Example Asset Allocation All In One Etf Best Way To Grow Your Money Do you want the allocation between stocks and bonds to remain the same for the life of your investment? or do you want that allocation to adjust as you get closer to retirement? buy into global etfs. First, a quick refresher on vcns and its sister funds. early in 2018, vanguard launched a family of asset allocation etfs that allow you to hold a diversified portfolio using a single.

Why The All In One Etf Might Be The Best Way To Grow Your Money Planeasy As best i can, i’ll try to include one asset allocation fund from 10 different etf providers with five active and five passive etfs. here’s my list of etfs to buy: adaptive core etf (bats:. Vanguard, as most of you are already well aware, is the industry's low cost leader. if you want an etf that costs next to nothing to own, this is the place you want to go. vanguard's lineup is. If you think an all etf portfolio might suit you, here are three ways to build one, ranging from ultra simple to very fine tuned. 1. keeping it simple. one option you can consider would be using two etfs to help provide a balanced, diversified portfolio of stocks and bonds:. The best way to grow your money. while not perfect, the “all in one” etf provides a very attractive balance of all the different factors to consider when creating an investment portfolio. it isn’t the lowest fee option available, but it’s pretty darn close. it’s easy to choose a target asset allocation.

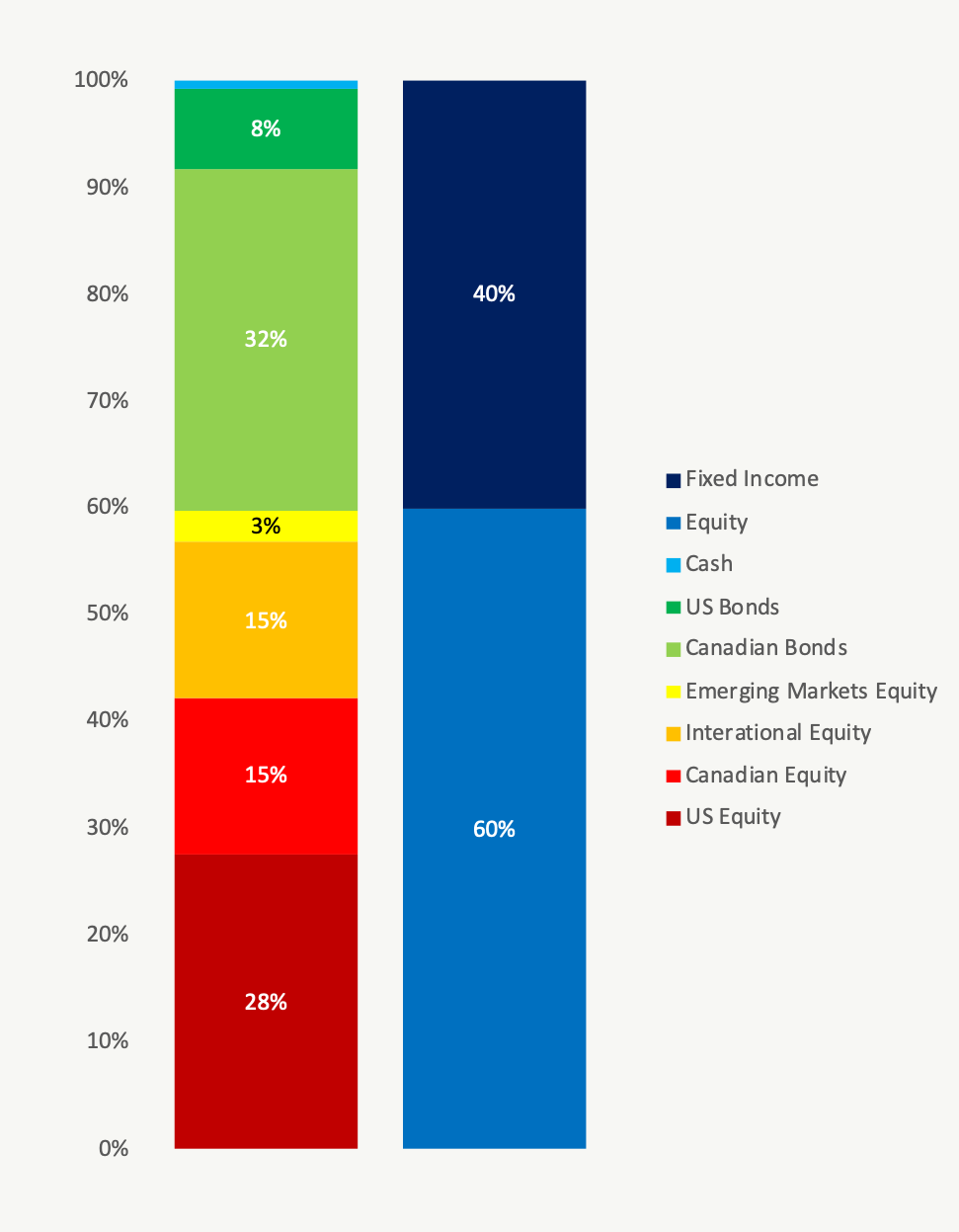

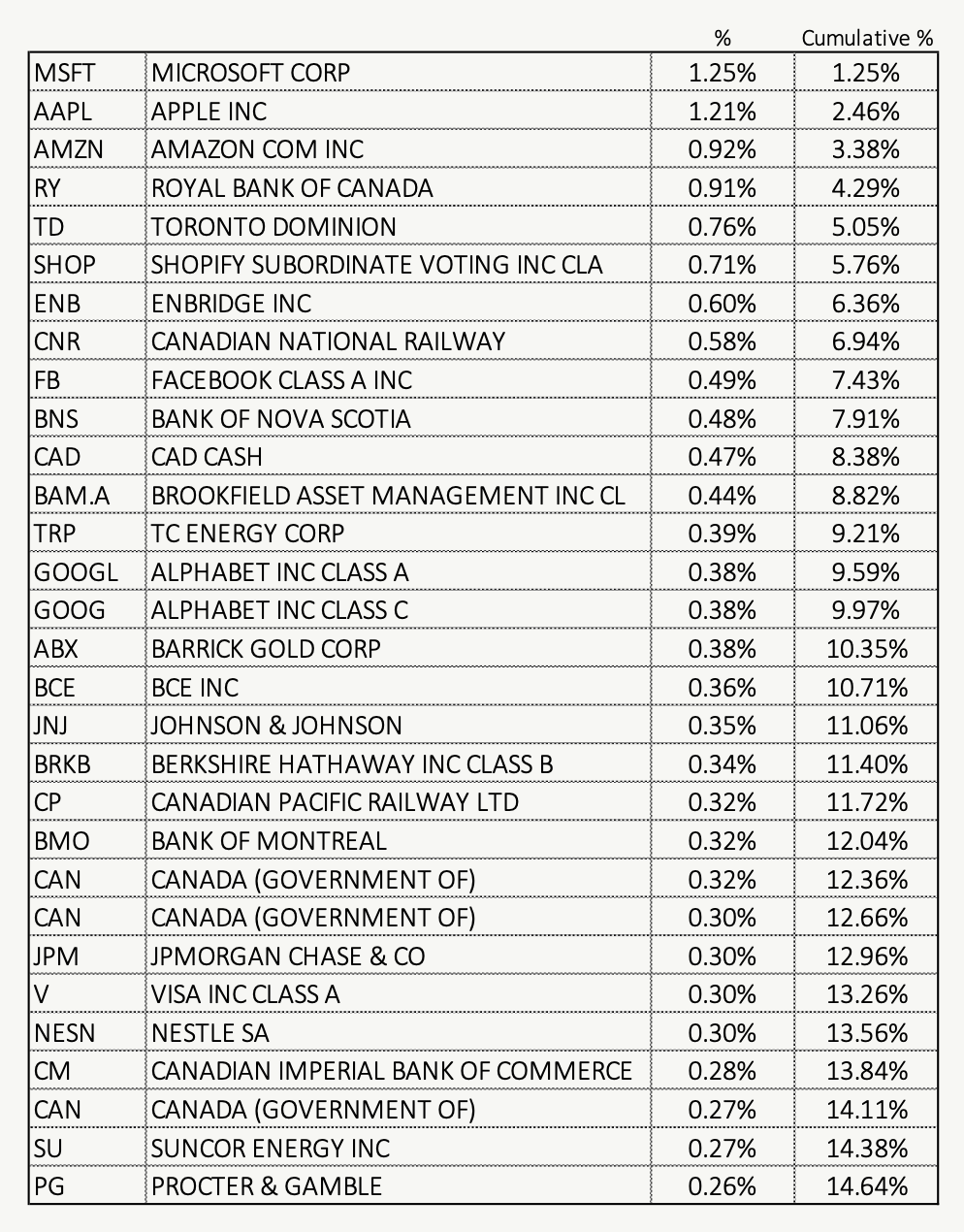

Investing Etf Asset Allocation Strategies Explained If you think an all etf portfolio might suit you, here are three ways to build one, ranging from ultra simple to very fine tuned. 1. keeping it simple. one option you can consider would be using two etfs to help provide a balanced, diversified portfolio of stocks and bonds:. The best way to grow your money. while not perfect, the “all in one” etf provides a very attractive balance of all the different factors to consider when creating an investment portfolio. it isn’t the lowest fee option