Generative Ai Value Chain Anticipated Trends For 2024 Generative ai (gen ai) burst onto the scene in early 2023 and is showing clearly positive results—and raising new potential risks—for organizations worldwide. banking leaders appear to be on board, even with the possible complications. We concluded that 73% of the time spent by us bank employees has a high potential to be impacted by generative ai—39% by automation and 34% by augmentation. its potential reaches virtually every part of a bank, from the c suite to the front lines of service and in every part of the value chain.

Generative Ai Value Chain Anticipated Trends For 2024 Generative ai (gen ai) is revolutionizing the banking industry as financial institutions use the technology to supercharge customer facing chatbots, prevent fraud, and speed up time consuming tasks such as developing code, preparing drafts of pitch books, and summarizing regulatory reports. Organizations should expand their thinking to encompass entire value chains. it’s important to have a clear understanding of the current operational baseline and performance, envision future goals, and strategize on how generative ai can help to bridge that gap. To gain material value from ai, banks need to move beyond experimentation to transform critical business areas, including by reimagining complex workflows with multiagent systems. much has been written about the power of ai, including generative ai (gen ai), to transform banking. By broadening the scope beyond single applications, banks can integrate generative ai more holistically into their value chains, leading to transformative improvements across business functions. however, this broader integration requires strong c level sponsorship and a broad business strategy, all underpinned by a robust governance mechanism.

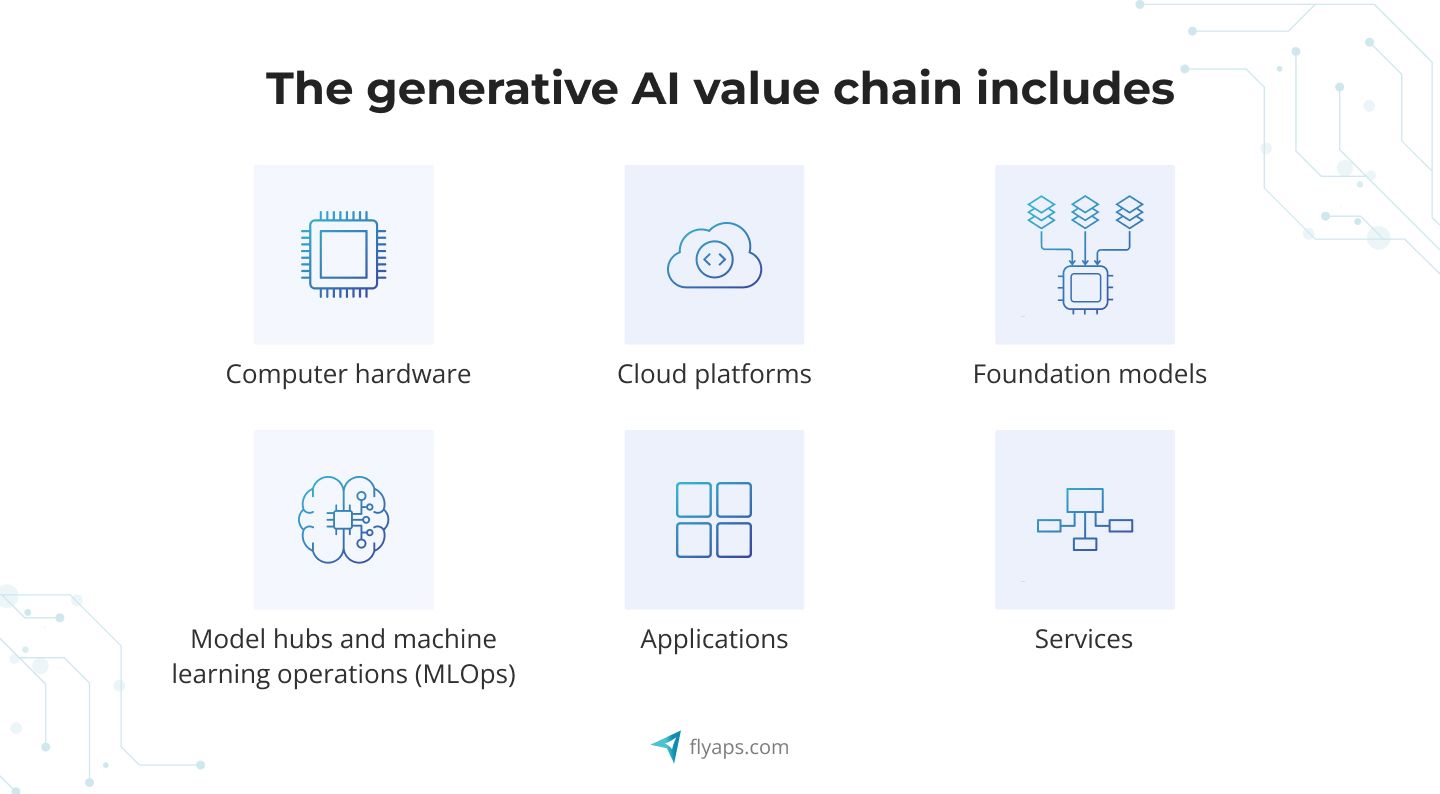

The Importance Of Generative Ai In Banking Industry Techvify Software To gain material value from ai, banks need to move beyond experimentation to transform critical business areas, including by reimagining complex workflows with multiagent systems. much has been written about the power of ai, including generative ai (gen ai), to transform banking. By broadening the scope beyond single applications, banks can integrate generative ai more holistically into their value chains, leading to transformative improvements across business functions. however, this broader integration requires strong c level sponsorship and a broad business strategy, all underpinned by a robust governance mechanism. Generative ai has added a whole new dimension to what we mean by intelligent banking and the possibilities it creates to unlock greater innovation and business value at an accelerated pace. learn how the financial services industry is innovating and transforming. This report takes a close look at the generative ai opportunity in banking. it examines what the technology is and isn’t, how it is being used already, and how it may be used in the near and longer term. Generative ai is creating a new technology stack for banks, with startups attacking different layers of the banking value chain. this stack can be divided into two main categories: customer facing applications and underlying data infrastructure. at the top of the stack, startups are reimagining customer facing banking processes. We identify 28 distinct applications across 40 articles, mapping them to the banking value chain and outlining six levers through which bmi could be delivered in banking. our study presents methodologies replicable for other industries and identifies avenues for future research.