Global Asset Allocation Views June 2023 Adviservoice

Global Asset Allocation Views June 2023 Adviservoice The global risks report 2025 analyses global risks to support decision makers in balancing current crises and longer term priorities. The global cybersecurity outlook 2025 highlights key trends shaping economies and societies in 2025, along with insights into emerging threats and solutions.

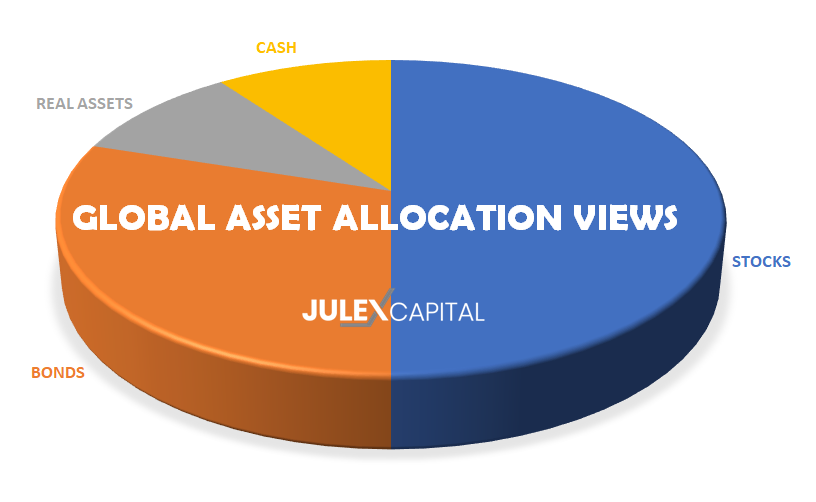

Global Asset Allocation Views August 2023 Julex Capital Management The world economic forum’s global risks report 2024 says the biggest short term risk stems from misinformation and disinformation. in the longer term, climate related threats dominate the top 10 risks global populations will face. two thirds of global experts anticipate a multipolar or fragmented order to take shape over the next decade. Technological change, geoeconomic fragmentation, economic uncertainty, demographic shifts and the green transition – individually and in combination are among the major drivers expected to shape and transform the global labour market by 2030. the future of jobs report 2025 brings together the perspective of over 1,000 leading global employers—collectively representing more than 14 million. The global energy review found that global energy demand grew by 2.2% last year, which was considerably faster than the average annual demand increase of 1.3% over the previous 10 years. emerging and developing economies accounted for over 80% of the increase in 2024 and, after several years of declines, advanced economies returned to growth. Health was a major focus in 2024, shaping global news and driving key discussions at the world economic forum. from climate change health impacts to the rise of antimicrobial resistance and improving health equity for women, here are 6 top health stories of the year.

The Global Asset Allocation Conference 2023 F M Abunayyan Holding The global energy review found that global energy demand grew by 2.2% last year, which was considerably faster than the average annual demand increase of 1.3% over the previous 10 years. emerging and developing economies accounted for over 80% of the increase in 2024 and, after several years of declines, advanced economies returned to growth. Health was a major focus in 2024, shaping global news and driving key discussions at the world economic forum. from climate change health impacts to the rise of antimicrobial resistance and improving health equity for women, here are 6 top health stories of the year. The global gender gap index annually benchmarks the current state and evolution of gender parity across four key dimensions (subindexes): economic participation and opportunity, educational attainment, health and survival, and political empowerment. since launching in 2006, it is the longest standing index tracking the progress of numerous countries’ efforts towards closing these gaps over time. The global gender gap index 2024 benchmarks the current state and evolution of gender parity across four key dimensions (economic participation and opportunity, educational attainment, health and survival, and political empowerment). it is the longest standing index tracking the progress of numerous countries’ efforts towards closing these gaps over time since its inception. The world economic forum's energy transition index 2025 indicates a rebound in the energy transition globally, but progress is set to remain uneven. The world economic forum's global risks report 2023 explores some of the most severe risks we may face over the next decade that include energy supply and food crisis, rising inflation, cyberattacks, failure to meet net zero targets, weaponization of economic policy, weakening of human rights.

Comments are closed.