available, but it’s pretty darn close. it’s easy to choose a target asset allocation. Look no further as the all in one etfs (a.k.a. asset allocation etfs) may be the answer for you. we’ll explain what is an all in one etf, which companies offer them and the benefits of having it in your portfolio. Asset allocation etfs, or all in one etfs, are a low cost, diversified way of investing. in this article we talk about what asset allocation means, some investing decision considerations and more about our suite of ishares asset allocation etfs. Factors like your investing timeline, risk tolerance and capacity, and investing goals make your “right” asset allocation mix unique to you, but morningstar’s christine benz recommends using the. In the mutual fund industry, there are funds called balanced funds or asset allocation funds or portfolio funds that try to make investing easy and simple. they will mix and match different asset classes to try to create “optimal” investment portfolios to take the work or effort of building and managing a portfolio for you off your shoulders.

Why Use An Asset Allocation Etf To Invest Video Look no further as the all in one etfs (a.k.a. asset allocation etfs) may be the answer for you. we’ll explain what is an all in one etf, which companies offer them and the benefits of having it in your portfolio. Asset allocation etfs, or all in one etfs, are a low cost, diversified way of investing. in this article we talk about what asset allocation means, some investing decision considerations and more about our suite of ishares asset allocation etfs. Factors like your investing timeline, risk tolerance and capacity, and investing goals make your “right” asset allocation mix unique to you, but morningstar’s christine benz recommends using the. In the mutual fund industry, there are funds called balanced funds or asset allocation funds or portfolio funds that try to make investing easy and simple. they will mix and match different asset classes to try to create “optimal” investment portfolios to take the work or effort of building and managing a portfolio for you off your shoulders.