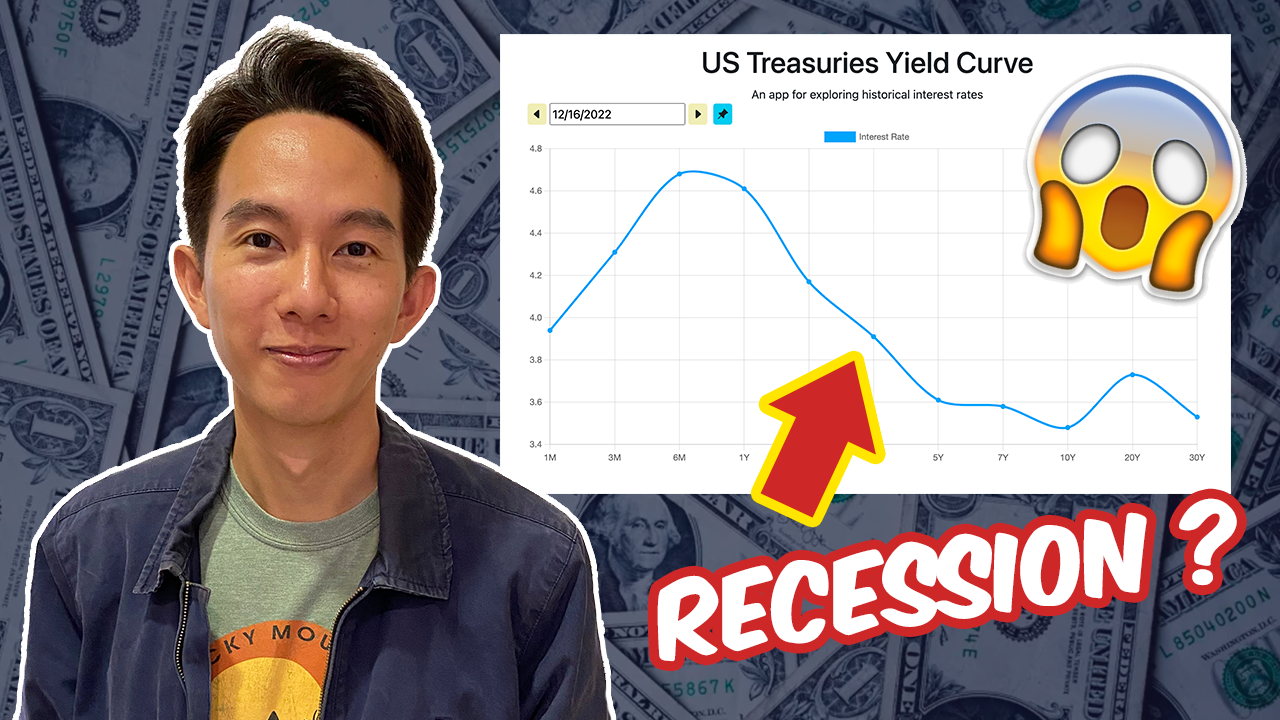

Econmatters The Inverted Yield Curve And Recession To put it simply, it’s when the bond market (which controls the longer end of the curve) is at odds with the central banks (which control the short end of the curve). for instance, inversion happens when a central bank forces up short term rates (such as when the fed hikes the discount rate). But longer term yields have dropped since january 10. as a result, yields from 1 year through 10 years are now all lower than short term yields, and only the 20 year yield (4.61%) and the 30 year yield (4.59%) are higher than short term yields, creating this sag in the middle of the yield curve with the low point at the 3 year yield (red line).

108021323 17237809121723780910 35849309183 1080pnbcnews Jpg V It's true the yield curve has accurately signaled almost every recession since 1955. keen observers, however, will point to the lone exception, 1966, when the yield curve got it wrong. First, why would an inverted yield curve spook investors if the reason it inverts is that investors already know a recession is coming? second and more significant: krugman’s explanation would make sense if yield curve inversions typically occurred when the long bond yield collapses. An inverted yield curve—or a situation in which market yields on shorter term u.s. treasury securities exceed those on longer term securities—has been a remarkably consistent predictor of economic recessions. Here’s what thursday’s yield curve looked like: and here is what it sounded like: that’s the song of an inverted yield curve, and it is often considered a bad economic omen. but the yield.

