A Guide On Leverages In Crypto Trading Decode Global Leverage trading is the act of using borrowed capital to make larger trades. it can amplify your buying or selling power, allowing you to trade with more capital than what you have in your wallet. leverage trading is often done through margin trading, futures contracts, and options contracts. Leverage cryptocurrency trading is when you borrow assets from exchanges to amplify your trading capacity. in other words, you borrow to increase your buying and selling power in the market. this way, you end up operating with more capital than you actually have. moreover, there are various leverages based on the exchange you use.

What Is Leverage Trading In The Crypto Market How does leverage trading work in the crypto market? imagine having $1,000 but using leverage to control a $10,000 position in a crypto trade, which would amplify gains if the trade moves favourably. for example, if the crypto asset appreciates 1%, profit isn’t based on the $1,000 capital; rather, it is based on the $10,000 leveraged position. Today, we’ll cover one of them and answer the question: what is leverage trading crypto like and what role does it play in different markets? for starters, we’ll define what crypto trading with leverage is and how it relates to the concept of margin trading. then we’ll take a look at how leverage can be used in spot and derivatives markets. How does leverage trading work? with leverage, you are basically borrowing money from the broker to make a better investment deal with your money. say you want to buy 1000$ worth of bitcoin but you don’t have the money. Leverage gives traders the ability to trade larger value contracts while putting down relatively smaller amounts upfront. this provides traders with greater efficiency for their capital and also allows them to increase their exposure without needing additional capital.

How Does Leverage Trading In Crypto Work How does leverage trading work? with leverage, you are basically borrowing money from the broker to make a better investment deal with your money. say you want to buy 1000$ worth of bitcoin but you don’t have the money. Leverage gives traders the ability to trade larger value contracts while putting down relatively smaller amounts upfront. this provides traders with greater efficiency for their capital and also allows them to increase their exposure without needing additional capital. How does leverage trading work? crypto leverage trading involves these key steps to maximize returns and manage risk: deposit collateral: provide funds as a margin to secure borrowed capital for leveraged trades. Crypto leverage trading has revolutionized the way traders interact with cryptocurrency markets, enabling them to amplify their potential gains by borrowing funds to trade larger positions than their initial investment allows. this powerful tool can unlock new opportunities but also carries increased risks. In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own. many centralized crypto exchanges like kraken, bybit, and binance offer leverage in the form of margin trading. defi (decentralized finance), however, presents far more options to leverage your crypto. Crypto leverage trading involves using borrowed funds (leverage) to enter larger trades, amplifying potential profits (or losses) based on asset price movements. unlike traditional trading, where traders use their own capital, leverage trading allows traders to control larger positions with minimal capital, increasing potential returns but also.

What Is Leverage In Crypto Trading Sublime Traders How does leverage trading work? crypto leverage trading involves these key steps to maximize returns and manage risk: deposit collateral: provide funds as a margin to secure borrowed capital for leveraged trades. Crypto leverage trading has revolutionized the way traders interact with cryptocurrency markets, enabling them to amplify their potential gains by borrowing funds to trade larger positions than their initial investment allows. this powerful tool can unlock new opportunities but also carries increased risks. In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own. many centralized crypto exchanges like kraken, bybit, and binance offer leverage in the form of margin trading. defi (decentralized finance), however, presents far more options to leverage your crypto. Crypto leverage trading involves using borrowed funds (leverage) to enter larger trades, amplifying potential profits (or losses) based on asset price movements. unlike traditional trading, where traders use their own capital, leverage trading allows traders to control larger positions with minimal capital, increasing potential returns but also.

How Does Leverage Trading Work In Cryptocurrency Crypto Trading Plus In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own. many centralized crypto exchanges like kraken, bybit, and binance offer leverage in the form of margin trading. defi (decentralized finance), however, presents far more options to leverage your crypto. Crypto leverage trading involves using borrowed funds (leverage) to enter larger trades, amplifying potential profits (or losses) based on asset price movements. unlike traditional trading, where traders use their own capital, leverage trading allows traders to control larger positions with minimal capital, increasing potential returns but also.

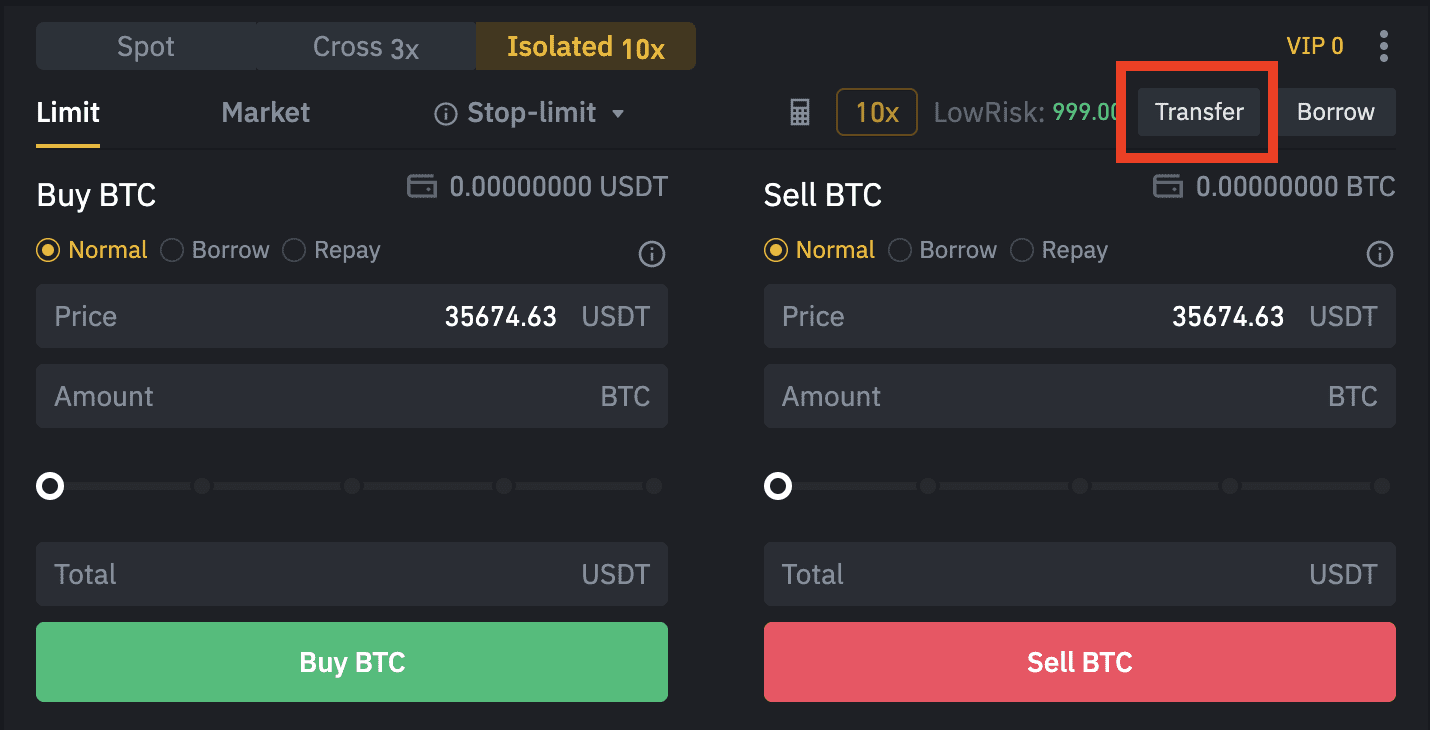

5 Best Crypto Leverage Trading Platforms 2023 Ranked