Funeral Insurance Vs Family Funeral Plan Life insurance differs from prepaid funeral plans and funeral insurance in that the funds paid to beneficiaries are intended to replace lost income. money can be used to pay for a funeral, though generally that's not why people buy life insurance, and there are downsides to this strategy. Burial insurance explicitly covers funeral expenses, life insurance provides broader financial protection to beneficiaries, and prepaid funeral plans involve prearranging and prepaying for funeral services to alleviate the burden on loved ones.

Funeral Insurance Step By Step Guide To Final Expense Insurance Aarp new york life and state farm are the best burial insurance companies, according to our analysis of costs and complaints. burial insurance can be a compelling option for people who. We’ve detailed out two options to help you understand the difference between burial insurance vs pre paid funerals. burial insurance. usually refers to a whole life insurance policy with a death benefit of from $5,000 to $25,000. individuals buy this type of policy to provide money for funeral and burial costs for themselves and or family members. Unlike prepaid funeral plans, final expense insurance provides flexibility, affordability, and lifelong coverage, ensuring that your family is adequately supported when the time comes. The main difference with funeral insurance is that you have no protection against rising funeral costs and your family may be left with a shortfall to pay if the cash lump sum doesn’t cover the entire bill.

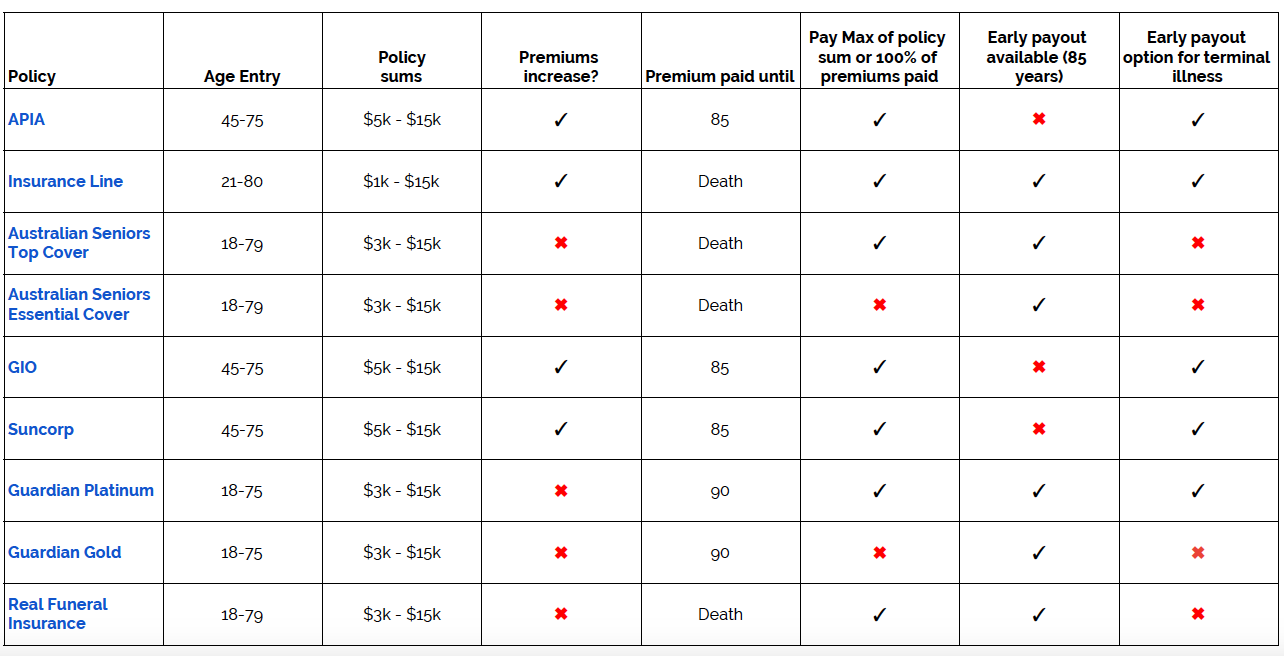

Funeral Insurance Vs Prepaid Funeral Plan What S Best For Me Bare Unlike prepaid funeral plans, final expense insurance provides flexibility, affordability, and lifelong coverage, ensuring that your family is adequately supported when the time comes. The main difference with funeral insurance is that you have no protection against rising funeral costs and your family may be left with a shortfall to pay if the cash lump sum doesn’t cover the entire bill. The main difference between final expense life insurance and a prepaid funeral plan is the insurance policy will pay out a tax free cash benefit directly to your beneficiary (s). Burial plans are specifically designed to cover funeral and burial expenses, including services like caskets, urns, cemetery plots, and related costs. life insurance offers broader coverage, providing a death benefit that can be used for various purposes beyond funeral expenses. Funeral insurance is a financial protection that provides your family or nominated beneficiaries with a lump sum payment to pay for funeral expenses when you die. policyholders usually made either fortnightly or monthly payments in exchange for cover ranging between $5,000 and $15,000. Many people choose between over 50 life insurance (an over 50 plan) or a funeral plan to help cover their funeral costs. an over 50 life insurance policy pays out a cash lump sum to your loved ones when you pass away, whereas a funeral plan allows you to arrange and pay for your chosen funeral services in advance.

Funeral Insurance Vs Prepaid Funeral Plan What S Best For Me Bare The main difference between final expense life insurance and a prepaid funeral plan is the insurance policy will pay out a tax free cash benefit directly to your beneficiary (s). Burial plans are specifically designed to cover funeral and burial expenses, including services like caskets, urns, cemetery plots, and related costs. life insurance offers broader coverage, providing a death benefit that can be used for various purposes beyond funeral expenses. Funeral insurance is a financial protection that provides your family or nominated beneficiaries with a lump sum payment to pay for funeral expenses when you die. policyholders usually made either fortnightly or monthly payments in exchange for cover ranging between $5,000 and $15,000. Many people choose between over 50 life insurance (an over 50 plan) or a funeral plan to help cover their funeral costs. an over 50 life insurance policy pays out a cash lump sum to your loved ones when you pass away, whereas a funeral plan allows you to arrange and pay for your chosen funeral services in advance.