Best Crypto Leverage Trading Platform Crypto leverage trading involves these key steps to maximize returns and manage risk: deposit collateral: provide funds as a margin to secure borrowed capital for leveraged trades. choose leverage ratio: select an appropriate leverage level (e.g., 5x or 10x) based on risk tolerance, trading experience, and objectives within the crypto market. Leverage trading is one of the most powerful yet dangerous tools in cryptocurrency markets. by borrowing funds to amplify positions, traders can magnify profits—but also losses—exponentially. this guide breaks down how leverage works, its key risks, and strategies to trade smarter. 1. what is crypto leverage trading?.

What Is Leverage Trading In The Crypto Market Leverage trading in cryptocurrencies enables you to increase your exposure to the market without committing a substantial amount of capital upfront. essentially, you are borrowing funds to magnify your trading position beyond what would be possible with your account balance alone. To use leverage safely, traders must adopt risk management strategies, set stop loss orders, and understand how liquidation works. in this guide, we will explore how leverage works in crypto trading, the risks involved, and strategies to minimize potential losses while maximizing profits. what is leverage in crypto trading? 1. liquidation risk. 2. Leverage trading crypto amplifies both profits and losses, allowing traders to control larger positions with less capital, but requires careful risk management strategies. setting appropriate leverage multipliers, stop loss points, and position sizes is crucial for protecting capital and maintaining sustainable trading performance. Leverage in crypto trading (also known as margin trading) is the practice of borrowing funds from a cryptocurrency exchange to increase the potential return on investment for a trade. essentially, leverage allows traders to control a larger position with a smaller amount of capital.

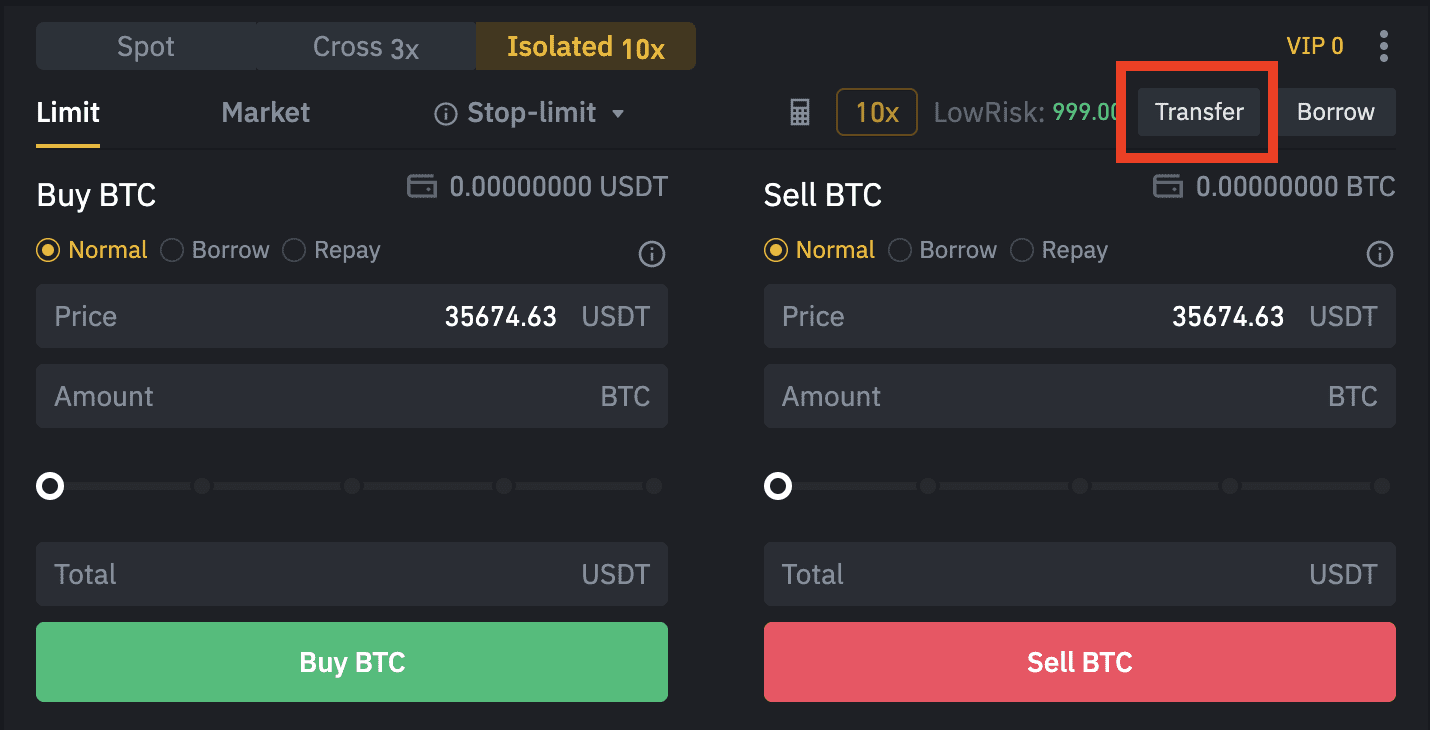

How Does Leverage Trading In Crypto Work Leverage trading crypto amplifies both profits and losses, allowing traders to control larger positions with less capital, but requires careful risk management strategies. setting appropriate leverage multipliers, stop loss points, and position sizes is crucial for protecting capital and maintaining sustainable trading performance. Leverage in crypto trading (also known as margin trading) is the practice of borrowing funds from a cryptocurrency exchange to increase the potential return on investment for a trade. essentially, leverage allows traders to control a larger position with a smaller amount of capital. In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own. many centralized crypto exchanges like kraken, bybit, and binance offer leverage in the form of margin trading. There are several risks associated with crypto leverage trading, including volatility, liquidation, interest costs, and counterparty risk. risk management is paramount, and responsible leverage used smartly can be an effective tool to enhance trading returns. what does leverage mean?. For starters, we’ll define what crypto trading with leverage is and how it relates to the concept of margin trading. then we’ll take a look at how leverage can be used in spot and derivatives markets. What is crypto leverage trading, and how does it differ from traditional trading? crypto leverage trading involves using borrowed funds (leverage) to enter larger trades, amplifying potential profits (or losses) based on asset price movements.

How Does Crypto Leverage Trading Work How To Manage Risk In Crypto In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own. many centralized crypto exchanges like kraken, bybit, and binance offer leverage in the form of margin trading. There are several risks associated with crypto leverage trading, including volatility, liquidation, interest costs, and counterparty risk. risk management is paramount, and responsible leverage used smartly can be an effective tool to enhance trading returns. what does leverage mean?. For starters, we’ll define what crypto trading with leverage is and how it relates to the concept of margin trading. then we’ll take a look at how leverage can be used in spot and derivatives markets. What is crypto leverage trading, and how does it differ from traditional trading? crypto leverage trading involves using borrowed funds (leverage) to enter larger trades, amplifying potential profits (or losses) based on asset price movements.