Hmrc Issue Briefing Calculating The 2012 To 2013 Tax Gap Gov Uk We estimate the 2012 to 2013 tax gap was 6.8% of total tax and duties due, which equates to £34 billion, after we deduct the money we bring in through our compliance activities. the tax gap. This briefing explains why we calculate the tax gap each year and how it influences the way we work to collect taxes. this briefing gives a broad picture of the tax that should in theory.

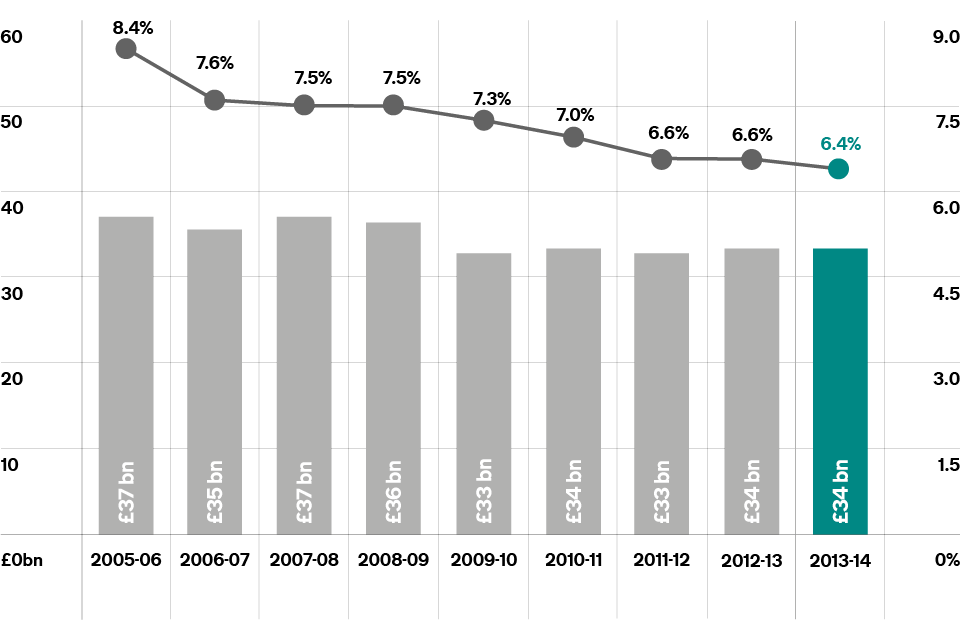

Hmrc Issue Briefing Calculating The 2013 To 2014 Tax Gap Gov Uk We estimate the 2013 to 2014 tax gap was 6.4% of total tax and duties due to hmrc, which equates to £34 billion, after we deduct the money we bring in through our compliance activities. this. The tax gap gives hmrc a broad picture of the tax that should in theory be collected, against what is actually collected. this briefing explains why we calculate the tax gap each. During 2012 13 the tax gap was 6.8 per cent of tax liabilities amounting to an eye watering £34 billion. with revised estimates for the 2011 12 tax year indicating liabilities were at the 6.6 per cent mark, it would seem hmrc failed to reduce its liabilities over the previous 12 months. Hmrc has published its figures for the 2012 13 tax gap, which is the difference between the amount of tax due and the amount collected. according to hmrc, this was 6.8% of all tax liabilities, or £34bn in 2012 13 – an increase on the revised estimate for 2011 12 of 6.6% of tax liabilities or £33bn.

Hmrc Issue Briefing Calculating The 2013 To 2014 Tax Gap Gov Uk During 2012 13 the tax gap was 6.8 per cent of tax liabilities amounting to an eye watering £34 billion. with revised estimates for the 2011 12 tax year indicating liabilities were at the 6.6 per cent mark, it would seem hmrc failed to reduce its liabilities over the previous 12 months. Hmrc has published its figures for the 2012 13 tax gap, which is the difference between the amount of tax due and the amount collected. according to hmrc, this was 6.8% of all tax liabilities, or £34bn in 2012 13 – an increase on the revised estimate for 2011 12 of 6.6% of tax liabilities or £33bn. Details this briefing explains why we calculate the tax gap each year and how it influences the way we work to collect taxes. The tax gap, which is the difference between the amount of tax due and the amount collected, was 6.8% of tax liabilities, or £34 billion, in 2012 13. this compares with a revised estimate. Hmrc publishes issue briefings for external organisations who want to know more about its work. they are also sent to mps and politicians in scotland, wales and northern ireland. added.

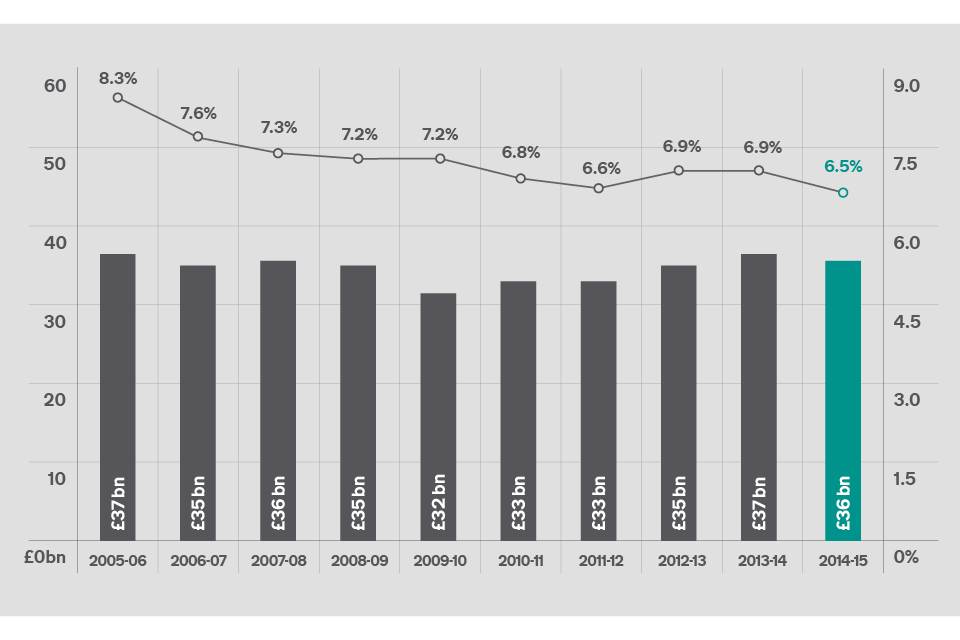

Hmrc Issue Briefing Calculating The 2014 To 2015 Tax Gap Gov Uk Details this briefing explains why we calculate the tax gap each year and how it influences the way we work to collect taxes. The tax gap, which is the difference between the amount of tax due and the amount collected, was 6.8% of tax liabilities, or £34 billion, in 2012 13. this compares with a revised estimate. Hmrc publishes issue briefings for external organisations who want to know more about its work. they are also sent to mps and politicians in scotland, wales and northern ireland. added.