Hmrc Measuring Tax Gaps 2023 Edition Tax Gap Estimates For 2021 To This report provides an estimate of the tax gap across all taxes and duties administered by hmrc. the tax gap is the difference between the amount of tax that should, in theory, be. The uk tax gap in 2022 to 2023 is estimated to be 4.8% of total theoretical tax liabilities, or £39.8 billion in absolute terms, which means hmrc collected 95.2% of all tax due.

Hmrc Have Marked Their Own Homework On The Tax Gap Again And Have The tax gap takes into account the amount of tax collected through hmrc’s enforcement activity – known as the ‘compliance yield’. despite a long term reduction in the reported percentage tax gap figures, there are a number of data points in hmrc’s report which deserve a closer look. The measuring tax gaps report is hmrc’s annual publication, covering tax gap estimates for all the taxes, levies and duties hmrc administers. this includes estimates of the overall tax gap, and tax gap split by tax type, customer group and behaviour between 2005 06 to 2021 22. The measuring tax gaps report is our annual publication, covering tax gap estimates for all the taxes, levies and duties we administer. this includes estimates of the overall tax gap, and tax gap split by tax type, customer group and behaviour between 2005 06 to 2021 22. Hmrc has published measuring tax gaps 2023 (their annual summary of the tax they haven’t collected). another strong performance for hmrc raises interesting questions about what hmrc might do next.

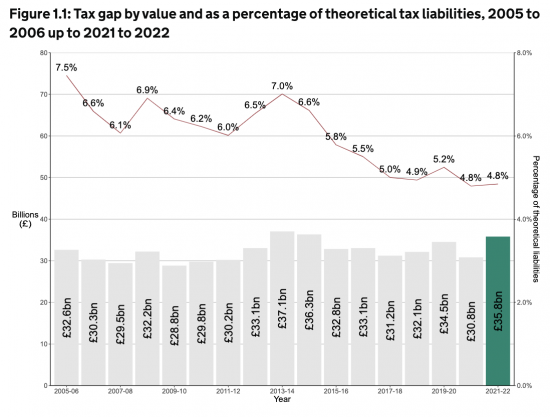

Hmrc Says The Tax Gap Remains Low The measuring tax gaps report is our annual publication, covering tax gap estimates for all the taxes, levies and duties we administer. this includes estimates of the overall tax gap, and tax gap split by tax type, customer group and behaviour between 2005 06 to 2021 22. Hmrc has published measuring tax gaps 2023 (their annual summary of the tax they haven’t collected). another strong performance for hmrc raises interesting questions about what hmrc might do next. Analysis and predictions has been £32.1bn, £34.5bn, £30.8bn and now £35.8bn. both measures of the tax gap are helpful: the former tells us about the eficiency of hmrc and th. As always, the figure represents hmrc’s best estimate of the tax gap at the time of publication and is subject to revision as more data becomes available. the tax gap cash figure for 2022 23 is estimated at £39.8 billion. this compares with £38.1 billion the year before. The official gap between the amount of tax owed and what the government collects, has grown to nearly £40 billion, new hmrc figures show. the official figures released by hmrc were also expected to provide an estimate of the annual offshore tax gap for individuals in self assessment. The publication provides an estimate of the tax gap across all taxes and duties administered by hmrc. the tax gap is the difference between the amount of tax that should, in theory, be.