How Does The Hashrate Impact The Bitcoin Mining Profitability

How Does The Hashrate Impact The Bitcoin Mining Profitability When the price of bitcoin fluctuates, miners have to juggle these fixed costs and the selling price to avoid losses. an increase in the hash rate, for example, leads to increased competition, thus raising expenses while jeopardizing profitability. typical costs for miners:. Hashrate is a pivotal metric in cryptocurrency mining, integral to the functioning of proof of work (pow) consensus mechanisms. it not only gauges the security robustness of a blockchain network but also significantly influences the profitability of mining operations.

Bitcoin Mining Hashrate Difficulty Cspr Ghost Staking At the core of bitcoin mining is the production of hashrate, a measure of the number of computational guesses made per second in the pursuit of solving complex mathematical problems that validate transactions and create new blocks on the blockchain. Pow.re ceo mike cohen discusses how hashrate influences bitcoin mining's balance between energy use and profitability. the mechanics behind bitcoin mining are often misunderstood,. The hashrate directly affects the profitability of bitcoin mining. the more hashrate a miner has, the more likely they are to validate a transaction and receive a reward in the form of bitcoins. Bitcoin hashrate represents the total computing power securing the network at any given moment. in practical terms, it measures how many calculations miners worldwide are performing each second to process transactions and compete for mining rewards.

