Global Asset Allocation Views August 2023 Julex Capital Management Navigating increasingly unstable markets. Key themes for 3q 2023 europe is weakening, china is disappointing, and the u.s. is approaching recession. while manufacturing has struggled, global growth has been supported by the services sector.

Global Asset Allocation Views June 2023 Adviservoice Global asset allocation viewpoints . 3q 2023. inflation is decelerating, but at a slow pace, and will end the year meaningfully above target. headline inflation is falling rapidly, but core inflation is proving to be a worry in developed markets (dm). slower economic growth will be required to reach global central bank inflation targets. Qualitative insights that encompass macro thematic insights, business cycle views and systematic and irregular market opportunities; quantitative analysis that considers market inefficiencies, intra and cross asset class models, relative value and market directional strategies. Given our view that 2023 will be a year of transition from a contraction regime to one of recovery, we reduce the defensiveness of our model asset allocation, while keeping some powder dry for when recovery is confirmed. we are reducing the government bond allocation to neutral, while increasing the allocation to high yield (to overweight). The asset allocation committee reviews and sets long term asset allocation models, establishes preferred near term tactical asset class allocations and, upon request, reviews asset allocations for large, diversified mandates and makes client specific asset allocation recommendations. the views and recommendations of the asset allocation.

Global Asset Allocation Views 3q 2023 Given our view that 2023 will be a year of transition from a contraction regime to one of recovery, we reduce the defensiveness of our model asset allocation, while keeping some powder dry for when recovery is confirmed. we are reducing the government bond allocation to neutral, while increasing the allocation to high yield (to overweight). The asset allocation committee reviews and sets long term asset allocation models, establishes preferred near term tactical asset class allocations and, upon request, reviews asset allocations for large, diversified mandates and makes client specific asset allocation recommendations. the views and recommendations of the asset allocation. Global asset allocation views insights and implications from the multi asset solutions strategy summit in brief • our portfolios reflect a pro growth outlook and a strong preference for u.s. assets. • we expect pro growth economic policy to extend the business cycle in 2025. Our core scenario sees subtrend growth and gradually cooling inflation, with recession odds down to 25% (from 35%) over the next two to three quarters. with greater two way risk in economic. Global inflation will fall but remain above many central bank targets; major western central banks are approaching the end of their tightening cycles; long term government yields will be mixed; yield curves 1 steepen during 2023 h2; credit spreads widen in the us but narrow in europe and defaults rise. Global economic themes that are most likely to influence our views on portfolio asset allocation over the next 12 to 18 months. global growth will likely be challenged as the lagged impact of higher interest rates takes hold on the global economy. a recession is possible, however, if one were to happen, we do not expect it to be deep or prolonged.

Gcc Asset Allocation 2023 Go Curry Cracker Global asset allocation views insights and implications from the multi asset solutions strategy summit in brief • our portfolios reflect a pro growth outlook and a strong preference for u.s. assets. • we expect pro growth economic policy to extend the business cycle in 2025. Our core scenario sees subtrend growth and gradually cooling inflation, with recession odds down to 25% (from 35%) over the next two to three quarters. with greater two way risk in economic. Global inflation will fall but remain above many central bank targets; major western central banks are approaching the end of their tightening cycles; long term government yields will be mixed; yield curves 1 steepen during 2023 h2; credit spreads widen in the us but narrow in europe and defaults rise. Global economic themes that are most likely to influence our views on portfolio asset allocation over the next 12 to 18 months. global growth will likely be challenged as the lagged impact of higher interest rates takes hold on the global economy. a recession is possible, however, if one were to happen, we do not expect it to be deep or prolonged.

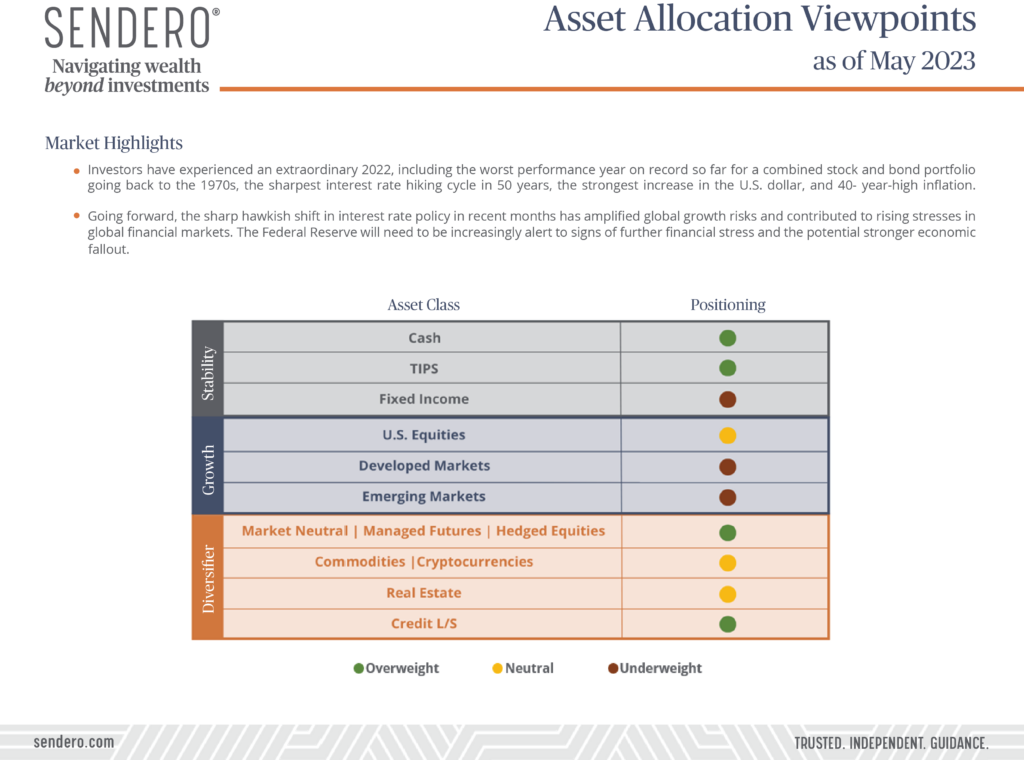

Asset Allocation Viewpoints As Of May 2023 Sendero Global inflation will fall but remain above many central bank targets; major western central banks are approaching the end of their tightening cycles; long term government yields will be mixed; yield curves 1 steepen during 2023 h2; credit spreads widen in the us but narrow in europe and defaults rise. Global economic themes that are most likely to influence our views on portfolio asset allocation over the next 12 to 18 months. global growth will likely be challenged as the lagged impact of higher interest rates takes hold on the global economy. a recession is possible, however, if one were to happen, we do not expect it to be deep or prolonged.