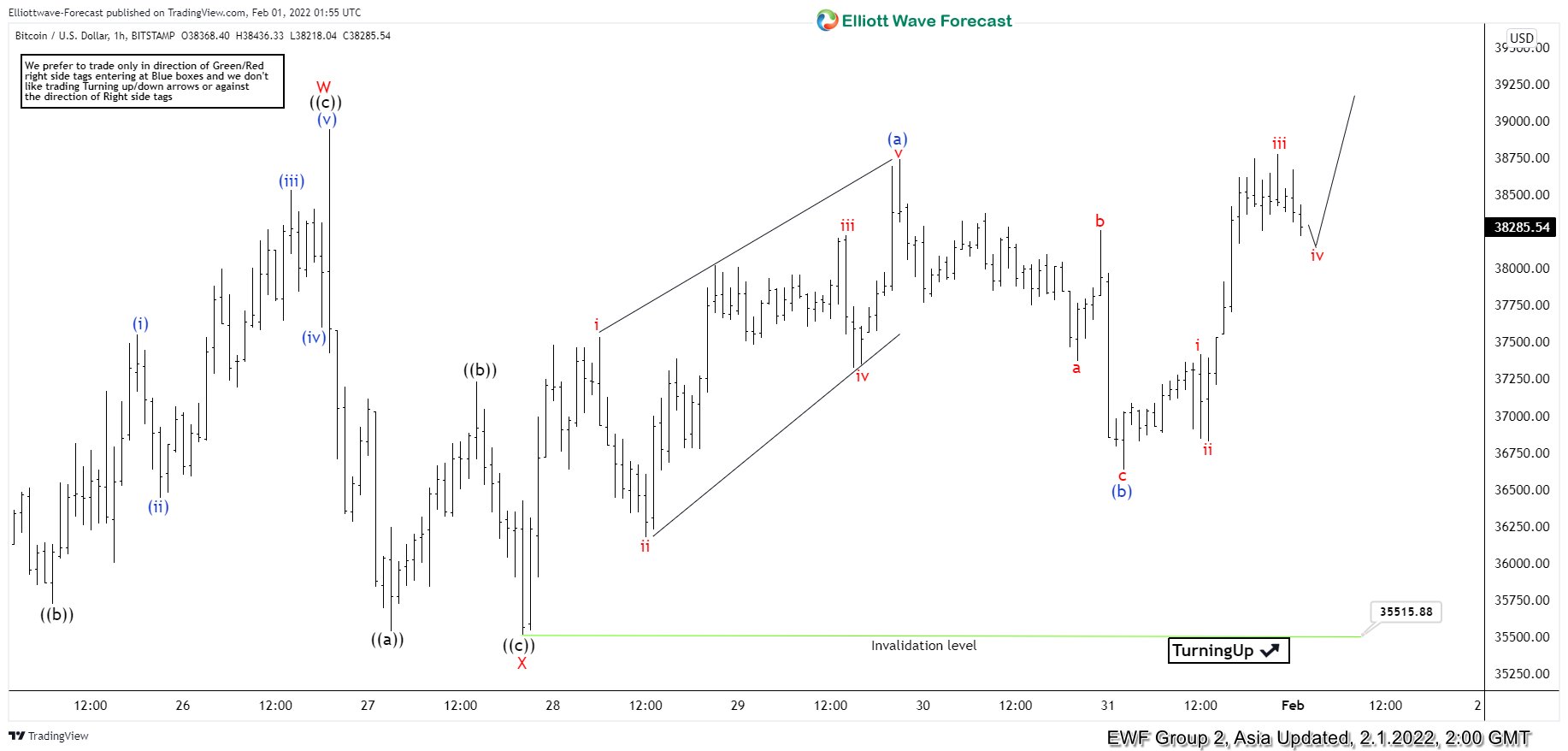

Elliott Wave View Bitcoin Btcusd Turning Lower Short term elliott wave view in bitcoin (btcusd) suggests that rally from 8.5.2024 low is in 5 swing. as 5 swing is a motive sequence, this favors further upside in bitcoin. 1 hour chart below shows the decline to 58,867 ended wave 2. the crypto currency has extended higher in wave 3 with internal subdivision as a 5 waves impulse elliott wave. Short term elliott wave view in bitcoin (btcusd) suggests rally from 6 september 2024 low is in progress as a 5 waves impulse. up from 6 september, wave 1 ended at 66508 and dips in wave 2 ended at 58867. the crypto currency has extended higher in wave 3 towards 103647 as the 1 hour chart below. Btc usd elliott wave technical analysis. function: follow trend. mode: motive. structure: impulse. position: wave (3). direction next higher degrees: wave ((3)). details: the five wave. Short term elliott wave view in bitcoin (btcusd) suggests that cycle from jan 13, 2025 low is in progress as a 5 waves impulse diagonal. up from jan 13, 2025 low, wave (1) ended at 109,356. wave (2) pullback unfolded as a double three elliott wave structure. down from wave (1), wave ((a)) ended at 100,087 and wave ((b)) ended at 105,424. Elliott wave analysis for bitcoin (btcusd) outlines a corrective zigzag pattern, currently positioned in wave b. with resistance around $90,792 and a potential drop in wave c, the article offers a clear trading strategy for short term traders, along. Monitoring the 93,100 usd level will be crucial for confirming the entry into wave 3, targeting 108,000 usd and beyond. bitcoin market update: key developments today. bitcoin experienced a notable dip below $100,000 for the first time in six days, following the announcement of new import tariffs by u.s. president trump on china, canada, and mexico.

Elliott Wave View Bitcoin Btcusd Recovery In Progress Btc usd elliott wave technical analysis. function: follow trend. mode: motive. structure: impulse. position: wave (3). direction next higher degrees: wave ((3)). details: the five wave. Short term elliott wave view in bitcoin (btcusd) suggests that cycle from jan 13, 2025 low is in progress as a 5 waves impulse diagonal. up from jan 13, 2025 low, wave (1) ended at 109,356. wave (2) pullback unfolded as a double three elliott wave structure. down from wave (1), wave ((a)) ended at 100,087 and wave ((b)) ended at 105,424. Elliott wave analysis for bitcoin (btcusd) outlines a corrective zigzag pattern, currently positioned in wave b. with resistance around $90,792 and a potential drop in wave c, the article offers a clear trading strategy for short term traders, along. Monitoring the 93,100 usd level will be crucial for confirming the entry into wave 3, targeting 108,000 usd and beyond. bitcoin market update: key developments today. bitcoin experienced a notable dip below $100,000 for the first time in six days, following the announcement of new import tariffs by u.s. president trump on china, canada, and mexico.