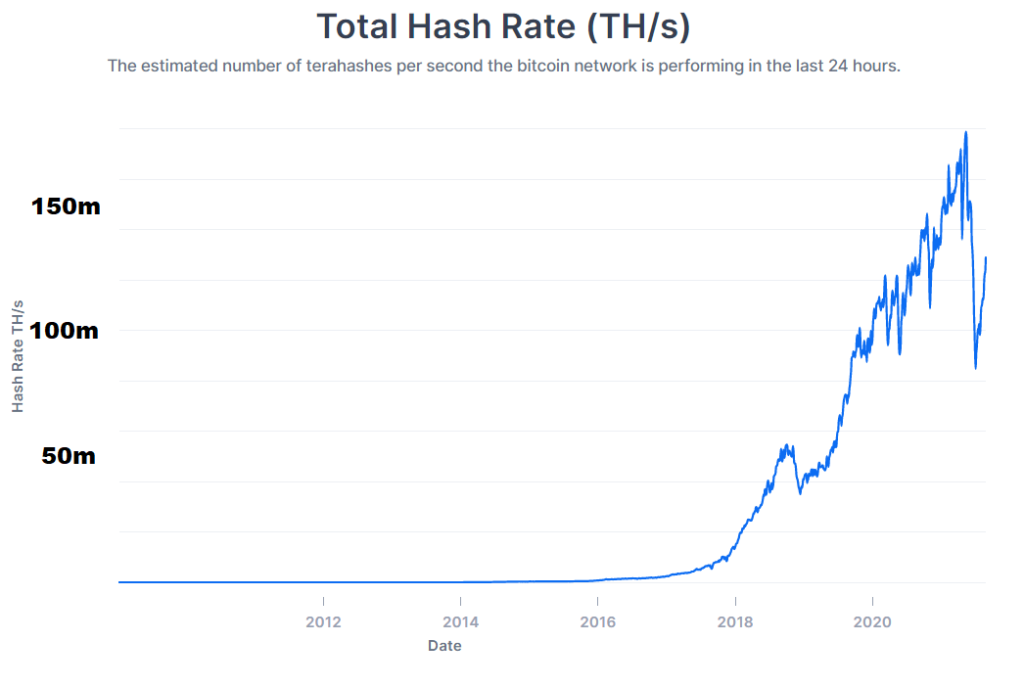

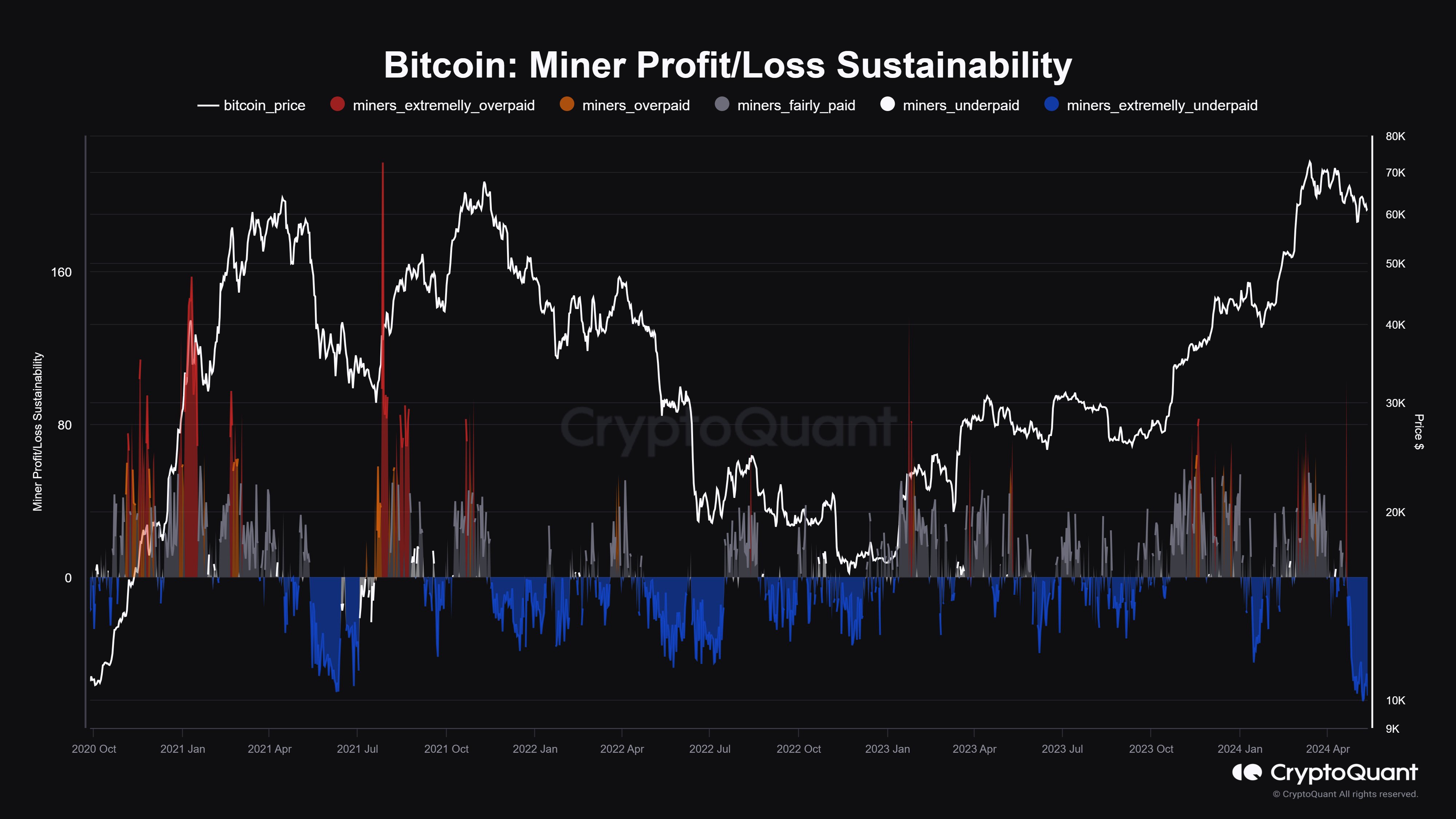

Bitcoin Hashrate Plunges 11 As Miner Profits At 3 Year Lows The hashrate directly affects the profitability of bitcoin mining. the more hashrate a miner has, the more likely they are to validate a transaction and receive a reward in the form of bitcoins. Bitcoin hashrate represents the total computing power securing the network at any given moment. in practical terms, it measures how many calculations miners worldwide are performing each second to process transactions and compete for mining rewards. Understanding hashrate is vital as it directly impacts the efficiency and performance of mining operations. the higher the hashrate, the greater the ability to mine new blocks and earn bitcoin rewards. Impacts profitability, as energy costs can exceed rewards when difficulty is high. this constant adjustment dynamic is one of the features that make bitcoin so resilient to potential attacks, as a higher hashrate makes it more difficult for any malicious entity to disrupt network operations. Over time, the bitcoin price and bitcoin hashrate have a positive correlation: bitcoin price compared with bitcoin hashrate since 2016. a mining position is a perfect hedge for when the btc price rips through the roof and leaves hashrate in the dust. hashrate growth is diminishing. Bitcoin price drives hashrate growth: when btc price rises, mining becomes more profitable, attracting more miners and investment in hardware, thereby increasing the hashrate. hashrate lagging behind price: due to the cost and time required to set up mining operations, hashrate doesn’t instantly react to price increases.

Understanding Bitcoin Mining Profitability The Role Of Hashrate And Understanding hashrate is vital as it directly impacts the efficiency and performance of mining operations. the higher the hashrate, the greater the ability to mine new blocks and earn bitcoin rewards. Impacts profitability, as energy costs can exceed rewards when difficulty is high. this constant adjustment dynamic is one of the features that make bitcoin so resilient to potential attacks, as a higher hashrate makes it more difficult for any malicious entity to disrupt network operations. Over time, the bitcoin price and bitcoin hashrate have a positive correlation: bitcoin price compared with bitcoin hashrate since 2016. a mining position is a perfect hedge for when the btc price rips through the roof and leaves hashrate in the dust. hashrate growth is diminishing. Bitcoin price drives hashrate growth: when btc price rises, mining becomes more profitable, attracting more miners and investment in hardware, thereby increasing the hashrate. hashrate lagging behind price: due to the cost and time required to set up mining operations, hashrate doesn’t instantly react to price increases.

Comments are closed.