Does An Inverted Yield Curve Lead To Recession And How To Invest In An inverted yield curve—or a situation in which market yields on shorter term u.s. treasury securities exceed those on longer term securities—has been a remarkably consistent predictor of economic recessions. Here’s what thursday’s yield curve looked like: and here is what it sounded like: that’s the song of an inverted yield curve, and it is often considered a bad economic omen. but the yield. That said, an inverted yield curve has accurately predicted the ten most recent recessions. there has been so much emphasis on interest rates lately. the truth, however, is far more. Experts urge caution, noting no single signal guarantees an economic recession. what is an inverted yield curve? a yield curve shows how interest rates for bonds change over time. investors and economists track this graph to predict economic trends. let’s break down its basics. bond yields vary depending on how long a bond takes to mature. The current inversion is not necessarily a harbinger of recession, despite the rule of thumb that an inverted yield curve predicts a recession in about a year. in fact, the us economy is four years into an expansion period with few signs pointing to its end in the near term. With an inverted curve hitting their net interest margins, banks may opt to lend less, causing a pullback in consumer spending that can lead to recession.

Inverted Yield Curve Signals Recession Modern Wealth Management That said, an inverted yield curve has accurately predicted the ten most recent recessions. there has been so much emphasis on interest rates lately. the truth, however, is far more. Experts urge caution, noting no single signal guarantees an economic recession. what is an inverted yield curve? a yield curve shows how interest rates for bonds change over time. investors and economists track this graph to predict economic trends. let’s break down its basics. bond yields vary depending on how long a bond takes to mature. The current inversion is not necessarily a harbinger of recession, despite the rule of thumb that an inverted yield curve predicts a recession in about a year. in fact, the us economy is four years into an expansion period with few signs pointing to its end in the near term. With an inverted curve hitting their net interest margins, banks may opt to lend less, causing a pullback in consumer spending that can lead to recession.

Inverted Bond Yield Curve Is Recession Here The current inversion is not necessarily a harbinger of recession, despite the rule of thumb that an inverted yield curve predicts a recession in about a year. in fact, the us economy is four years into an expansion period with few signs pointing to its end in the near term. With an inverted curve hitting their net interest margins, banks may opt to lend less, causing a pullback in consumer spending that can lead to recession.

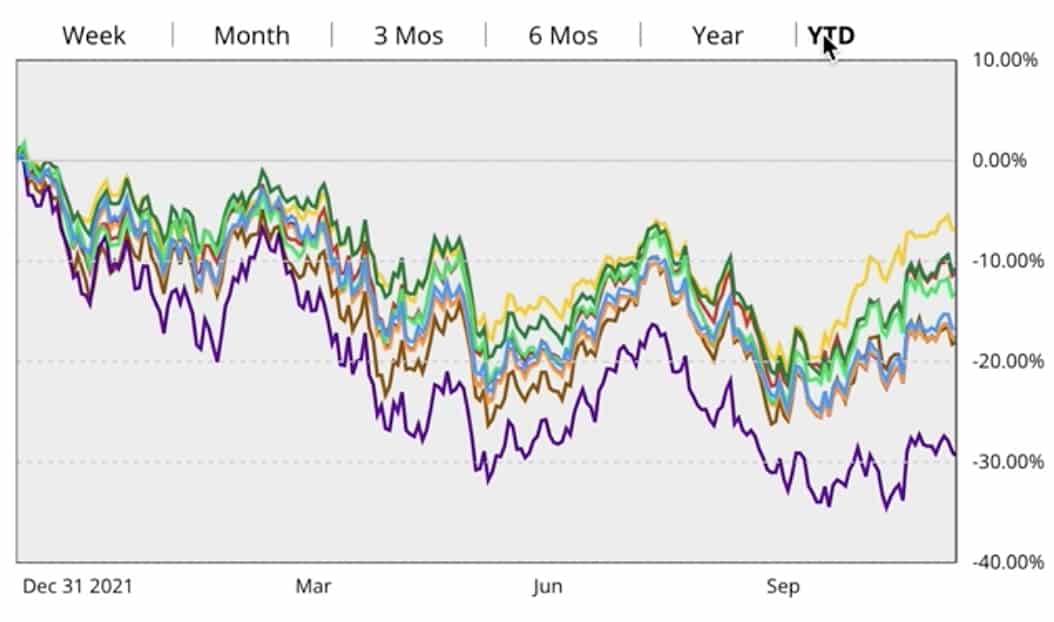

How An Inverted Yield Curve Actually Amplifies A Recession As Banks